Norman Cleveland suffered a medical emergency travelling in Europe and racked up $600,000 in medical expenses

When a bad cold in Europe turned into something more serious, Norman Cleveland never imagined it could cost him $600,000.

SA News

Don't miss out on the headlines from SA News. Followed categories will be added to My News.

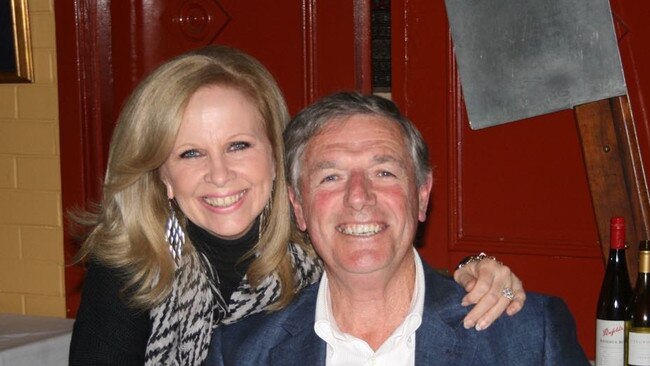

Norman Cleveland and his wife Jo-Anne Jury give thanks each day he took out travel insurance for a trip to Europe last year, after it covered a $600,000 claim.

Mr Cleveland, 75, of Eastwood was travelling with his brother and after visiting Portugal and Ireland arrived in London where Norman was suffering from a bad cold.

He deteriorated into delirium, was taken by ambulance to hospital where he was diagnosed with an infection in his brain and ended up in intensive care.

He remained in hospital for 10 weeks before being medically evacuated to Australia and transferred by ambulance to the Royal Adelaide Hospital where he stayed for two months.

Ms Jury said the experience was extremely stressful for her husband and his family in Australia.

“His daughter flew to London to be with them and his brother needed to stay for an additional nine weeks, meaning he needed further accommodation and transport,” she said.

“Norman is still recovering with his rehabilitation and is no longer able to drive, so things that were very simple are now quite difficult.

“But we are very grateful he made it home safe and the fact all of his and his brother’s extra expenses were covered by insurance.

“We did not see any hospital or air ambulance bills, and the accommodation for Norman’s brother was taken care of by our insurer. The final claim came to more than $600,000.”

RAA Travel general manager Gina Norman said it is an important reminder that overseas travellers who skip travel insurance risk paying a hefty price.

A RAA survey of South Australian travellers showed 23 per cent didn’t purchase an insurance policy before heading overseas — meaning they were uninsured or relying on complimentary forms of cover such as insurance associated with credit cards.

The number who wait until the last minute has surged, leaving them exposed if something goes wrong before they purchase the policy.

Ms Norman said a dream holiday is a big financial investment so travellers need to consider how they are protecting it as soon as they outlay money.

“If you leave your insurance until the last minute, there may be a period when you’re at risk of being out of pocket if something unexpected happens such as a medical emergency that prevents you from going on your trip,” she said.

“If you are looking to take out insurance, levels of cover can vary so always read the fine print in detail to ensure you understand what is included before your trip.

“Check the policy covers all the activities you plan to do while you’re away – such as snow-skiing, scuba diving or driving in a foreign country.”

More Coverage

Originally published as Norman Cleveland suffered a medical emergency travelling in Europe and racked up $600,000 in medical expenses