19 chambers of commerce back changes to fix broken insurance market

Pressure is being ramped up on the federal government to fix northern Australia’s broken insurance market in the lead up to the budget. See what needs to be changed.

News

Don't miss out on the headlines from News. Followed categories will be added to My News.

Tired of seeing NQ businesses and residents get a raw deal from the failed insurance market, the Townsville Chamber of Commerce has continued their advocacy for a federal intervention, with the backing of Chambers of Commerce from across Northern Australia.

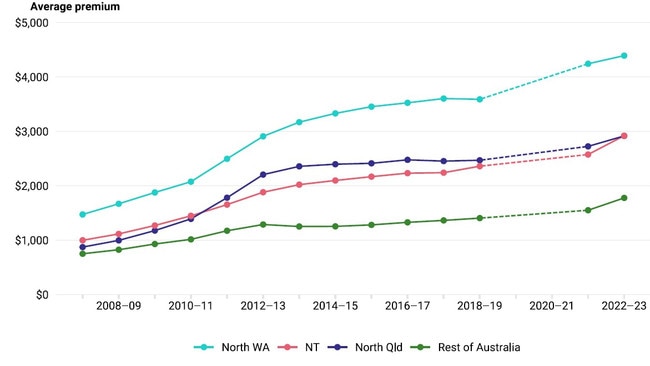

The desire for a fairer deal in insurance isn’t new for the Chamber, which first lodged a submission with the federal government back in 2021 with four recommendations to reduce insurance premiums in cyclone impacted areas.

It provided a list of four recommendations “to create parity in the insurance market for northern Australia” and the Re-insurance Pool for Cyclone and Flood Related Damage (RPCFRD) was one recommendation that has been progressed.

With the continued market failure in insurance in the north, the Chamber’s new chief executive Heidi Turner rallied support from northern chambers and industry groups.

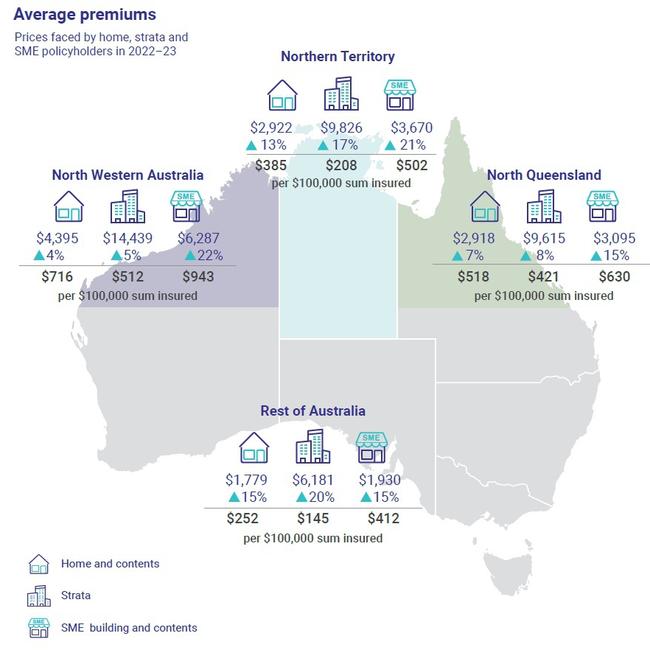

“Our Federal Budget submission is backed by 19 chambers of commerce from Rockhampton right round to Exmouth in Western Australia. We discussed the challenges we’re all seeing across the north, it’s not just a Townsville thing, the cost of insurance is being felt heavily by businesses across the north of Australia,” Ms Turner said.

“The reinsurance pool was announced three years ago but there are so many additional costs for businesses, and insurance premiums are a major part of those increasing costs.”

Ms Turner said unaffordable insurance was forcing businesses to take their chances with reduced or no coverage, which created anxiety on the eve of Tropical Cyclone Kirrily’s impact with Townsville in January.

“Can you imagine having a grown man on the phone crying to you, worried there’s a cyclone coming, and he hasn’t got insurance for his business?” she asked.

“That really spurs you on.”

Regarding the RPCFRD, the Chamber has called for an interim review ahead of the legislated full review in July 2025, to ensure it is effective at reducing premiums.

Additionally, the Chamber recommends that insurers should be required to provide products to all Australians rather than cherry picking the most profitable areas, that the government should create a national insurer providing a baseline of insurance, and the abolishment of tax on insurance, as it is an essential service.

“We’re already being punished by higher insurance premiums than our southern counterparts, this is then compounded by the addition of GST, plus stamp duty on top of all that,” she said.

“It’s extremely unfair that we are paying more tax for the same level of cover as businesses in other parts of the state and country… with horizontal fiscal equalisation it is effectively double-dipping from the state.

“We’d need more than one of our recommendations to come into play to ensure that there is no longer a market failure in insurance in the north.”

Ms Turner has met with the ACCC and asked them to include how many properties are insured and underinsured in their annual insurance monitoring report.

“We need to know the impact that these unsustainable premiums are having on our community and to have clear data on how many properties are insured and underinsured,” she said.

“As the insurer of last resort if people don’t have enough cover the government will be the ones supporting businesses and communities to rebuild as we have seen in Cairns, and that is at a cost to us all.

“Mitigation isn’t an instant remedy for the long-standing market failure we’ve endured in insurance for over a decade. Currently, insurers can’t provide clear information on which mitigation efforts will lower premiums. While some are investing in systems to pinpoint risk for each property, the impact on their risk profiles is currently uncertain. We urgently require premium reductions, and tax adjustments represent a lever that both federal and state governments can employ.”

>> READ: NQ business speaks out after insurance bill doubles

Federal members discuss insurance challenges

Challenged on what was being done to improve insurance affordability for northern Australians, Assistant treasurer Stephen Jones reaffirmed his government commitment to working with insurers and local communities on the issue.

“There are several global factors contributing to high insurance costs – global inflation, supply chain issues, and costs to rebuild – we know these pressures can be especially acute for northern Australians,” Mr Jones said.

“The Albanese government is working hard to make communities more climate resilient and reduce the risk of natural hazards so that people are safer and insurance is more affordable.

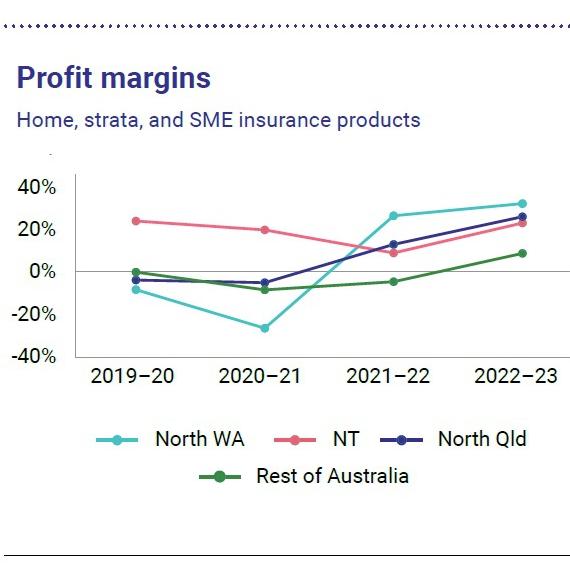

“We have seen some positive early signs that the Pool is working as intended and we will continue to monitor its effectiveness to produce the best outcomes for northern Australians.”

The federal government was investing $1 billion over five years in disaster resilience through the Disaster Ready Fund, and established the Hazards Insurance Partnership, a collaboration between government and insurers to understand where to invest to reduce risk.

By December 2023, all major insurers had joined the Reinsurance Pool for Cyclone and Flood Related Damage and about 95 per cent of home insurance policies were covered.

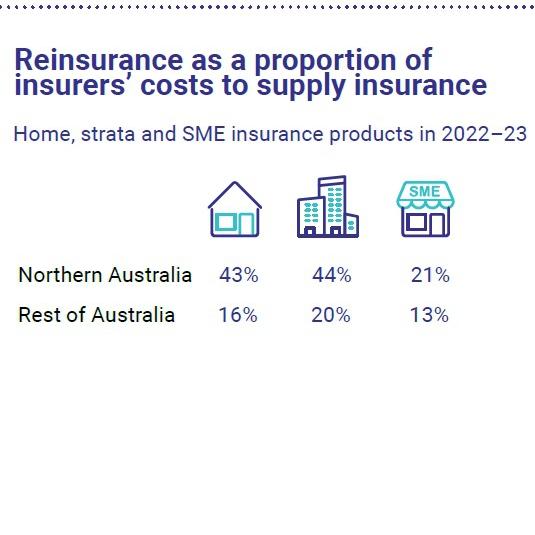

The former Coalition Government claimed the pool would save northern Australians up of up to 34 per cent for small business, 46 per cent for homeowners, 58 per cent for strata from the Cyclone Reinsurance Pool, but revised modelling has determined it would only save 10 per cent for small business, 13 per cent for homes and 37 per cent for strata.

It is understood that the true impact of the Reinsurance Pool in reducing premiums could not be known until some time after the end-of-2024 deadline for the remainder of insurers to join the pool.

Herbert MP Phillip Thompson said he has had many constituents report to him saying that they had managed to find savings on quoted premiums for their homes in the hundreds to thousands of dollars by shopping around.

“However, this is not always the case, and tweaks need to be made to ensure the savings are experienced by as many people as possible,” Mr Thompson said.

“The former Coalition Government committed to reviewing the Reinsurance Pool a year after its implementation. This was not matched by the Albanese Labor Government.

“I wrote to the Labor Assistant Treasurer in December last year calling for the operational period of the pool to be extended to 7 days following a cyclone. The Coalition’s original legislation acknowledged this change may be required. I have not received a response from the Labor Assistant Treasurer.”

Originally published as 19 chambers of commerce back changes to fix broken insurance market