Virgin Australia to cut 750 roles after $349 million full-year loss

Aviation watchers say some of Virgin Australia’s most high profile routes are under threat after the airline announced a dire $349.1 million annual loss.

Virgin Australia has announced it will review every single flight route on its network, as well as cut 750 jobs, as part of a drastic restructure to claw back a “disappointing” full-year loss of $349.1 million.

The airline, which recorded its seventh consecutive annual loss on Wednesday, said the job cuts were aimed at saving $75 million by the end of the 2020 financial year.

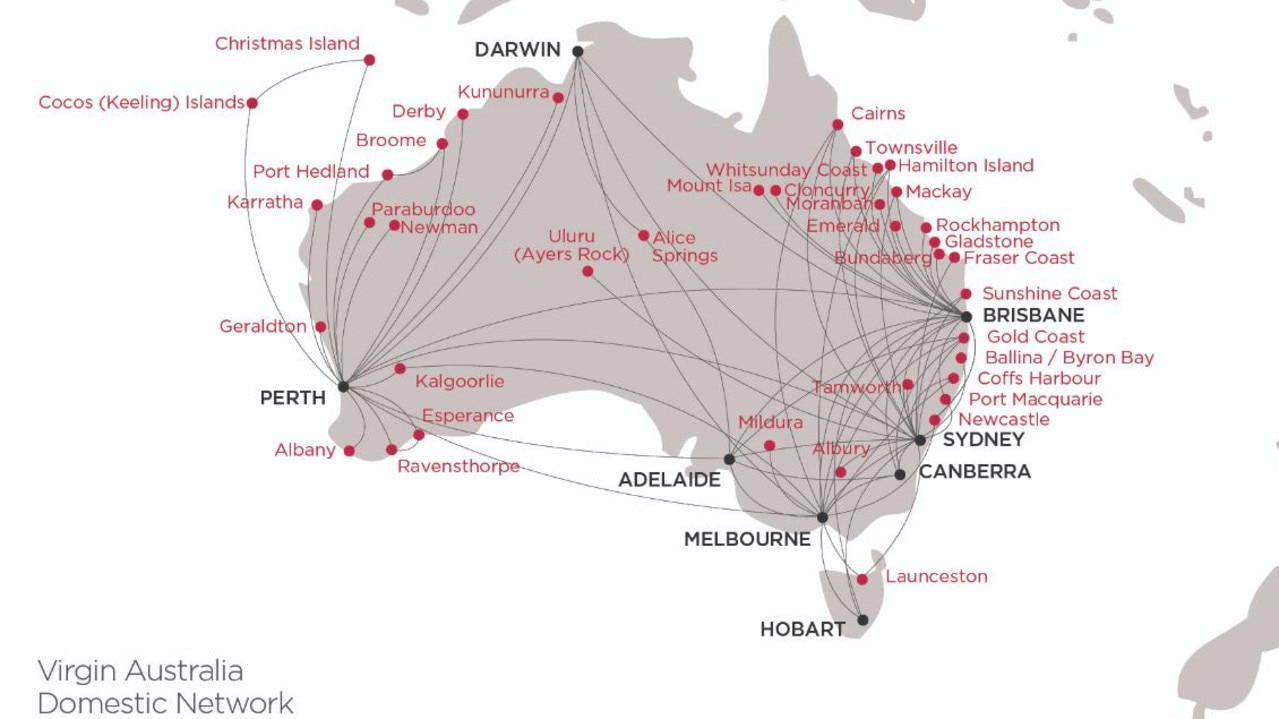

In addition, the airline is going to review all routes in its network in a bid to lower costs and use aircraft more efficiently.

But aviation expert Neil Hansford told news.com.au the losses were “totally predictable” and passengers who used the airline for leisure flights would be hit the hardest following the review.

“The business model that Virgin has now is not financial sustainable,” Mr Hansford, chairman of Strategic Aviation Solutions, told news.com.au.

“Virgin set out on a course to become a head-to-head competitor with Qantas. They invested enormously when they weren’t a profitable business. They tried to be the Qantas alternative … focusing on expensive lounges and provide certain service levels when they were having losses.

“Reviewing the flight route is the standard response when you’re in trouble like this.

“I think cuts will likely be made to leisure routes … and the time has come to address whether they should stay in the international market because when you’re in this much trouble, you need to get rid of anything that’s not making money.”

ROUTES AT RISK

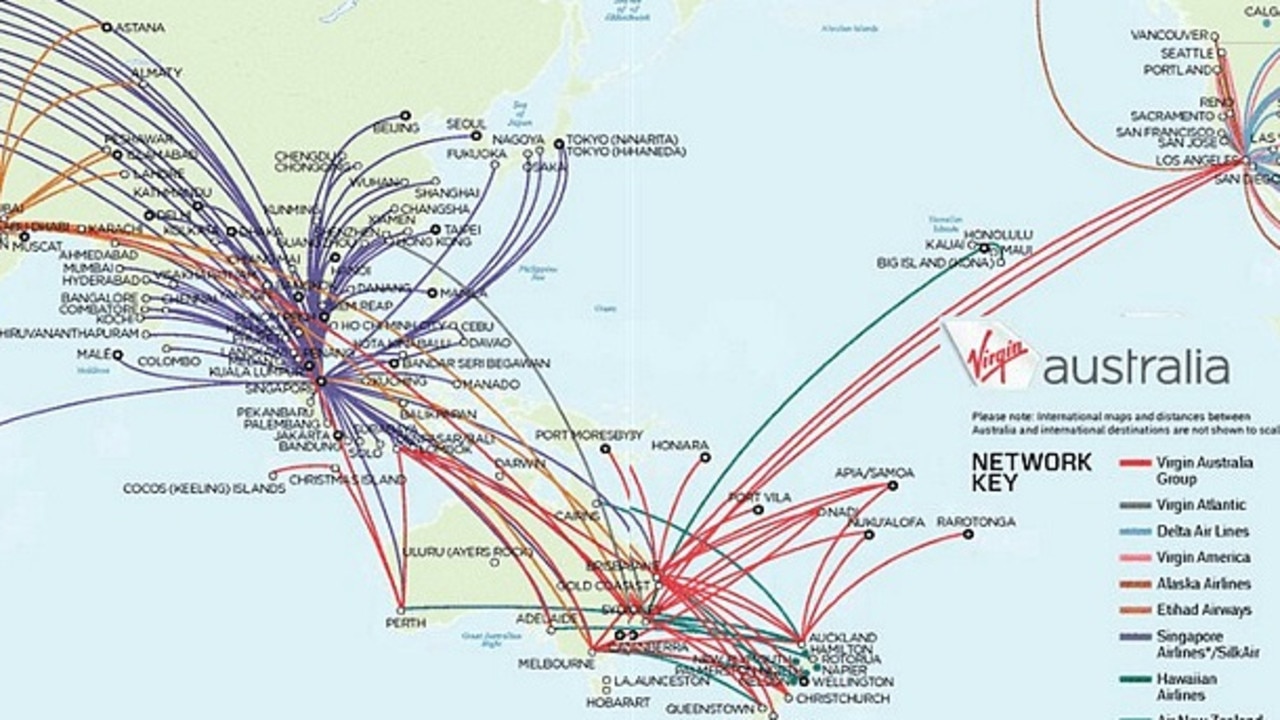

Currently, the airline has a fairly limited international network with flights from Sydney, Melbourne and Brisbane to Los Angeles and Hong Kong as well as from several cities in Australia to Bali, the South Pacific and New Zealand.

The airline also has flights from Brisbane to Papua New Guinea.

Last year, the airline wound up a code share deal with Air New Zealand where the two combined their Trans Tasman networks. The ending of this deal saw Virgin open more routes between Australia and New Zealand of its own, but this could have saturated the market. Don’t be surprised if some routes — such as Newcastle to Auckland and Sydney to Wellington — are dropped, the latter of which is a premium route already flown by Qantas and Air New Zealand.

Virgin Australia acknowledged the result was driven by subdued trading conditions in the second half of the financial year combined with fuel and foreign exchange headwinds and increased operational costs.

The company said it would more closely integrate the functions of Virgin Australia Airlines, Virgin Australia Regional Airlines and Tigerair Australia.

news.com.au is giving you the opportunity to win a $5000 Escape holiday voucher to enjoy a trip of a lifetime! Enter here

Mr Hansford expects Virgin Australia will need to combine forces with Tigeair if it is any chance of turning the nosedive around.

“They can’t afford to keep Tigerair separate,” he explained.

“Virgin Australia will need to bring everything in-house with competitive pricing.

“Tiger Air still isn’t making money like Jetstar. Their on-time delivery is still not satisfactory. They are losing money and not performing.

“With their current business model, they will not be able to turn these losses around.”

Virgin Australia chief executive Paul Scurrah said operating in a tough economic climate with high fuel costs, a low Australian dollar and subdued trading conditions had all impacted on their latest results.

“Decisions which have a direct impact on people’s livelihoods are never made lightly, and I regret the need to reduce the size of our workforce so quickly,” he said of the job cuts, which will be made across corporate and head office positions.

“However, today’s financial results tell us loud and clear that we need to reduce costs.”

The company on Wednesday also announced the appointment of Keith Neate as its new chief financial officer, starting on September 2.

Virgin, which did not declare a final dividend, noted that there had been a “continuation of softer conditions” at the start of July.

Virgin shares were worth 16.5 cents before the start of trade on Wednesday.

Earlier this month, Qantas Airways posted a 6.5 per cent fall in annual net profit, attributing the slide in earnings to higher oil prices and a weaker Australian dollar.

Despite record revenues, the Australian flag carrier said its after-tax profit fell to AU$891 million, down from AU$953 million the previous year.

The 99-year-old airline was hit by an AU$614 million fuel bill increase and AU$154 million in foreign exchange impacts.

But Qantas CEO Alan Joyce was upbeat about the results, which came on the back of healthy profits the previous year.

“Even with headwinds like fuel costs and foreign exchange, we remain one of the best-performing airline groups in the world,” he said.

— with AAP