RBA may be forced to raise interest rates despite 2024 promise

A promise was made to keep interest rates low until at least 2024 but new circumstances could see a world of pain for Aussie homeowners.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

In the old Looney Tunes cartoons, Wile E. Coyote would always chase the Road Runner attempting to catch him to eat for dinner. Over the course of the many episodes of the show, Wile E. Coyote would come up with all sorts of crazy schemes to catch his nemesis, from strapping giant ACME rockets to his back to cleverly concealed traps.

Yet despite the enormous amount of effort he put into achieving his task, he never did manage to make Road Runner his lunch.

This brings us to the Reserve Bank, or for the purposes of this story, our Wile E. Coyote.

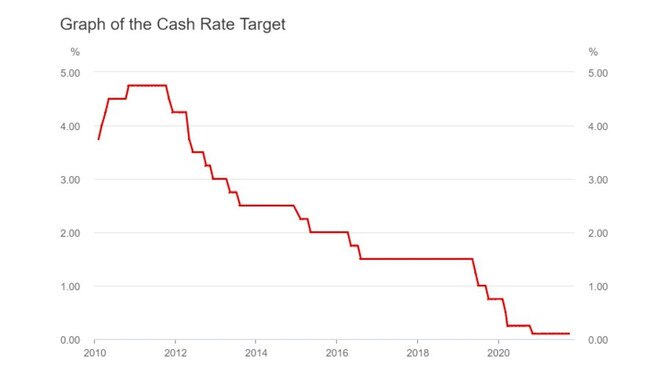

Since last raising interest rates almost 11 years ago, the RBA has cut interest rates time and time again in an attempt to achieve its inflation target of 2-3 per cent annually.

In essence the idea is that when the RBA cuts interest rates, households have more money to spend on consumption and businesses have more of an incentive to borrow to invest in improving their business.

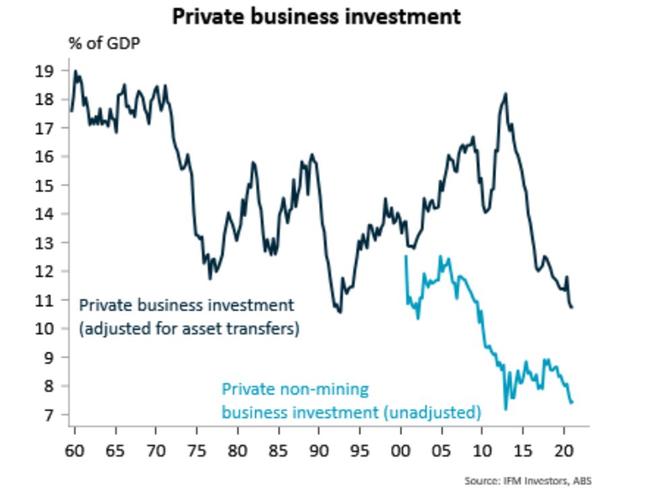

In times now long past, the relationship between lowering rates and business investment worked relatively well, helping to ensure decades of prosperity for the vast majority of Australians.

But in the years since the GFC things have changed. The RBA cutting rates is no longer a sufficient incentive for businesses to borrow to invest in anything like the numbers that did so previously.

Instead, in recent years, the mantle of lower interest rate driven activity increasingly fell to households.

The wealth effect

Another key part of lower interest rate driven consumption is a result of the so called ‘wealth effect’, whereby homeowners feel wealthier due to rising home prices and feel incentivised to go out and spend more than they otherwise would have.

While this psychological factor is challenging to quantify, what we do know is that rising housing prices helped homeowners borrow nearly $93 billion against their homes in the year to June, to spend as they choose.

Yet despite the billions of dollars of household consumption, the RBA has failed to achieve its inflation target for years.

The threat of rising inflation

According to the latest inflation figures from the ABS, annual inflation is currently sitting at 3.8 per cent, well outside the RBA’s target band.

One of the contributing factors in the strong inflation figures is the impact of last year’s lockdowns distorting the data.

But when you start to strip out the impacted components of the consumer price index, it becomes clear that there is a strong inflationary impulse in its own right.

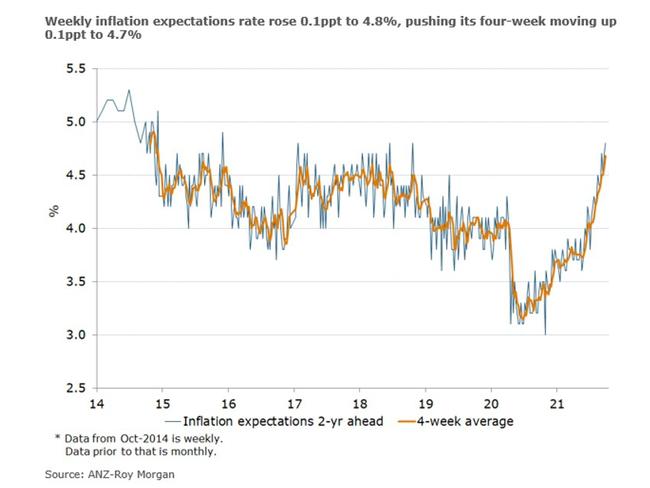

The Australian public see things pretty similarly. According to ANZ’s Inflation Expectations index, households are expecting inflation to run at 4.7 per cent, the highest rate since 2014 and the index has risen rapidly to this level.

In this Australia is not alone, inflation is rapidly becoming a major issue across the globe. In the United States consumer confidence has plummeted, as the cost of living rises well above wages.

In New Zealand concerns about inflation have prompted the RBNZ to raise interest rates earlier this week, following well over a dozen central banks globally that have raised rates during 2021.

Inflation, Wile E. Coyote and the RBA

If these strong inflationary pressures continue as many prominent economists increasingly believe they will, then the RBA may end up with a problem.

Through the impact of global supply chain issues, rising energy prices and pandemic driven demand, its inflation goals may get not only met, but significantly exceeded.

Yet despite the threat of rising inflation forcing the RBA to raise interest rates, RBA Governor Philip Lowe remains committed to rates staying low until at least late 2024.

ANZ-Roy Morgan Australian Consumer Confidence up a touch, with #inflation expectations reaching a post pandemic high and the highest level since 2014. #ausecon#ausbiz#auspol@arindam_chky@DavidPlank12@roymorganonlinepic.twitter.com/Xqflcx7Xaz

— ANZ_Research (@ANZ_Research) September 27, 2021

This is quite a contrast to other central banks throughout the Anglosphere. In Britain, the Bank of England is expected to become the first major central bank to hike rates and in the US, speculation is building that the Fed could be forced to raise rates next year.

The RBA is widely accepted to resist the push to raise rates, even if supply chain issues and other pandemic driven factors keep inflation above their target band.

This brings us back to good old Wile E. Coyote.

As rates continued to fall, rate cuts lost much of their effectiveness in spurring businesses to invest, to create jobs and expand their capabilities. Arguably partially as a result, inflation adjusted household disposable income per capita went practically no where over a similar time period.

Yet like Wile E. Coyote the RBA keep doing the same thing over and over, in an attempt to achieve their goals.

Now however, the shoe is on the other foot. Instead of cutting rates again and again in pursuit of its 2-3 per cent inflation target, it may be forced to raise rates in an attempt to achieve that same goal.

Impacts and the future

If the RBA is forced down the same path of rising interest rates as the RBNZ and a long list of other central banks, Aussie mortgage holders could be in for an unpleasant surprise.

Despite being promised three years of no rate hikes by the RBA, rising inflation and moves within global bond markets could force their hand much sooner than that.

After no rate increases in almost 11 years, a rate hike or series of rate hikes would come as quite a surprise to borrowers accustomed to rates going only one way, down.

In the same way that the RBA’s routine of rate cuts boosted housing prices on their way down, the RBA being forced into rate hikes may have the opposite effect on the way up.

Where rates head from here in reality is anyone’s guess and the experts have been known to be wrong. But one thing is clear, if a series of rate hikes are forced on the RBA, it could blow up in a lot of people’s faces, just like it did Wile E. Coyote.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator

Originally published as RBA may be forced to raise interest rates despite 2024 promise