MIT economic researcher praises Aussie government’s insurance intervention

Fresh research has revealed that Australia’s cyclone reinsurance pool was beginning to have positive effects on the insurance market. Read the latest data.

Townsville

Don't miss out on the headlines from Townsville. Followed categories will be added to My News.

An economics researcher has revealed data showing that northern Australia’s cyclone reinsurance pool was beginning to bring down the cost of insurance, running counter to “quite pessimistic” media coverage on rising insurance prices.

A former undergraduate at UNSW in Sydney, Adam Solomon is a PhD candidate at the Massachusetts Institute of Technology’s (MIT) Department of Economics in the USA.

Given the increasing risk of hurricanes and wildfires in the US, he said there was increasing attention on how home insurance was getting harder to find and/ or very expensive.

He embarked on investigation into how governments could intervene to improve insurance markets and mitigate the increased climate risk.

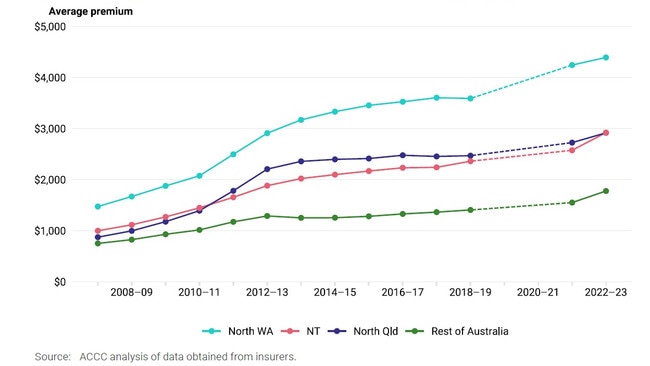

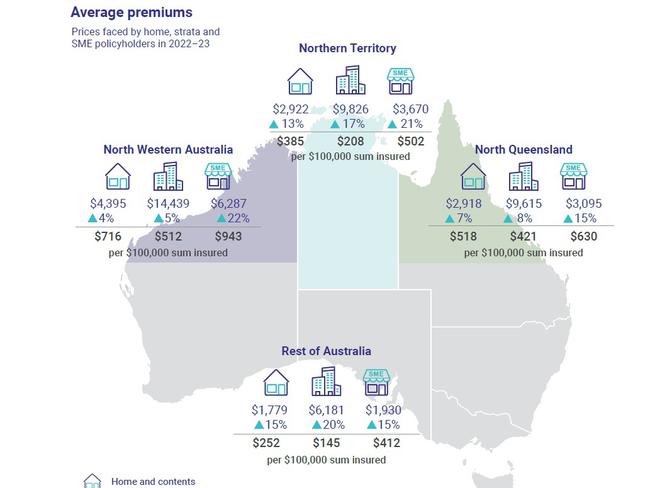

In his recently released research paper, Mr Solomon determined that the cost of insurance in northern Australia rose by 122 per cent, compared to 52 cent for the rest of the country, between 2007 to 2019.

He said Australia’s Cyclone Reinsurance Pool (CRP) provided “insurance for insurers”, by agreeing to take on all the risk related to cyclones for the enrolled insurer’s home insurance policy.

Since the introduction of the CRP in 2022, he found it had reduced premiums for home insurance policyholders and increased the availability of insurance.

“I estimate premiums fell by 10 per cent on average and up to 27 per cent for the highest risk houses … as a result of the pool,” Mr Solomon said.

“Also important is the fact that insurance is now more available – insurers are now offering coverage to 6 per cent more of the average houses in northern Queensland, and 11 per cent more of the highest risk houses.”

He commended the Australian government for being willing to pursue this novel policy solution, which has had “demonstrable positive effects”.

“Climate change is changing and increasing the risks we face. Making sure people have fairly priced financial protection against these risks is critically important,” he said.

“I think it can be an example to governments in other countries and regions about how to help people obtain fairly priced protection against risks to their livelihoods.”

While some smaller insurers were still yet to enter the CRP, he didn’t expect their entry to have a huge impact on premium costs, given that the pool already included the biggest insurers and 95 per cent of the policies.

“The pool seems to be working well. In fact, there are now suggestions that the pool should be expanded to floods that are not caused by cyclones,” he said.

Last month the Australian Reinsurance Pool Corporation (ARPC) said it was in the process of reviewing the current (2022) CRP premium rates and was considering minor changes which would be applicable from April 1, 2025.

More Coverage

Originally published as MIT economic researcher praises Aussie government’s insurance intervention