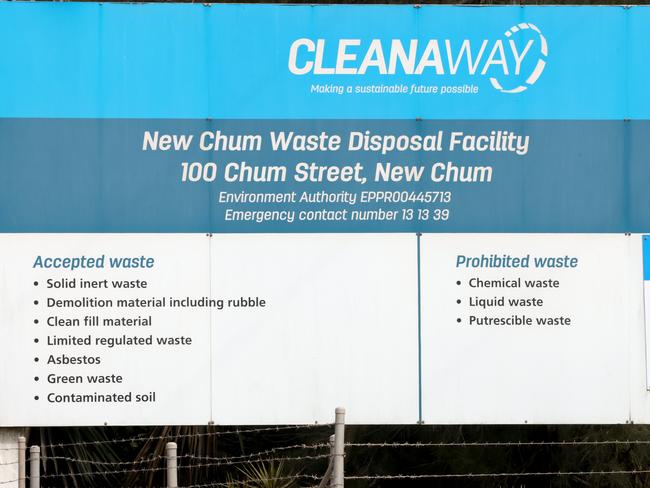

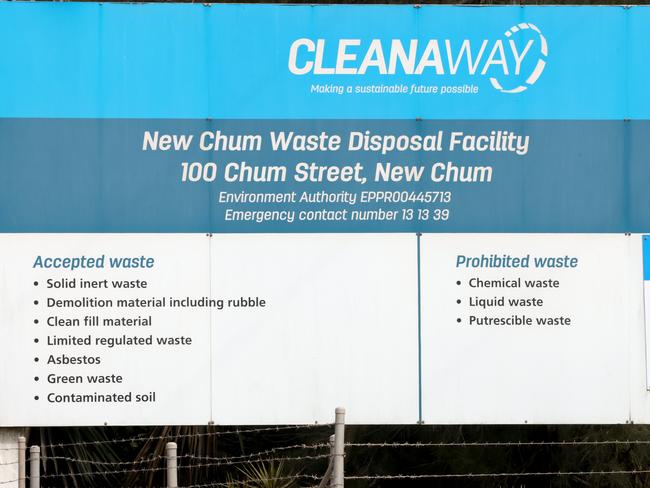

Cleanaway has Repurpose It firmly in its sights

Australian listed waste disposal company Cleanaway is believed to be zeroing in on a potential acquisition of Repurpose It from Downer.

Australian listed waste disposal company Cleanaway is believed to be zeroing in on a potential acquisition of Repurpose It from Downer.

Transport companies Toll Holdings and Lindsay Brothers are believed to already have held talks about a potential acquisition of Scott’s Refrigerated Logistics Group.

Australian-listed logistics company Qube Holdings has signalled acquisitions are on its agenda.

McGrath Nicol is voluntary administrator of Scott’s Refrigerated Logistics, while KordaMentha has been named as the receivers.

Palisade Investment Partners is working with investment bank Macquarie Capital as its business underwrites the latest raise for the telco business GigaComm.

Eyes will be on AdBri when the building materials provider reports on Tuesday with a privatisation by Barro Group still being discussed as a real possibility in the near term.

Apollo Global Management and Cimic could be about to press the button on a block trade out of Ventia after investment banks were testing buyer interest in the stock late last week.

Bids for TPG Telecom’s Vision Networks are believed to be due next week, and so far the expectation is that it will be just Uniti and perhaps Vocus Group that will shape as contestants.

Trading technology company Iress is understood to be again attracting attention from private equity firms.

Australian private equity firm Potentia has offered more money to oust KKR’s Alludo in the race for Nitro Software.

Original URL: https://www.theaustralian.com.au/author/bridget-carter/page/200