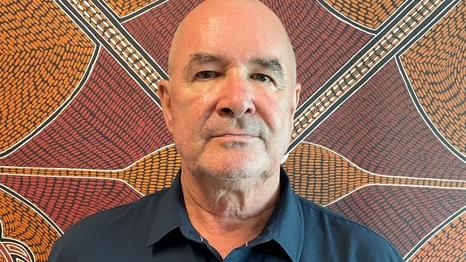

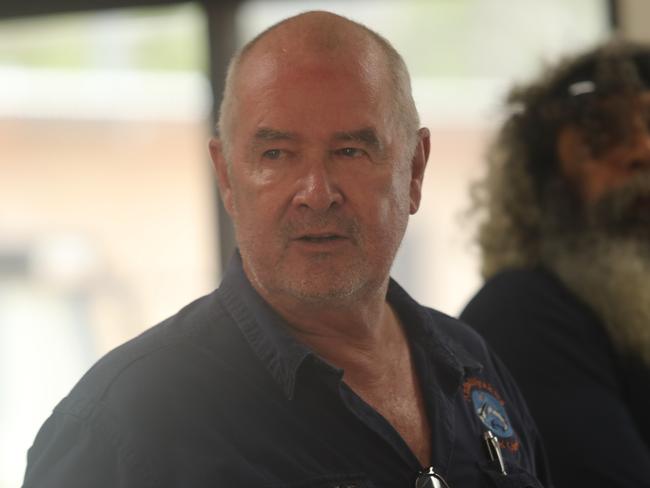

Anindilyakwa Land Council chief executive Mark Hewitt defends ‘disproportionate benefit’ found by audit office

The Anindilyakwa Land Council boss has defended ‘disproportionate’ funding benefits uncovered by the National Audit Office.

Indigenous Affairs

Don't miss out on the headlines from Indigenous Affairs. Followed categories will be added to My News.

The boss of an Aboriginal land council controlling royalties from the world’s largest manganese mine has defended criticism of millions of dollars going towards a mining company which he directs.

Mark Hewitt is chief executive of Anindilyakwa Land Council on the Groote Archipelago, where much of the local Indigenous population lives in poverty despite the Gemco mine making the region one of the most royalties-rich in the country.

The Australian National Audit Office found $24m, or half of the ALC’s 2021-22 royalties, was invested into entities supporting Winchelsea Mining – an enterprise jointly established and directed by Mr Hewitt and council chair Tony Wurramarrba.

Mr Hewitt is chief executive and director at Winchelsea Mining and Mr Wurramarrba is its chair.

Auditors found “the risk of conflicts of interest is high” and management strategies to mitigate risk were either not implemented or insufficient given the influence of Mr Hewitt and Mr Wurramarrba over funding decisions, and the financial benefit Winchelsea Mining could obtain from the ALC.

The May 2023 report made 15 recommendations, of which the ALC accepted 14 and said 10 have since been implemented, “as well as many subsequent related actions and self-identified initiatives to enhance our governance”.

Mr Hewitt denied any wrongdoing and the ALC said it was confident conflicts of interest had been properly managed.

“I want to make it very clear that Winchelsea Mining is not my ‘own mining venture’,” Mr Hewitt said.

“The majority shareholder in the Winchelsea Mining project is the Anindilyakwa Advancement Aboriginal Corporation, whose directors comprise senior Traditional Owners from the two relevant clan groups. AAAC is a not-for-profit Aboriginal corporation whose objective is to provide for and assist with the economic, social, and cultural advancement of the Groote Archipelago Traditional Owners.

“I have no role in AAAC – all directors of AAAC must be Aboriginal people.”

Of the $47.8m in royalties the ALC received in 2021-22, $4.5m went to AAAC, whose primary project is resource development on Winchelsea Island and which owns a 60 per cent share in Winchelsea Mining.

Groote Holdings Aboriginal Corporation received $19.5m, its primary project Little Paradise supporting infrastructure development for Winchelsea Mining.

Mr Hewitt is executive director of Groote Holdings, his wife is chief operating officer and Mr Wurramarrba is one of the directors.

The National Audit Office found Mr Hewitt was the applicant on behalf of GHAC or AAAC for 16 funding requests, totalling $25.7m, with a success rate of 99 per cent – compared with a 53 per cent success rate for other applicants.

“There was no clear reason for the ALC CEO being the applicant on behalf of AAAC, since the ALC CEO holds no formal position in AAAC (although he is co-CEO and director of Winchelsea Mining, which is a subsidiary of AAAC),” the report said.

In council funding decisions, auditors “observed disproportionate benefit to the entities with which the CEO is associated”.

Another 30 per cent of the royalties, $14.4m, went to the Anindilyakwa Royalty Aboriginal Corporation, of which Mr Wurramarrba is one of the eight directors, and the remaining $9.4m went to 11 Aboriginal corporations.

The National Audit Office found the council’s own audit committee failed to provide adequate oversight and scrutiny of ALC operations.

The committee chair is the founder of Enmark, a consultancy service which received $896,056 from the ALC over the seven years to 2021-22.

Enmark also provides consultancy advice to GHAC and AAAC.

Mr Hewitt said the ALC had updated its register of interests and implemented a new management plan to manage conflicts of interest, and that Mr Hewitt and Mr Wurramarrba recused themselves from Board meetings about Winchelsea Mining.

“In relation to governance of royalty distributions, the Finance Committee reviews all funding applications and makes recommendations to the Board based on the 15-year strategic plan,” he said.

Mr Hewitt emphasised the significance of the Winchelsea project to help plug the revenue gap when South 32’s Gemco mine closes in 2031 after 65 years of operation.

“The ALC is focused on delivering better outcomes for the benefit of all 14 traditional clans of the Groote Archipelago and achieving our mission to protect, maintain, and promote Anindilyakwa culture, invest in the present to build a self-sufficient future, and create pathways for our youth to stand in both worlds,” he said.