Buying and selling scams at record levels ahead of Christmas

Australians need to be on high alert this festive season, with cybercriminals hoping to prey on stressed families as the holiday season approaches.

Cybercriminals are ramping up efforts to scam Australians out of their money ahead of Christmas, with plans to prey on stressed-out families.

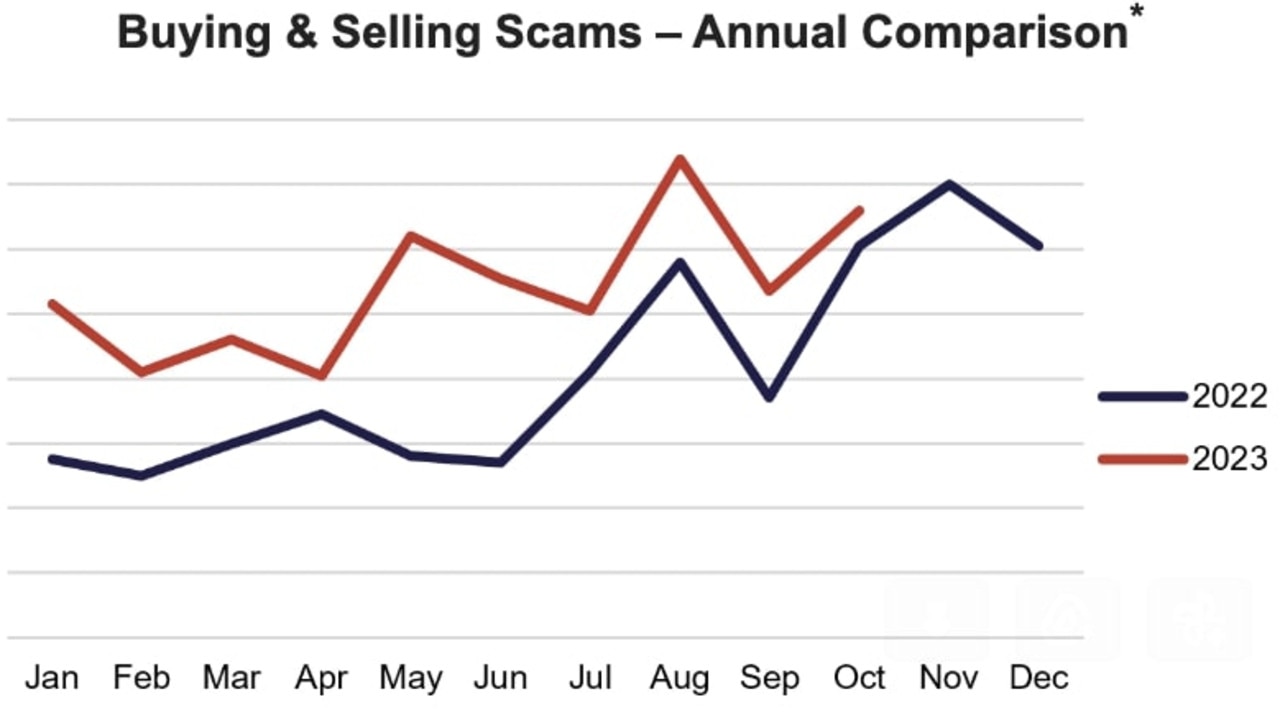

Westpac has issued a warning to be extra careful around scams this festive season, as new data reveals that buying and selling scams are up a whopping 47 per cent compared with last year.

These scams are often advertised through fake websites, social media ads and online market places and offer cheap prices to consumers looking to purchase presents for loved ones this Christmas.

With the increase of gift giving around this time of year, these frauds are now at their peak according to Westpac’s head of fraud Ben Young.

“Scammers often target customers at this time of year when people are spending more and can sometimes be a bit more distracted.

“To put this into perspective, Westpac facilitated more than 31 million point-of-sale transactions during the recent Black Friday and Cyber Monday sales, leading to a 5 per cent increase in fraud-related calls.”

He said buyers who were seeking out bargains for the festive season should be on high alert to fake offers on highly sought after products, especially if the price seems too good to be true.

While scammers will be ramping up Christmas-related tricks, Mr Young warns that other kinds of cons are still prevalent.

“Investment scams remain one of the biggest challenges, accounting for more than half of all losses. These scams can be appealing because they promise lucrative returns and scammers invest a lot of time grooming victims, making them very difficult to spot,” Mr Young said.

“Other common scam tactics include issuing fake invoices with altered payment details and tricking you into downloading software or installing apps on your devices that allow the scammer to access personal information like emails, passwords or even your banking details.

“Always call a business or supplier to independently confirm if payment details are accurate before sending any money, never click on links sent via SMS or email and be cautious about anyone who instructs you to urgently download an app or install a program onto your mobile or computer.”

Westpac has detected more than 60 per cent of all scam cases in its customers, according to Mr Young, with prevention initiatives saving customers more than $235m.