‘Alarming trend’ in Aussie mortgages

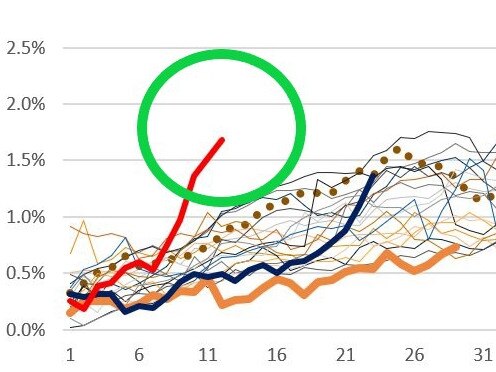

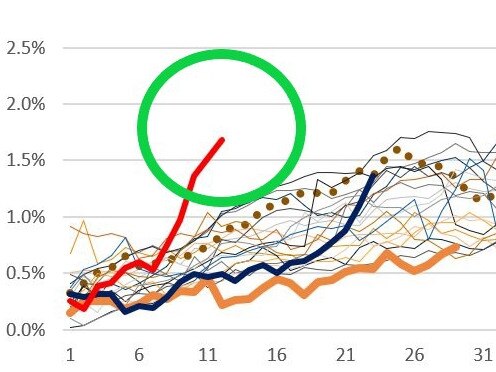

An “alarming trend” in Australian mortgages could signal a new era of difficulty for a certain section of Aussie mortgage holders.

An “alarming trend” in Australian mortgages could signal a new era of difficulty for a certain section of Aussie mortgage holders.

A huge claim has been made about Australia’s notoriously expensive property market – and the news isn’t good for the average person.

The global economy is struggling and there’s alarming news coming out of China – and it could all spell disaster Down Under.

Australia has “near-legendary luck in avoiding recessions” over the years. But could that luck be about to finally run out?

They’re questions we all want answered – how long rates will stay high, when they’ll be cut and by how much. But the news isn’t good.

Struggling to make the dollars stretch between pay days? You’re not alone – and here’s the proof Aussie employees are getting a raw deal.

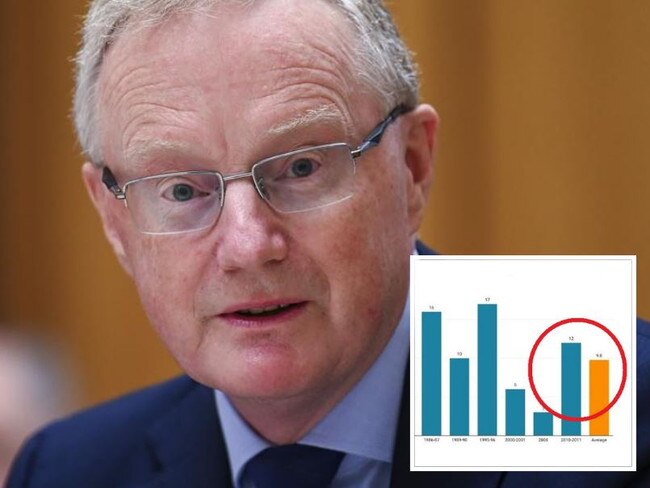

Bring up today’s cash rate and Boomers will inevitably gripe about the 17 per cent rate of the 1980s. But they’re forgetting one major thing.

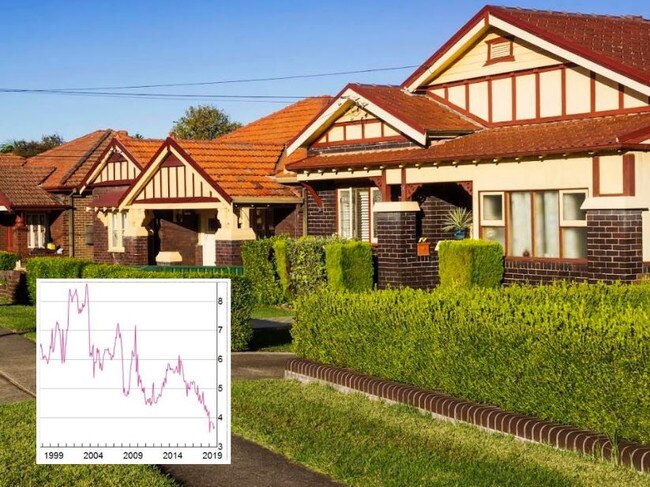

Australia is in the grip of a devastating housing crisis – and the Albanese government’s so-called “solution” seems doomed to fail.

Australia is in the grip of a devastating housing crisis – and it’s not just struggling young renters who are suffering as a result.

One major factor in Australia’s housing crisis has been simmering for decades – and older Aussies are right in the thick of it.

Original URL: https://www.news.com.au/the-team/tarric-brooker/page/10