Sneaky surcharges are showing up on people’s bank statements

Don't we have enough already?!

Lifestyle

Don't miss out on the headlines from Lifestyle. Followed categories will be added to My News.

Aussies are no strangers to the odd surcharge when paying for a meal.

Of course, we have the trusty credit card surcharge, plus sometimes a little extra on public holidays and weekends. But, more often than not, we know about them before paying.

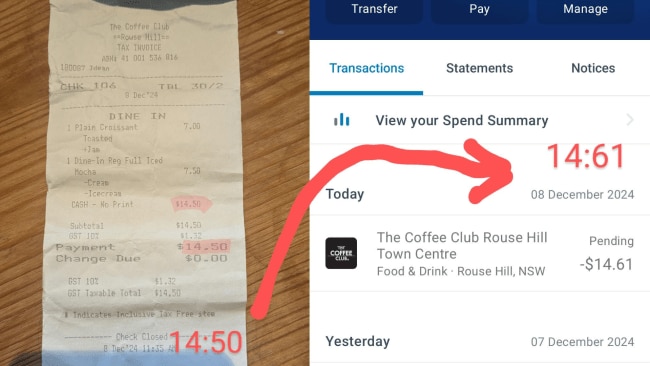

However, one Reddit user has taken to the platform to share their confusing find, after noticing that their bank statement read a higher amount than the receipt they received in-store.

Want to join the family? Sign up to our Kidspot newsletter for more stories like this.

RELATED: We tried this viral trolley to see if it makes shopping easier

No one likes a surcharge

A Reddit user has taken to the platform after enjoying a croissant and an iced mocha at The Coffee Club in Rouse Hill.

Whilst the customer’s receipt reads $14.50, their bank statement shows a payment of $14.61, indicating some sort of additional surcharge.

“Surcharges keep on creeping creeping creeping into the future…” the post said.

Introducing our new podcast: Mum Club! Listen and subscribe wherever you get your podcasts so you never miss an episode.

RELATED: The $11.50 cleaning product that cleared my stinky drains

“Those numbers should be exactly the same”

Commenters on the post were fuming over the discrepancy.

“I know it's only $0.11, but I very much do not like that there is zero mention of it on the invoice. Those numbers should be exactly the same,” one commenter said.

“Agreeing to a price and getting slugged with hidden ones is not okay,” said another.

Some commenters noted that adding an undisclosed surcharge is illegal, encouraging the poster to do something about it regardless of the small monetary amount.

“IDC if it's only 11c I'd report that to the ACCC and dispute it with my bank,” one commenter said.

“I'd be contacting ACCC, Consumer Affairs etc.,” another agreed.

“Isn’t this the card fee?”

However, other eagle-eyed commenters noted that the additional cost may have just been a card fee.

On the original receipt, it says that the amount was paid in cash, whilst the bank statement indicates it was paid by card.

“Isn’t this the card fee? It gets added by the machine at the last second when paying. If you went cash it would have been 14:50,” said one commenter.

“It's simple, the register isn’t linked to the eftpos. This happens all the time. You just don’t see an invoice for it,” another said.

Who’s in the right?

Kidspot reached out to The Coffee Club to see if they could debunk this issue. And, it seems it has a simple explanation - though our spokesperson said they’re looking into why it happened in the first place.

“We are disappointed to read of this customer’s experience in one of our stores,” the spokesperson said.

“We’ve reviewed the transaction at Rouse Hill, and we can see it was unfortunately processed as a cash payment on the point-of-sale system when this should have been EFTPOS.

“When the customer completed their payment via EFTPOS, the standard surcharge of 0.75% was applied, which typically would have been displayed both on the payment screen and on the receipt.

“To prevent such errors, our stores use an integrated POS system. We are currently investigating why this was evidently not the case at this location and will work to ensure this is rectified promptly.

“We take transparency seriously and are committed to providing our customers with clear and accurate information.”

More Coverage

Originally published as Sneaky surcharges are showing up on people’s bank statements