After years of success, how did it all go wrong for Virgin Australia?

Virgin is losing money by the millions, with hundreds of jobs and flight routes on the chopping block. It’s all down to one bad decision.

It’s the seven-year war Virgin Australia hasn’t been able to win.

A battle to get out of the red, make some money and at the very least manoeuvre away from its shares trading at near all-time lows.

But after more “disappointing” full-year results were released by the airline’s new chief executive officer Paul Scurrah yesterday — how can Virgin Australia stop its year-on-year, back-to-back nosedive?

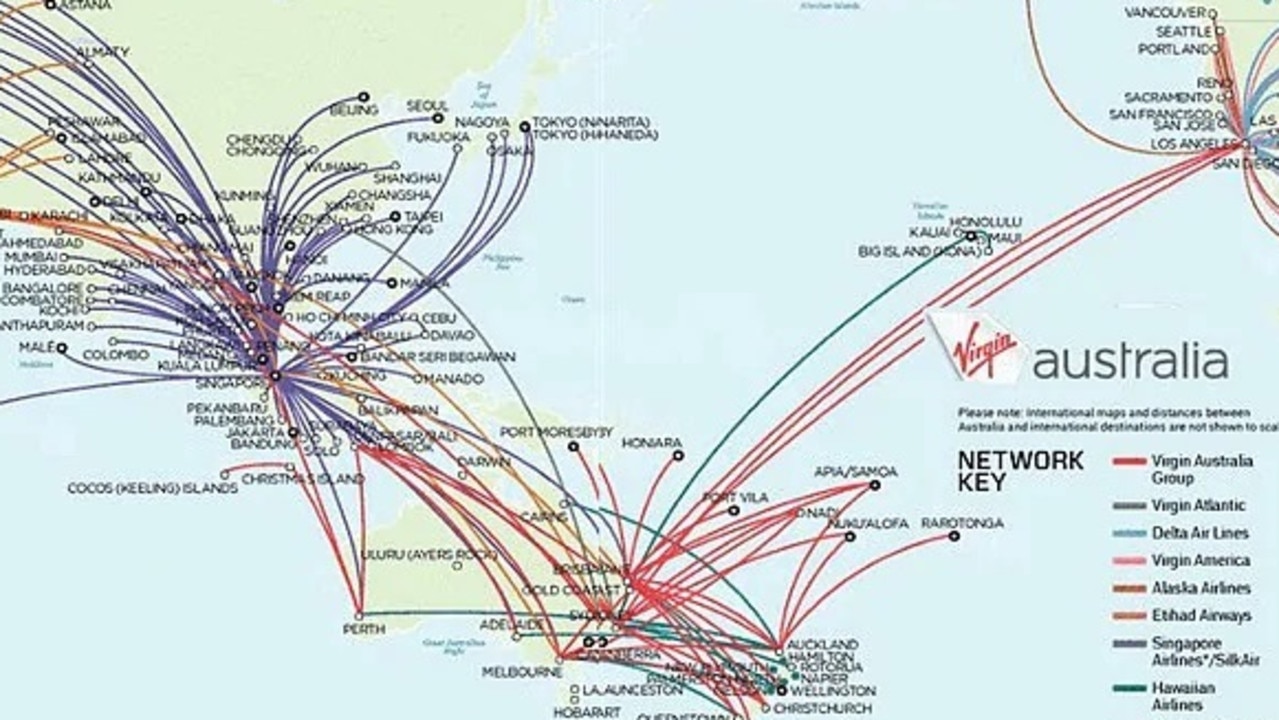

Drastic action is needed that could include axing services to Los Angeles, Bali and some regional cities and even ditching the difficult Tigerair brand.

Australia’s second biggest carrier announced yesterday it would review every single flight route on its network, as well as cut 750 jobs, as part of a drastic restructure to claw back a full-year loss of $349.1 million.

The massive restructure of employees is set to save the airline $75 million by the end of the 2020 financial year. And when every cent counts, it’s a wonder the airline didn’t take a similar restructure after its third, fourth or even fifth year of annual losses.

Mr Scurrah, who only took over the reins as CEO from John Borghetti in March and is the third boss since the airline entered Australian airspace in 2000, has his work cut out for him.

After six years of losses and a total of $1.2 billion down the drain, the former Queensland Rail boss has five weapons to help bring the airline back from the brink: cut costs, restructure management, rebrand (including their underperforming budget carrier Tigerair Australia), review routes and end any loss-making flights, and tighten control over the loyalty division.

But in an interview with news.com.au, aviation expert Neil Hansford said the airline’s biggest mistake was losing touch of its original business model. Finding its way back will be the biggest challenge of all.

“The business model that Virgin has now is not financial sustainable,” Mr Hansford, chairman of Strategic Aviation Solutions, said.

“Virgin set out on a course to become a head-to-head competitor with Qantas. They invested enormously when they weren’t a profitable business. They tried to be the Qantas alternative … focusing on expensive lounges and provide certain service levels when they were having losses.

“That (was very different) to the model they chased early on as a low-cost carrier. They painted themselves as a young, yuppie, typical ‘Virgin’ image. That was their focus and the culture was created,” said Mr Hansford.

“When Ansett folded in 2001, somebody said ‘we can nibble off what they previously had against Qantas’ … and that’s what Virgin chased.

“They wanted to get in with corporate and business class customers, but were doing it at a time when they were losing money. They took on a war they didn’t have without the soldiers or the ammunition to fight it.”

WHERE IS THE AIRLINE FALLING SHORT

Mr Scurrah cited subdued trading conditions in the second half of the financial year combined with fuel and foreign exchange headwinds and increased operational costs as the biggest blows amid a weakening domestic market.

In an interview with Reuters, sources from the airline said Mr Borghetti, who served as CEO for nine years, was able to transform the airline from a budget alternative upon inception in 2000 against failed airline Ansett, in to a more serious rival for Australia national carrier, Qantas.

But in doing so, some “hasty” decisions proved costly for Virgin in the long term.

“Virgin Australia do a lot right, but the brand has lost a bit of its joy and spunkiness,” Adam Ferrier, consumer psychologist and founder of creative agency Thinkerbell, told news.com.au.

“I’d imagine the best way forwards is to maintain a price point just under Qantas, but build more personality and spunk back into the brand.”

But Mr Ferrier said it’s not all doom and gloom for the airline, with the foundation of the brand proving strong among consumers. They will, however, need to “find more moments of emotional connection and likability”.

“I would make the Virgin Australia brand feel a little more Virgin-y,” he said.

“It’s maybe taken itself a little too seriously of late, and perhaps, as a brand needs to have a bit more fun.”

At a time when Ansett and Qantas ruled the sky, Virgin Blue broke in to the domestic market as a cool, cheaper alternative to fly with at a time when other carriers came with a premium price tag.

Angus Kidman, editor-in-chief and travel guru at comparison site Finder, said one of Virgin’s biggest setbacks in the past decade had been the shift in its branding.

Spending more than 200 days in the past year travelling, Mr Kidman said the airline needed to reconsider its identity in the market and figure out its key demographic.

But since the collapse of Ansett in 2001, and after years of positive trade under the leadership of Brett Godfrey, the airline is in a tough battle to boost the balance sheet.

“The balancing act for Virgin is tricky,” Mr Kidman said.

“It’s competing with Qantas for business passengers but with a less frequent service and fewer global connections, while also hoping to retain some of its ‘outsider’ aura and pull in passengers who don’t want the low-cost carrier experience but can’t afford top-tier fares.”

WHAT VIRGIN’S FINANCIAL WOES MEAN FOR CONSUMERS

Virgin Australia acknowledged the result was driven by subdued trading conditions in the second half of the financial year combined with fuel and foreign exchange headwinds and increased operational costs.

In a bid to claw back seven years of losses, the airline is going to review all routes in its network to lower costs and use aircraft more efficiently. This could mean reduced frequencies on busy routes like Sydney to Melbourne and Brisbane and some city links cut altogether.

“Virgin’s difficulties are bad news for consumers,” Mr Kidman said.

“Fewer flights means less competition, which could see other airlines up their prices, and for frequent flyers it means fewer opportunities to redeem Velocity reward seats.

The airline has a fairly limited international network with flights from Sydney, Melbourne and Brisbane to Los Angeles and from Sydney and Melbourne to Hong Kong. It also flies from several cities in Australia to Bali, the South Pacific and New Zealand.

Last year, the airline wound up a code share deal with Air New Zealand which had seen the two combine their Trans Tasman networks. The end of this deal forced Virgin to open more routes across The Ditch to compensate for losing Air New Zealand as a partner, but this could have saturated the market. Don’t be surprised if some routes — such as Newcastle to Auckland and Sydney to Wellington — are dropped, the latter of which is a premium route already flown by Qantas and Air New Zealand. LA and Hong Kong could also be at risk.

Mr Hansford said reviewing routes was a standard response from any airline that fell into trouble, noting holiday routes would be the first pins to fall.

“I think cuts will likely be made to leisure routes,” he said.

“The time has come to address whether they should stay in the international market because when you’re in this much trouble, you need to get rid of anything that’s not making money.”

“Cuts in staff numbers are also going to make it challenging for the airline to maintain solid customer service. That said, Virgin’s far from the only airline worldwide facing financial challenges, and it remains a solid competitor in Australia with lots of enthusiastic repeat passengers.”

WHAT VIRGIN MUST DO TO SURVIVE

Mr Hansford said the airline’s shareholders — Singapore Airlines, Etihad Airways, HNA Group, Nanshan Group and Richard Branson’s Virgin Group — were unlikely to provide any more capital. According to Reuters, Mr Scurrah has told staff the airline cannot rely on shareholder financing.

Instead of focusing on Qantas, Mr Hansford said Virgin needed to develop its own strategy because the focus of moving up-market had added too many costs relative to the revenue gains.

“To survive, one of their first moves should be to terminate all flights to the US and Hong Kong,” Mr Hansford said. The Sydney to LA route, for instance, is operated by five airlines.

“It’s too hard to hard to run this route with so much competition when you’re not making any money.

“They should look to rationalise Bali because leisure travel will always be hard with seasonality.

“They must merge Tiger and Virgin together, and remove management as to operate as a brand of Virgin. They need to create a true low cost carrier, like ‘Virgin Light’. Otherwise, close it down.

“The final area, which may be an admission of failure, is to get rid of their business class offering to places like Coolangatta or Hamilton Island. These rows could be filled with leisure if those seats are removed. They should work out if it’s viable to go to capital cities only, and if the demand isn’t on other routes don’t offer the product.”

news.com.au is giving you the opportunity to win a $5000 Escape holiday voucher to enjoy a trip of a lifetime! Enter here