Virgin Australia: Billionaire shareholders who could save airline

From an insanely rich royal family to billionaire businessmen, Virgin Australia has a lot of wealthy foreign owners. Why are they refusing to help?

As beleaguered Virgin Australia faces an uncertain future after entering into voluntary administration, the question many are asking is: Why isn’t its wealthy foreign owners helping?

The second-biggest airline in Australia is 90 per cent owned by foreign shareholders. They are Etihad and Singapore Airlines, Chinese conglomerates HNA and Nanshan Group, and the Virgin Group.

Behind those names are an assortment of high-profile billionaires, from Virgin’s Richard Branson to Abu Dhabi’s insanely wealthy royal family.

RELATED: Virgin flight credit could be worthless

RELATED: Branson hits out at Australian government

Virgin Australia’s announcement on Tuesday that accountancy firm Deloitte would take over as administrators came after it was refused the $1.4 billion taxpayer-funded bailout it said it needed to survive the coronavirus crisis.

The Federal Government has been emphatic it will not bail out the airline, and said the administration process will give it the chance to recapitalise and “come stronger on the other side” of the crippling pandemic.

“Virgin Australia is a very good airline performing a very important role and this is a difficult day for its staff, for its suppliers and for the aviation sector more broadly,” Mr Frydenberg said yesterday.

“But the Government was not going to bail out five large foreign shareholders with deep pockets who, together, own 90 per cent of this airline.”

So who are these rich shareholders and what are they doing?

The foreign owner with the largest slice is Etihad, with 21 per cent. It’s owned by Abu Dhabi’s oil-rich royal family, the Al Nahyan family, who are worth $238 billion.

The head of the family is Sheik Khalifa bin Zayed Al Nahyan, who is the current president of the United Arab Emirates and Emir of Abu Dhabi. Sheik Khalifa, 71, is one of the world’s richest monarchs, and his personal wealth in 2011 was estimated at around $24 billion, according to Forbes.

A royal relative, Ahmed bin Saif Al Nahyan, is the founder and former chairman of Emirates. The Crown Prince, General Sheik Mohammed bin Zayed Al Nahyan, 59, employs the current chairman of Etihad, Mohamed Mubarak Fadhel Al Mazrouei, as the undersecretary of his royal court.

But all those billions are unlikely to come to Virgin Australia’s rescue. In a statement overnight, Etihad said it was open to talks about the future of Virgin Australia but as the coronavirus pandemic continued to cripple the global airline industry, it had its own problems to deal with.

“Etihad Airways is disappointed Virgin Australia has had to enter voluntary administration due to the unprecedented challenges and consequences of the COVID-19 pandemic,” the airline said in a statement.

“Over recent weeks we have worked closely with the company and all key stakeholders to try and find a solution that would have avoided administration for Virgin Australia, but unfortunately did not succeed.

“Having to deal with the impact of the COVID-19 crisis on our own business, we were unable to provide additional financial support in the current circumstances.”

Virgin’s billionaire founder Sir Richard Branson, who owns 10 per cent of Virgin Australia and whose estimated wealth is $9.2 billion, is in a similar boat.

He’s currently seeking a UK government bailout to save his struggling airline Virgin Atlantic, and has even offered his luxury resort on Necker Island as collateral.

Sir Richard sought to clear up speculation about his finances in a heartfelt open letter about Virgin Australia’s woes this week.

“I’ve seen lots of comments about my net worth – but that is calculated on the value of Virgin businesses around the world before this crisis, not sitting as cash in a bank account ready to withdraw,” he said, claiming a large chunk of his personal wealth was being invested across Virgin companies, with “a big part of that going to Virgin Atlantic”.

“The challenge right now is that there is no money coming in and lots going out.”

Virgin Australia paid Sir Richard big bucks to continue use the Virgin brand name. Although the airline stopped officially reporting those fees in 2013, News Corp understands Sir Richard charged the airline around $10 million a year.

The rest of Virgin Australia’s foreign owners are in Asia.

Singapore Airlines, which is majority-owned by the Singapore Government, owns 20 per cent of Virgin Australia.

It has also been brought to its knees by the coronavirus pandemic. Singaporean state investor Temasek Holdings contributed to an enormous $21 billion rescue package to help Singapore Airlines survive the crisis, which was reported last month to be the single-biggest financial rescue of an airline in the world.

Chinese conglomerates Nanshan and HNA each have a 20 per cent share of Virgin Australia.

Nanshan, which bought its stake in the airline for $262 million in 2016, is one of China’s biggest business empires with interests in tourism, aerospace, airlines, education and infrastructure.

It also has an extensive multi-million property portfolio in Australia, including the $7.5 million Keeper’s Cottage in Sydney’s swanky Vaucluse, and the Pullman Hotel in at Sydney’s Airport, which was purchased for $84 million in 2015.

Last year Nanshan revealed plans for a $225 million redevelopment project of the Riverside Oaks Golf Course in Sydney’s northwest.

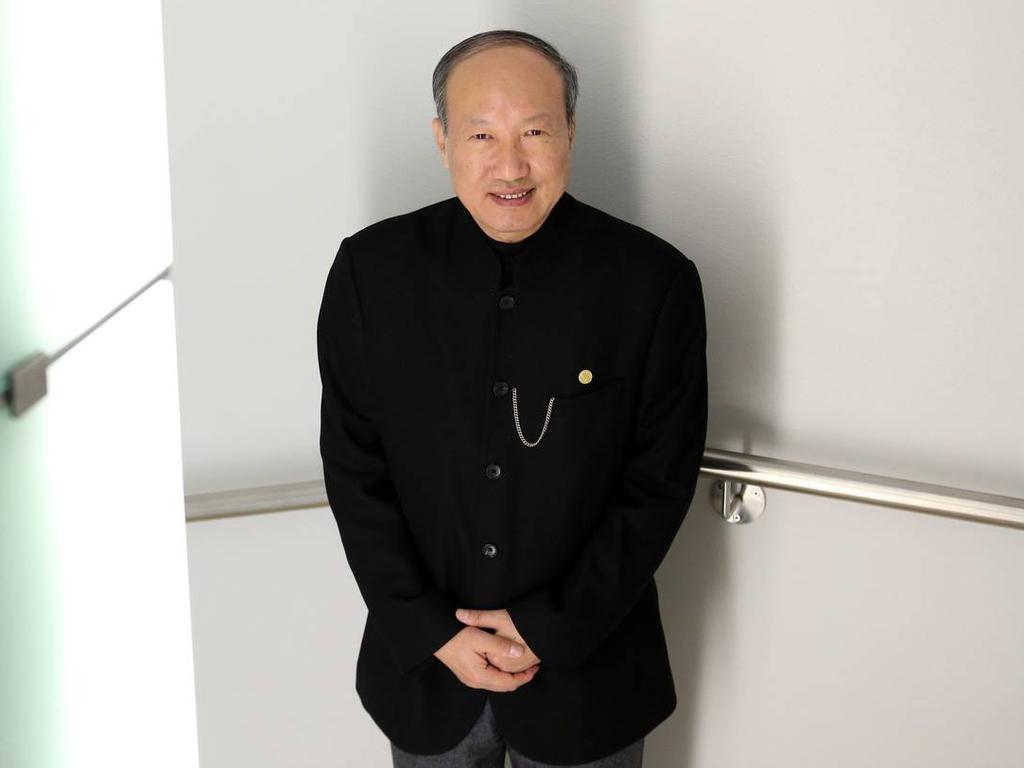

The group’s chairman Song Zuowen, 73, has a personal wealth of $2.8 billion, making him China’s 161st richest man, according to Forbes.

HNA is another sprawling conglomerate involved in real estate, logistics and hotels. It owns 25 per cent of Hilton Worldwide and a number of Chinese carriers, including its biggest money-maker, Hainan Airlines.

One of its companies, the baggage handler company Swissport, is now looking to cull up to 2000 of its workers in Australia as it suffers from a knock-on effect from Virgin Australia’s woes.

NHA headed by billionaire co-founder Chen Feng, 67. Mr Chen’s personal wealth was estimated at $2.8 billion in 2017, however he was knocked off Forbes’ rich list the following year amid HNA’s crippling debt woes.

Struggling HNA faces an uncertain future amid the pandemic. Last week the group said it was “walking a fine line between life and death”, the Financial Times reported, as internal conflict coupled with mounting debt – estimated at $119 billion in June – were compounded by the economic impact of the pandemic.

In February Bloomberg reported HNA risked losing Hainan Airlines in a state takeover. The airline is China’s largest non-state carrier by fleet.

Meanwhile Swissport, which is Australia’s largest aviation ground operation company, faces fresh problems in the light of Virgin Australia’s woes.

Swissport’s vice president of Asia-Pacific, Glenn Rutherford, told The Australian yesterday his company was feeling a damaging knock-on effect and 2000 workers could be made redundant in the next five to 10 days.

“This will have a material impact when (the government) eventually turns the (aviation) industry back on,” Mr Rutherford said.

“As soon as they open the borders and gates, it may take months … and all those skills and equipment will be gone. There will be a crisis in getting it back into operation.”