Qantas executive pay a problem, say proxy advisers ahead of AGM

Qantas shareholders are being urged to vote down the airline’s remuneration report due to ‘problematic pay practices’.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Three proxy advisory firms have recommended Qantas shareholders vote against the remuneration report at the airline’s upcoming AGM due to “problematic pay practices”.

Institutional Shareholder Services (ISS) joined Glass Lewis and Ownership Matters in advising against support for the remuneration report, which resulted in former CEO Alan Joyce being farewelled with a $21.4m package.

The ISS report raised concerns about “poor, absent and inferior disclosure of short-term incentives targets and hurdles” and Mr Joyce’s deferral of long-term incentives during the Covid-19 pandemic when Qantas made billions of dollars in losses.

ISS also advised against voting in favour of a long-term incentive plan for new chief executive Vanessa Hudson, worth a maximum of $2.08m.

The report found the performance measures on which the incentive plan was based were misaligned with shareholder returns, company performance and shareholder expectations.

Instead an “excessive percentage” of the long-term incentive was a “non-financial reputation” measure that lacked a precise methodology, the report said.

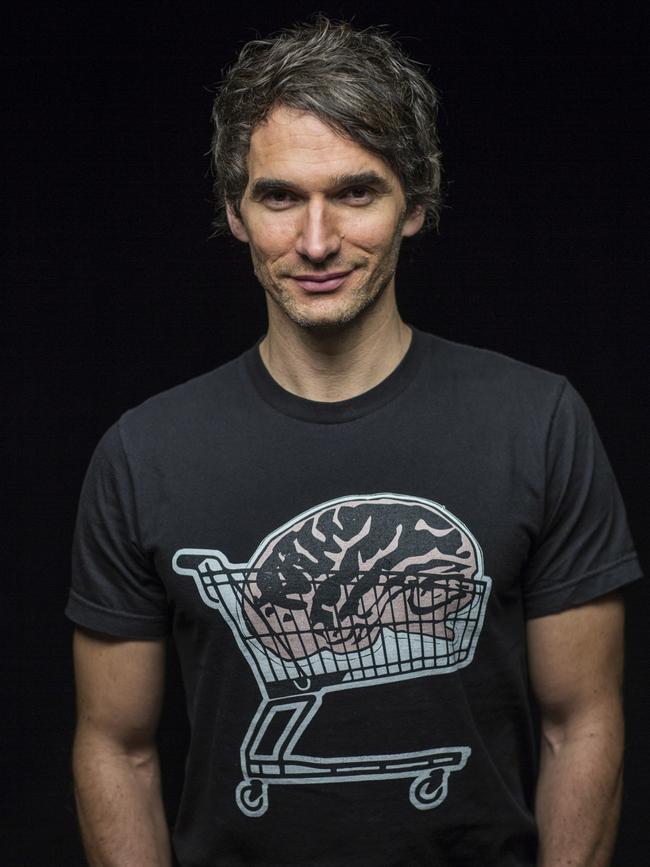

In a surprise move, ISS supported the re-election of directors Todd Sampson and Belinda Hutchinson, in the interests of “board stability”.

The same company recently advised Telstra shareholders against the re-election of director Maxine Brenner, based on her corporate governance failures at Qantas.

As a result, Ms Brenner’s re-election to the Telstra board saw a 17 per cent “protest” vote by shareholders.

The Australian Shareholders Association also released its voting guidance for the Qantas AGM on Thursday, recommending members oppose all but two of the resolutions.

Those which the ASA supported included the election of former American Airlines chief executive Doug Parker as a director and the re-election of Ms Hutchinson.

The ASA said Mr Sampson had not earned re-election, pointing out he was “supposed to have brought to the board marketing, public relations, communication and media management skills”.

“Yet Qantas has disappointed on all these fronts,” said the ASA report by CEO Rachel Waterhouse.

The association which represents about 10 per cent of Qantas shareholders, was also against appointing Ms Hudson to the board of Qantas, and approving her long term incentive plan.

Ms Waterhouse said there was no compelling need for the CEO to also be a director and Ms Hudson was yet to “prove” herself in the role.

She said given the fact Ms Hudson was part of the executive when a string of crises occurred, including the mishandling of travel credits, the illegal outsourcing of 1700 workers and the alleged sale of tickets on already cancelled flights, the jury was still out on her competence.

Qantas issued a statement in response to the proxy advisories, saying “we know this AGM will be an important opportunity for shareholders to express their frustration with past events”.

“The board and management are listening to the concerns of all stakeholders and are focused on the change now underway, including leadership renewal that also provides some level of continuity,” said the statement.

“Action has been taken on executive remuneration and remains a focus for the board. The company itself is in a fundamentally strong position to fix service issues and restore trust more broadly and that’s what we’re concentrating on.”

Chairman Richard Goyder is set to leave at next year’s AGM, and long-serving directors Ms Brenner and Jacqueline Hey will step down in February.

Michael L’Estrange will retire at the November 3 meeting, with senior ex-public servant Heather Smith nominated as his replacement.

Ms Waterhouse recommended shareholders vote against Dr Smith’s appointment, questioning the motivation behind her nomination.

“While Qantas seems to like having senior ex-public servants on the board, we are suspicious, given recent events, that this is more to maintain access to government rather than to bring governance skills to the board,” Ms Waterhouse said.

Originally published as Qantas executive pay a problem, say proxy advisers ahead of AGM