Aussies lose millions in Trump tariff chaos

They haven’t been implemented yet, but just the threat of Donald Trump’s US tariffs is damaging some of Australia’s biggest businesses.

Want to know the best stocks for investment? How about the rise and fall of the ASX? We have all your stock market news.

They haven’t been implemented yet, but just the threat of Donald Trump’s US tariffs is damaging some of Australia’s biggest businesses.

The ASX 200 has capped off an $85bn week on the back of renewed hopes tariffs could be walked back.

A surge in technology and real estate stocks helped drive the ASX 200 higher, despite fears of a slowing US and Chinese economy.

A jump in the banking and consumer discretionary stocks helped push the ASX into the green on Wednesday as investors factored in a rate cut in May.

Soaring energy, utilities and information technology stocks drove the ASX200 higher on an overall positive day for the market.

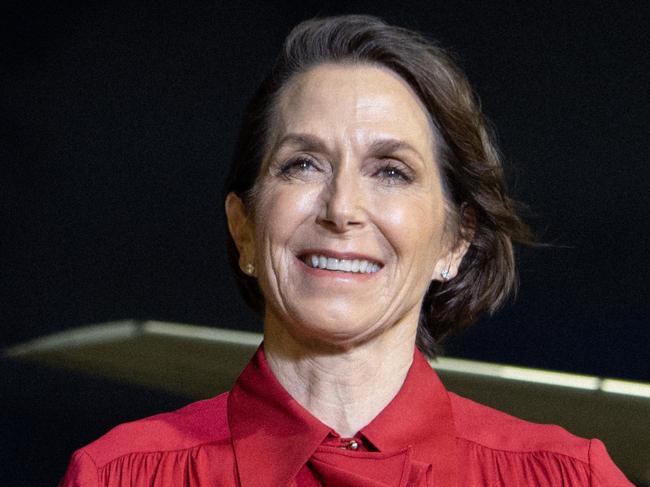

Jayne Hrdlicka has confirmed her next move after stepping down as Virgin Australia chief executive.

The ASX200 continued to trade higher on Monday on the back of renewed hope of a tariff back down.

The ASX 200 closed a shortened trading week in the green, following talk the US is considering stepping back on its tariff policies.

Major energy and mining stocks drove the ASX 200 higher, as the United States talks peace with China.

Australia’s stock market has recovered from a sharp fall at the start of trading thanks to the banks and major mining companies.

Absolute misery is playing out in the global economy today as stock markets take another pounding over comments made by Donald Trump.

A surge in energy stocks and Australia’s major miners has driven the ASX 200 higher.

The local market slid on sea-sawing session as investors wait to see the fallout from the latest Trump announcement.

Major healthcare stocks and the big four banks drive the market into the green on a relatively subdued day of trading.

The ASX 200 continues its relief rally on Monday following the latest back down from US President Donald Trump.

The Australian sharemarket market will likely remain volatile even after the ASX saw a $116bn rise in one day.

US President Donald Trump’s wild backdown on tariffs has lifted Wall Street and sent the Australian sharemarket shooting up.

The ASX resumed its sell-off on Wednesday with investors selling off the major miners as commodity prices slump.

The ASX 200 continued its sell-off during early trading on Wednesday, following the latest tit-for-tat tariff measure.

The ASX 200 soared during Tuesday’s trading, but investors are worried it is just a dead cat bounce.

Aussies have been warned of scammers trying to deceive people with too-good-to-be-true investment opportunities after a big hit to super funds.

Some positive signs are beginning to emerge for every nation on earth after a torrid few weeks. But one country is feeling Donald Trump’s wrath.

The ASX 200 has bounced back after suffering its biggest one-day fall since the start of the Covid pandemic.

Shadow treasurer Angus Taylor has written to Treasury to demand daily briefings during the election campaign, as the Trump tariffs hit the economy.

The ASX 200 was smashed again on Monday as investors fear the worst of Donald Trump’s aggressive tariff policy.

A sell-off has smashed the ASX 200 on Monday, but experts warn the local bourse still has further to fall.

Trump’s aggressive tariff policy may have shaken global markets, but superannuation members have been urged to do one thing to avoid ‘locking in losses’.

The ASX 200 is a sea of red on the opening, and the Aussie dollar has plunged below 60 cents, as investors continue to sell-off on fears of a global recession.

The fallout from US President Donald Trump’s tariff policy continued to send shockwaves through the market, wiping out more than $50bn on the local market.

Property shares have lifted the ASX 200 higher as markets wait for the impacts of US President Donald Trump’s trade tariffs.

Original URL: https://www.news.com.au/topics/asx/page/3