Aussie can fly business for free for rest of life

An Aussie man has revealed the insane reason he’s able to fly business class for free, more than 100 times.

If there is one person who knows a thing or two about loyalty points, it’s Sydney man Michael Dixon.

The 58-year-old has accumulated 25 million points over a period of 25 years, meaning he can travel the world on business class more than 100 times, for free, if he wishes.

He’s already travelled to more than 50 countries, including bucket-list destinations such as the Galápagos Islands and Antarctica, with a trip to Egypt around the corner.

“The feeling is one of gratitude that points have allowed me to do this and every time I arrive at Sydney airport I feel very lucky and extremely privileged,” Mr Dixon told news.com.au

A few years ago, the Sydney-based pharmacist took his mother on a European getaway for her 80th birthday, flying Singapore Airlines’ award-winning first class cabin, using his points.

And back in 2010 for his ex-wife’s 40th, he flew 18 of their friends to Hong Kong on former airline Virgin Atlantic’s business class.

He is planning on doing the same thing for his 60th in a few years when he will fly a bunch of his mates in business class, though the location is yet to be determined.

Basically, Mr Dixon’s wild amount of points means he can fly for free, for the rest of his life (he just needs to pay taxes for fares).

He’s been able to do all this through points, after having started his points-collecting life back in 2010 when he purchased his first pharmacy in 1998. He got himself an Amex card and simply used the card to pay bills.

“It involved paying all the expenses of my pharmacies, including stock, through an American Express card,” he told news.com.au.

“So rather than paying cash when a bill is due, I pay using an American Express card (or should I say cards because I have around eight).

“The American Express card gives me 2.25 American Express Membership Reward points per $1 charged to the card, which can then be generally converted to 1.125 airline loyalty program points. I put whatever business and personal expenses I can on American Express, because the points you miss out on are the points you’ll never get.”

Mr Dixon has 25 years of experience accumulating around 4,000,000 points and miles per year.

“I spend most of these points each year. I also have an analytical brain that likes numbers, and being business-minded means I always seek the best value,” he said.

“Best value means maximising the number of points and miles earned and then spending the least amount possible.”

The entrepreneur started Dispense Assist (pharmacy remote dispensing) in 2001 and in 2006 he established the pharmacy banner group, Chemsave, of which he is the CEO.

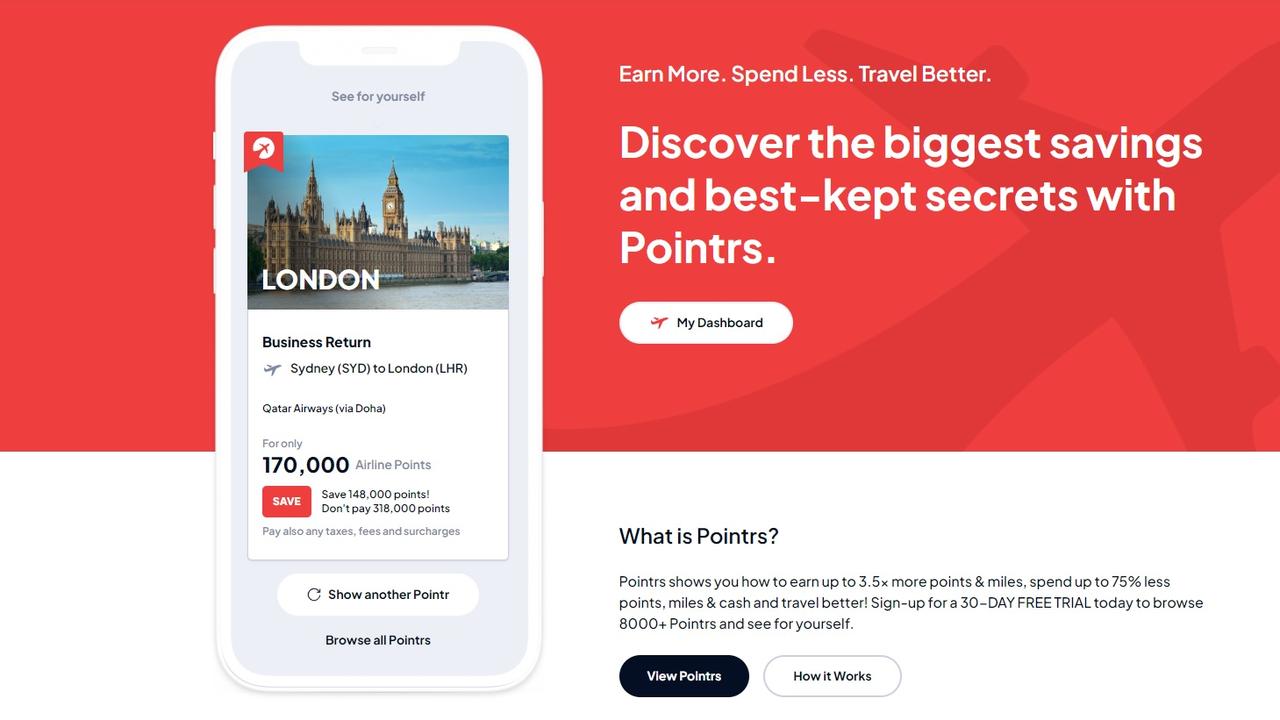

But among family and friends he is known as the ‘points guru’ and after noticing a gap in the market, he launched Pointrs — a travel loyalty website to help Aussies earn more points and miles, spend less and travel better.

“Pointrs takes all my years of accumulated knowledge and experience and distils it down and presents it in a simple way that makes the information quick and easy to find and understand and which is continually up-to-date,” he said.

He said it’s a “one-stop shop” that removes all the thinking and decision making.

“We provide support including tips on the best credit cards to use for earning points, how

to transfer points from one loyalty program to another, and, how to leverage promotions and discounts when transferring, and buying points to earn more, upgrade seats or a hotel room,” he explained.

Mr Dixon said with regards to spending less points and miles, users simply filter to show a flight they want to take and Pointrs will automatically show them the many different loyalty programs they can use to pay for that flight, along with the loyalty program requiring the fewest number of points and miles.”

He said if a user doesn’t have enough points and miles, they can click on a button to be instantly shown how to earn more, including transferring points and miles from other loyalty programs and spending on their credit cards.

“With credit cards, Pointrs will even tell them how much they need to spend on each credit card to earn enough points and miles for their flight.”

The website is designed in a way that travellers are instantly shown the most cost-effective way to use their points and miles on every flight.

“The biggest issue [I find] is people spending their points poorly, such as getting bad value for their points,” he said.

“The best value is obtained when transferring points from credit card loyalty programs to airline loyalty programs and then using these points to book flights, especially business and first class flights.”

Big points problem

He said there is also an issue in users spending far more points than required for a flight.

“For example, different loyalty programs charge different number of points for the exact same seat on the exact same flight, which most people don’t realise, meaning they often spend more points than they need to.”

He said one of the biggest things users don’t realise is that with the right credit card you can transfer credit card points to a number of airline loyalty programs rather than just one.

He said this is key to paying less for flights when using points and miles.

“People also aren’t aware that you can buy points and miles from the airlines. When done right, you save thousands of dollars on a single flight for a single person.”

“For example, you can buy points to fly Business return from Sydney to Los Angeles on United Airlines (non-stop) on their best business class seat for only $2,699 instead of up to $10,000. You can also do similar to fly Qantas for $3,599.”

Best card for points

When it comes to the best card to get - for Mr Dixon personally, it’s an Amex or MasterCard. He explained an Amex not only allows you to earn up to 67 per cent more points, but allows you to transfer points to many airline loyalty programs.

“Use your American Express card whenever possible. Not only will you get points but you will get up to 55 days extra to pay,” he added.

“Keep a Visa or MasterCard as a back-up for any merchants who don’t accept American Express. For businesses, earn even more points by using your American Express card to pay for your rent, payroll and superannuation.”

He said an American Express Platinum Card Or American Express Explorer Credit Card both come in personal and business versions.

“They both allow you to earn at least 50 per cent more points than most Visa and MasterCard.”

Is getting a points card worth it?

According to Mr Dixon, the answer is simple — “absolutely,” he says.

“It’s not only about being able to fly yourself, family and friends multiple times a year for essentially free (just pay any taxes, fees and surcharges), but being able to fly at the pointy end,” he said.

“Very few would be able to afford to fly a family of four business and first class to the furthest reaches of the world, multiple times of the year. And even if I had the cash to do so, it’s very hard to justify spending $10,000-$20,000 per person per return flight.

“But with points, cash is no longer a consideration. And very few things in life are better than travel. And nothing gives me more joy than being able to share my good fortune with my family and friends.”