ASX soars ahead of Trump tariff deadline

All 11 sectors finished in the green as the Australian sharemarket soared prior to the next phase of the Trump Tariffs.

Want to know the best stocks for investment? How about the rise and fall of the ASX? We have all your stock market news.

All 11 sectors finished in the green as the Australian sharemarket soared prior to the next phase of the Trump Tariffs.

The ASX 200 has slumped to its worst quarter since Covid on the back of fears of an economic trade war

The ASX finished slightly up on Friday, but investors remain uncertain over a potential hung parliament and US President Donald Trump’s tariffs.

The ASX stumbled into the red on Thursday as US President Donald Trump’s freshly announced auto import tariffs stirs ‘mass uncertainty’ among investors.

The local sharemarket has secured its fifth consecutive day of gains on Wednesday as optimistic investors rallied in 10 of 11 sectors.

President Trump’s hawkish tariff talk has softened and the local bourse soaked up the resulting Wall St boom.

The Australian ASX200 has seesawed as markets await major economic updates, including just what Donald Trump will do next on tariffs.

A rally in Woolworths and Coles shares on Friday helped the ASX finish higher on Friday, helping to lift the ASX to its best weekly gain in 2025.

Some of Australia’s most expensive mansions have been snapped up in secret lucrative deals by the nation’s top CEOs. Now it can be revealed how they live and what they own.

‘Pretty positive’ reactions from news from the US Federal Reserve and local employment data led the Australian sharemarket to its best day in six weeks.

Australia’s sharemarket has finished in the red as investors wait to see if the US Federal Reserve will spur on the world’s largest economy.

The Australian sharemarket relief rally continued for the third straight day on Tuesday, although the afternoon’s trading session will likely disappoint investors.

The Aussie sharemarket lifted today on talks of a potential rate cut in the US, the start of a big tech week and potential stimulus measures from the world’s second largest economy.

Australia’s sharemarket snapped a three-day losing streak on the back of the major miners, as the price of gold and iron ore climbed throughout the trading day.

Donald Trump’s tariffs are continuing to hit the Aussie sharemarket, with the value of coal companies falling, while investors look for a golden safe haven.

US President Donald Trump has refused to rule out a recession in the world’s largest economy and now Aussie shares are plummeting.

The ASX 200 rose on Monday, snapping a 2.5 per cent weekly fall last week, but market sentiment remains low on Donald Trump’s tariff plans.

The Australian sharemarket was hammered on Friday as escalating global trade tensions and the risk of a US recession continued to unsettle investors.

The ASX 200 has lost $200bn in just three weeks as the impact of US President Donald Trump’s brutal tariffs reverbate through markets.

A trio of stronger than expected economic data was not enough to stop Australia’s share market trading heavily in the red on Thursday.

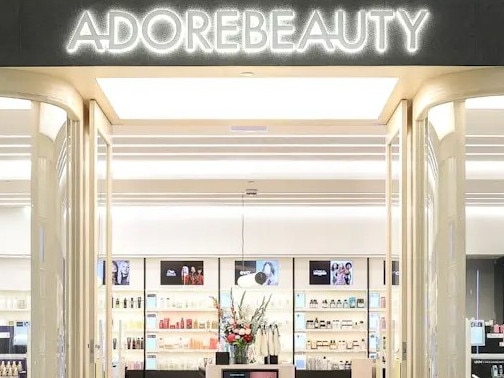

Cult online retailer Adore Beauty is opening its second-ever brick and mortar shop tomorrow, promising customers a ‘next-level’ experience.

The ASX 200 followed the US markets trading deep in the red on the back of the latest announcement by President Donald Trump on trade tariffs.

The Australian share market has been boosted on Monday from strong figures out of China and a resilient Wall Street.

The embattled Star Entertainment Group has failed to lodge its half-yearly results with the ASX.

Market heavyweights Coles, Qantas and Medibank soared on the back of a better than expected reporting season, helping the local sharemarket on Thursday.

The biggest upgrade in the business’s history and one of the newest planes in the world are all part of Qantas’s plans.

Supermarket giant Woolworths and the major miners have sent the Australian share market down to a new six week low on Wednesday.

The ASX 200 fell on Tuesday as US President Donald Trump confirmed tariffs and major businesses missed the mark during reporting season.

Nine Entertainment says it will try to save $100m in costs over the next two years, and there will be further restructuring of the business.

The ASX200 snapped a five day losing streak, but cracks are still appearing as more companies are missing the mark this reporting season.

Original URL: https://www.news.com.au/topics/asx/page/4