There’s a big catch about travel insurance most Aussies don’t know

IF YOU’RE partial to a few cheeky beverages on holiday, you need to have another look at the fine print in your insurance policy.

TRAVEL insurance. It’s our wonderful guarantee against the cost of something going very wrong while we’re on holiday.

It covers all manners of unexpected evils, from robbery, injury, sickness, loss and travel delays.

But there is a big catch about travel insurance could render well-intentioned policies worthless, and many Australians have no idea about it.

Travel insurance providers simply will not pay for any incidents that occur when the traveller has been drinking or under the influence of drugs at the time.

And that doesn’t just mean accidents or illnesses that happen because the person is drunk or on drugs — it can also apply to incidents that don’t really have anything to do with intoxication at all.

According to the Department of Foreign Affairs and Trade’s latest Consular State of Play report, 70 per cent of Australian travellers were uncertain about the status of claims in which alcohol or drugs were involved.

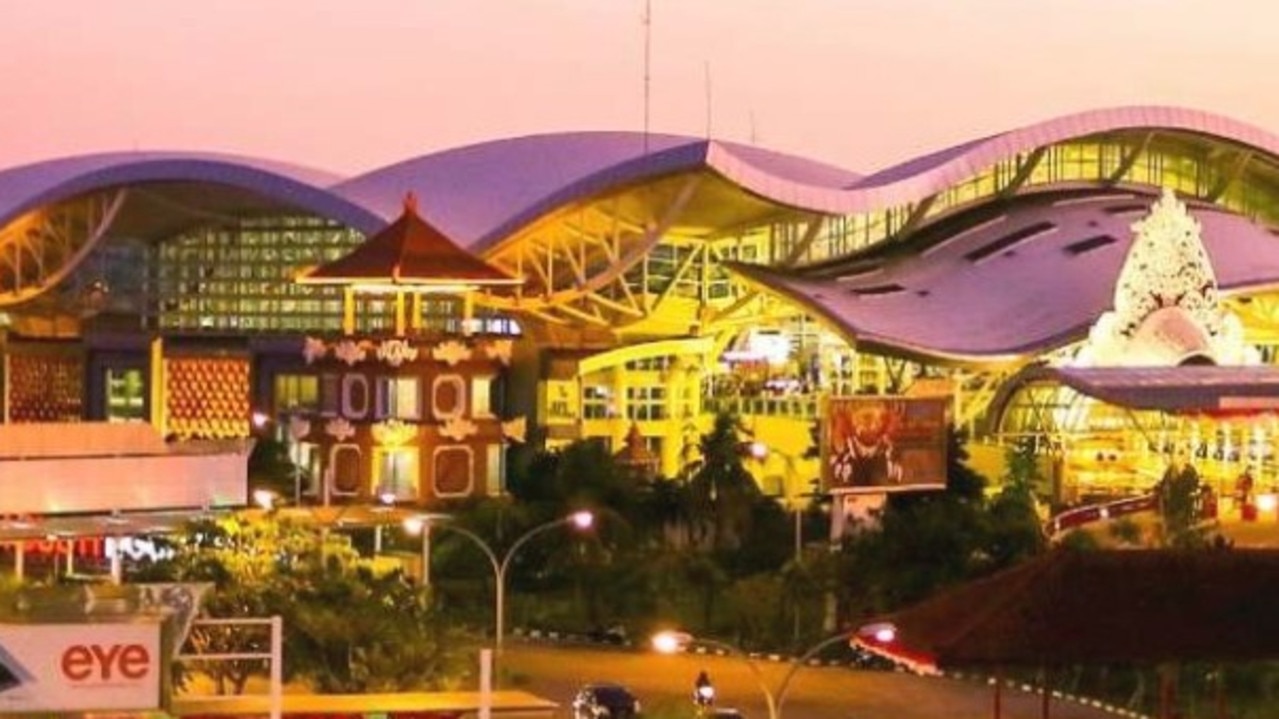

But the tough reality is, if you’ve had a few innocent Bintangs in Kuta or glasses in red in Tuscany — or something stronger — if something goes wrong, you could wind up with an even bigger headache than you bargained for.

“Many Aussies like to enjoy a drink or two on holiday but having a few too many could be an expensive mistake if you don’t check the fine print of your travel insurance policy,” finder.com.au insurance expert Bessie Hassan told news.com.au.

“Most insurance policies will include a blanket exclusion for any claims that are the result directly or indirectly of a traveller being under the influence of alcohol or unprescribed drugs.

“Each insurance company has a different yardstick when it comes to alcohol-related exclusions, but most will assess whether alcohol contributed to the claim rather than simply if it was involved.”

While some insurance companies may judge each claim on its own merit, others will outright refuse to assist a traveller where alcohol or drugs are involved, to any degree.

That’s something Sydney woman Brooke McNeil discovered after she wound up in hospital during a trip to the United States — a country notorious for astronomical medical costs.

The 22-year-old journalist said she was enjoying a night out on the Las Vegas Strip on a group tour when she “blacked out” after only a few drinks.

“After dinner at Planet Hollywood and a few drinks, the group alongside our two tour managers headed to ARIA nightclub. Shortly after entering the club I blacked out. I do not recall anything more from that night,” she said.

“I woke just before 6am in Desert Springs Hospital, Nevada, on my own and with a very hefty bill. Having only carried my Australian drivers licence out with me I wondered how I was going to pay for this. I remember thinking, ‘Maybe they’ll let me off for being Australian’. I wish.”

Ms McNeil, who said she wasn’t a heavy drinker, spent a few hours in hospital hooked up to an IV.

Hospital staff said her blackout could have been caused by any number of things, but may have been simply due to Ms McNeil having just arrived in Vegas, where summer temperatures were in the high-40s, straight from her last stop in Canada, where conditions were colder than 2C.

A toxicology report confirmed Ms McNeil had no drugs in her system but there was, as she expected, alcohol.

And for that reason, her insurer, Cover-More, would not help her when she arrived home to Australia and medical bills — of about $4500 in total — started piling up.

“(The bills arrived) once a week for months and months — I still get them now over a year later — and I fought with the insurer to try and sort out my coverage,” Ms McNeil said.

“Eventually, they came back with quite a short message about how they had decided they would not cover the hospital bills because I had been intoxicated at the time of admittance.

“I had both my tour managers write formal letters into the insurer to vouch for me not being a drinker and not putting myself in such a situation voluntarily but unfortunately, they then closed the case, having made up their minds.”

In a statement provided to news.com.au, a spokesperson for Cover-More said that while they cannot comment on this particular case, their policy is to “evaluate each incident on a case-by-case basis to ensure we’re fair and reasonable with all of our decisions”.

But what’s even more worrying about the alcohol insurance clause is that it may also catch out travellers who have fallen victim to drink spiking or methanol poisoning, such as in high-risk spots like Bali and Thailand.

“It’s important to note that depending on how strict your insurer’s alcohol exclusion clause is, treatment for drink spiking may not necessarily be covered,” Ms Hassan said. “So be careful and safe with your drinks.”

Ms Hassan said any traveller who was unclear on the exclusions or conditions in their policy should call the insurance company to clarify before they travel.

Finder.com.au has a comprehensive list of the travel insurance companies available to Australians and where they stand on drugs and alcohol.

Most have an exclusion along the lines of: “We will not pay for claims arising directly or indirectly from any conduct engaged in by you whilst under the influence of alcohol or drugs, unless prescribed by a doctor and taken in accordance with the doctor’s advice.”

It can be difficult to ascertain whether a traveller was intoxicated at the time of the incident without a drug or alcohol test — but that may or may not work in the traveller’s favour.