ASX Trader: Boom to bust - why Bitcoin is not ‘digital gold’

When there was mass euphoria and talk of ‘once in a lifetime’ gains around Bitcoin late last year, ASX Trader knew it was time to exit. Here’s the danger signs he saw.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Looking back, the signs were obvious.

In December 2024, just as former US President Donald Trump launched his own meme coin, the crypto market was already deep in euphoric territory.

Retail traders were rushing into speculative tokens, influencers were shouting about “once in a lifetime” gains, and social media was flooded with promises of easy riches.

But in markets, mass euphoria is often a warning sign, not a green light.

Many have since asked how I knew to exit the market in mid-December, right before altcoins collapsed and the broader crypto market turned south.

The answer? It wasn’t luck. It was data and preparation.

At AusCryptoCon, the largest crypto event in the Southern Hemisphere, I laid it all out publicly on stage.

On November 23, I presented three key price zones where I expected the market might peak: a weak zone at $108,000, a medium zone at $125,000, and an extended target at $145,000.

These weren’t random guesses.

They were carefully mapped areas where smart money tends to sell.

The market hit the first level, $108,000, and reversed almost immediately.

With volume shifting, momentum fading, and key trend signals breaking down, I exited.

Many others stayed in, hoping the Bitcoin halving would kickstart another rally.

What is a Bitcoin halving

For those new to the space, a halving is a scheduled event in Bitcoin’s code that happens approximately every four years.

When it occurs, the reward given to Bitcoin miners is cut in half.

That means fewer new coins are being introduced into circulation.

Historically, halvings have led to major price increases.

The logic is simple.

With fewer new coins being created, Bitcoin becomes more scarce and that scarcity has often driven prices up.

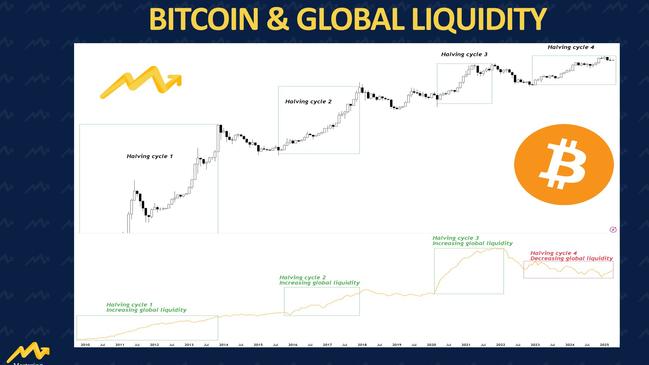

But this time, the halving didn’t deliver.

The Halving that didn’t work

Bitcoin’s most recent halving was expected to spark another major bull run, just as it had in previous cycles.

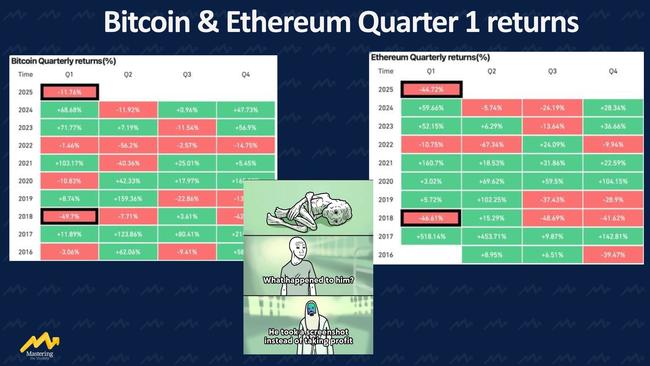

But instead, 2025 has started with one of the weakest quarters in crypto’s history.

This cycle has broken several long standing patterns:

• Bitcoin dropped below the high of its previous cycle for the first time

• It hit a new all time high before the halving, not after

• And rather than accelerating in early 2025, the market has sharply declined

So what changed?

The Macro Picture: A new global reality

This is the first halving in Bitcoin’s history to occur during global liquidity tightening (as seen in attached chart).

In simpler terms: money isn’t cheap anymore.

Governments and central banks are raising interest rates and pulling money out of the system to fight inflation.

In the past, Bitcoin grew in a world full of cheap credit, government stimulus, and a rising stock market.

That world is gone. And Crypto is reacting.

Bitcoin isn’t Digital Gold, It’s Blockchain technology

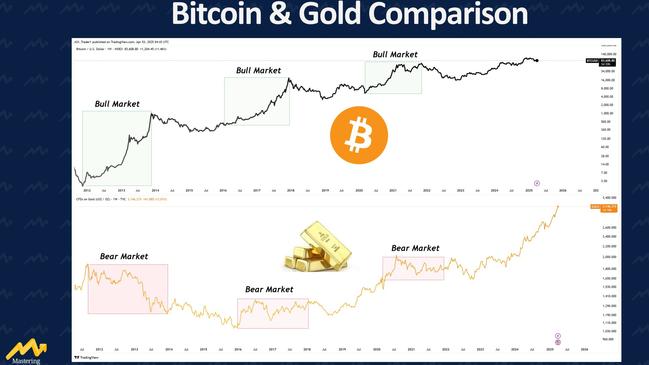

One of the most common misconceptions in finance is that Bitcoin is digital gold.

But the data doesn’t support that view.

Gold has been a safe haven for centuries.

When inflation rises or markets turn volatile, gold tends to rise.

And in 2025, it has done exactly that, becoming one of the best performing major assets of the year.

Bitcoin, however, has done the opposite.

That’s because Bitcoin is not a traditional safe haven.

It’s the first and most well-known use case of blockchain technology, a powerful and evolving system that underpins everything from decentralised finance to smart contracts and digital assets.

Bitcoin behaves more like a high growth tech stock.

When investor confidence is high and money is flowing, it can soar.

But when rates rise or liquidity dries up, it tends to fall, just like tech stocks do.

The numbers back this up.

Studies tracking Bitcoin’s relationship with gold since 2009 show only a weak correlation, typically between 0.10 and 0.30.

That means the two assets rarely move together in the long term.

Occasionally, like during the Covid panic, they’ve risen in tandem, but those moments are rare.

So, no, Bitcoin is not digital gold.

It’s blockchain exposure, and investors need to treat it that way.

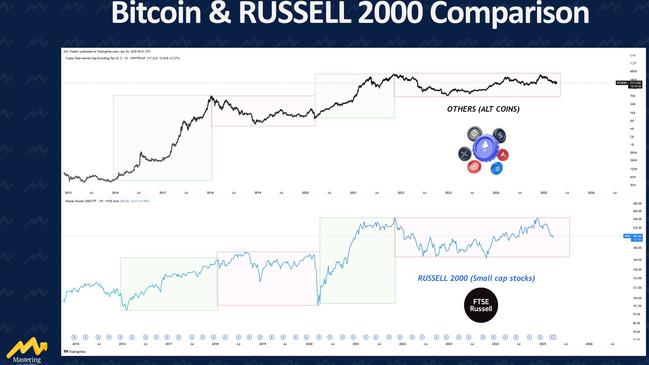

Altcoins are following the Russell 2000

While Bitcoin gets most of the media attention, altcoins are where everyday investors often aim for life-changing returns.

But this cycle, they’ve underperformed badly.

Why? Because altcoins behave like risk-on tech stocks, not digital gold.

The data shows that many altcoins move in sync with the Russell 2000, a U.S. index made up of small-cap companies.

When the Russell struggles, so do alts.

And this cycle, the Russell 2000 has significantly lagged behind the S&P 500 and Nasdaq.

• Altcoins surged during brief rallies

• But without broader risk-on momentum, most have crashed

• Some are down 75 per cent or more from their 2024 highs

Investors who didn’t lock in profits during the few hot periods - March 2023, October 2023 -March 2024, and September-December 2024 - have been left holding the bag.

Final Thoughts: Crypto isn’t broken. It’s maturing

For years, Bitcoin’s four year halving cycle has been treated as a guaranteed recipe for gains.

But 2025 has shown that those old narratives don’t hold up in today’s market.

The reality is this: Crypto has grown up.

It no longer exists in a vacuum.

It’s now part of a complex global financial system influenced by interest rates, monetary policy, inflation, and investor sentiment.

For some, the recent downturn was a shock.

For others, including myself, it was expected.

Analysts have been warning that the halving story no longer fits this new environment.

That message hasn’t always been popular.

But it’s not about fear. It’s about clarity.

It’s about moving past hype and relying on what matters most: data.

Crypto isn’t going away.

But it is evolving.

And to succeed in this next chapter, investors will need to shift from hopeful narratives to informed decisions.

Originally published as ASX Trader: Boom to bust - why Bitcoin is not ‘digital gold’