Palisade Investment Partners has hired investment bank Macquarie Capital to work with its telco business, GigaComm, as it recently raised $20m, say sources.

GigaComm is a non-NBN fixed wireless internet network with speeds up to 1000 megabytes.

The Sydney-based asset manager invested about $20m in the business last year, along with Endeavor Asset Management, and in recent days has invested a further $20m in a deal underwritten by its Palisade Impact Fund.

Last year, the funds sought were being used to support the expansion of GigaComm’s technology telecommunications infrastructure network in NSW and Victoria’s inner-city suburbs, and enter the Brisbane and Canberra markets.

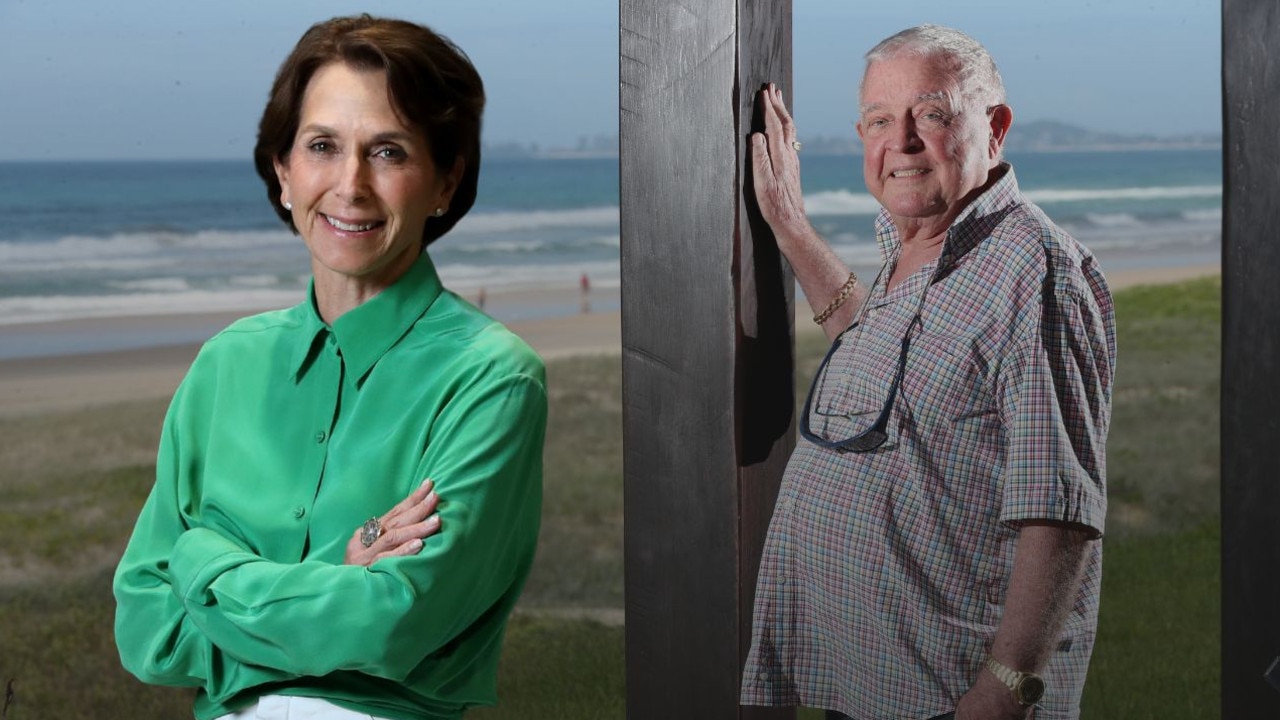

The business was co-founded by chief executive Sophearom En and chairman Peter Shore.

Palisade Impact Fund is a shareholder the business, which has a focus on next-generation infrastructure that addresses environmental and social challenges.

Last year, Palisade opened an office in New York as part of an effort to pursue opportunities in the North American market.

The infrastructure investor has been active in a number of Australian sale processes in the mid-market space.

Last year, it bid for GeelongPort with Spirit Super but did not finalise the deal after the Australian Competition & Consumer Commission did not give approval.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout