Windfall of property tax revenue spurs calls for changes to lower insurance costs

Queensland’s ‘antiquated’ property tax system is not fit for purpose according to critics who blame it for NQ’s painful insurance costs.

Townsville

Don't miss out on the headlines from Townsville. Followed categories will be added to My News.

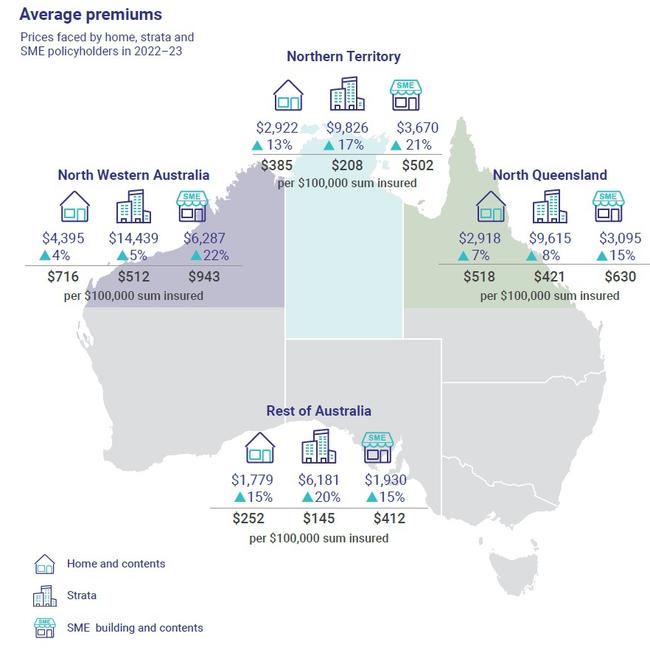

A bumper bounty of property tax revenue being collected off the back of NQ’s unaffordable insurance premiums has prompted calls for the state government to be weaned off taxes like stamp duty.

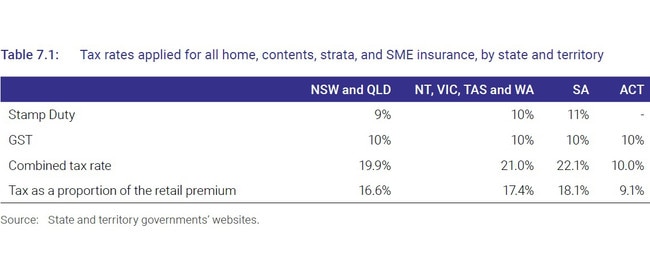

The Northern Australia Insurance Inquiry final report recommended that the governments of Western Australia, the Northern Territory and Queensland should abolish stamp duties on home, contents, and strata insurance.

REIQ chief executive Antonia Mercorella seized on new data from the ABS showing that the state government received a huge boost to its coffers from property tax revenue in the last financial year.

Property taxes (stamp duty and land tax) rose by 133 per cent (more than doubled) over the past ten years, equating to an additional $4.2bn per year,

Stamp duty now forms 25 per cent of the tax base for the state government compared to 20 per cent ten years ago.

“Over the past five years, Queensland has recorded the highest growth in property taxes of any state,” Ms Mercorella said.

“It’s clear our state’s antiquated property tax system is no longer fit for purpose, and this unhealthy addiction to new highs of property revenue must be tapered and kept in check.

“We’ll keep advocating for stamp duty to be completely overhauled.”

Townsville Chamber of Commerce chief executive Heidi Turner made the abolishment of additional fees like stamp duty and GST a key plank in hers and 19 other northern chambers’ campaign for a fairer insurance market in northern Australia.

She said in a budget submission to the federal government that state government based stamp duty had received criticism from multiple agencies, where it was applied to premiums amounts after the GST was applied – “a tax on tax”.

“In northern Australia where premium prices are two to three times the national average, stamp duty can account for up to a 30 per cent increase on a premium when trying to achieve premium parity,” Ms Turner said.

“Collecting stamp duty on top of the GST allocation is double taxing and completely unjustifiable on the essential service.”

“Stamp duty must be removed from insurance premiums. The federal government is currently doing the heavy lifting and the state must do their share.”

When asked whether it would make changes to stamp duty, a Queensland Treasury spokeswoman said insurance duty formed an important part of the Queensland Government’s critical revenue base to provide health, education, law and order, transport and other essential services for all Queenslanders.

“Insurance affordability is a key cost of living issue, particularly for North Queensland. The Queensland Government continues to substantially invest in resilience measures in disaster-prone areas to put downward pressure on insurance premiums, including in North Queensland,” the spokeswoman said.

It was asserted that insurance duty made up only a relatively small portion of the costs of insurance compared to the overall premium, despite the Insurance Council of Australia accusing the states of making more money from stamp duty ($5.6bn) than insurers made in profit ($4.6bn).

“As stamp duty is a percentage of premiums, states are experiencing windfall gains as a result of higher premiums in recent years due to the impacts of inflation and extreme weather events,” the ICA spokesman said.

“The ICA will be campaigning for the removal of stamp duty on insurance in Queensland in the lead up to the state election.”

Rival political parties weigh in on stamp duty

Addressing property taxes’ impact on insurance premiums could be a key campaign issue leading into October’s Queensland state election.

A spokesman for Katter’s Australian Party (KAP) leader Robbie Katter said their party was the first to drive stamp duty Stamp Duty reform to support North Queensland.

“Successive governments from both major parties have retained stamp duty as a greedy way to raise more government income,” Mr Katter said.

“KAP have long had the position that stamp duty is a burden on the development of regional Queensland, and disproportionately impacts North Queensland.

“It hamstrings development and investment.”

He said each time an insurance policy went up, it was important to remember that the Queensland government benefits with more stamp duty payable.

“A government who is serious about cost-of-living relief would immediately cut stamp duty payable on insurance in North Queensland,” he said.

“KAP remains a strong supporter of private investment and state driven development, especially in North Queensland.

“Any tax, duty, or other impost that stalls investment in North Queensland should be immediately removed.”

Shadow Treasurer and Shadow Minister for Home Ownership, David Janetzki said if his party was elected in October, “the LNP will raise the threshold for first home buyer stamp duty so Queenslanders spend less on tax when buying their first home”.

“Because Labor has the wrong priorities and doesn’t care about the issues that matter to Queenslanders, Labor has ruled out changing the stamp duty threshold,” Mr Janetzki said.

“Queensland has the lowest rate of home ownership in the nation and Queenslanders are spending thousands extra in taxes that could instead go straight to paying for their homes.

“Queenslanders are struggling under the burden of Labor’s cost of living hikes and taxes, but a priority for the LNP is to drive-down costs.”

More Coverage

Originally published as Windfall of property tax revenue spurs calls for changes to lower insurance costs