Australian banks introduce ID checks to combat scams

Australia’s biggest banks have launched a multimillion-dollar overhaul for online payment systems aimed at protecting people from fraudsters and identity scams.

Australia’s biggest banks have announced a $100m change to the way people pay online in a bid to protect customers against fraudsters and identity scams.

On Friday, the Australian Banking Association said community-owned banks, credit unions, and commercial banks were “joining forces” to tackle scammers with the new Scam-Safe Accord.

Customers will now have to confirm their account name and pay ID when making or collecting payments under a new payee system set to be rolled out across all Australian banks.

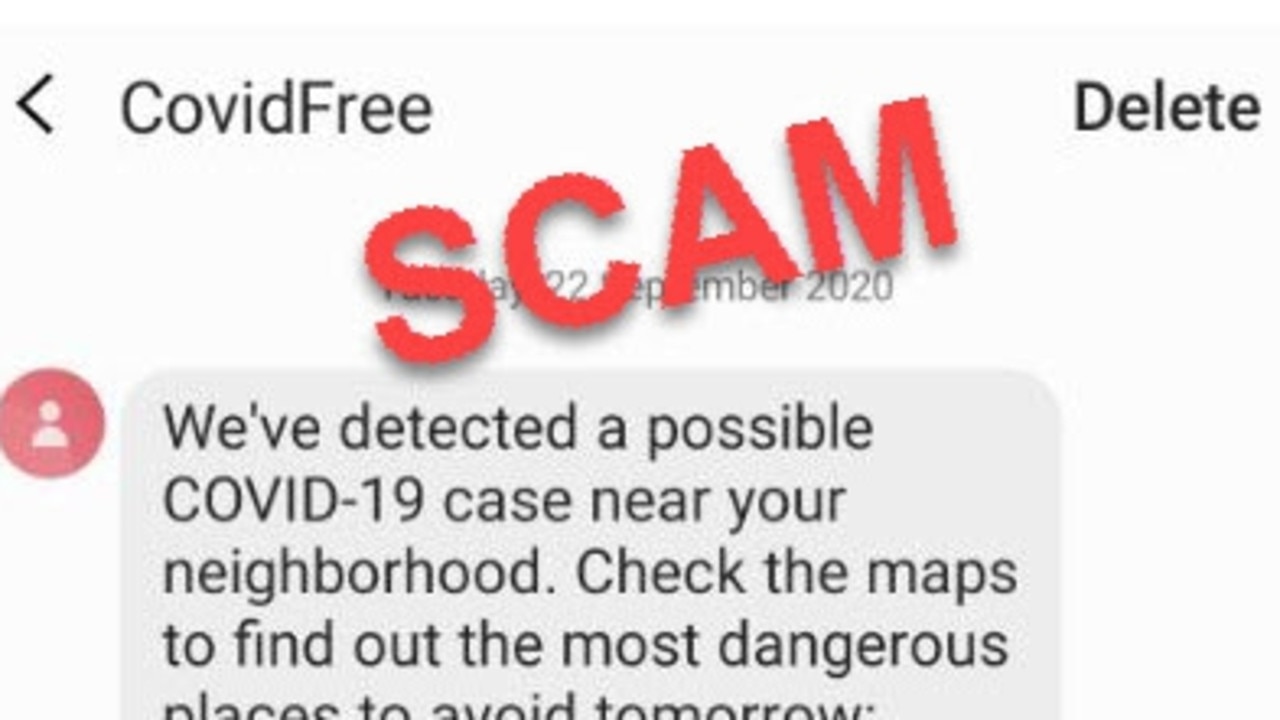

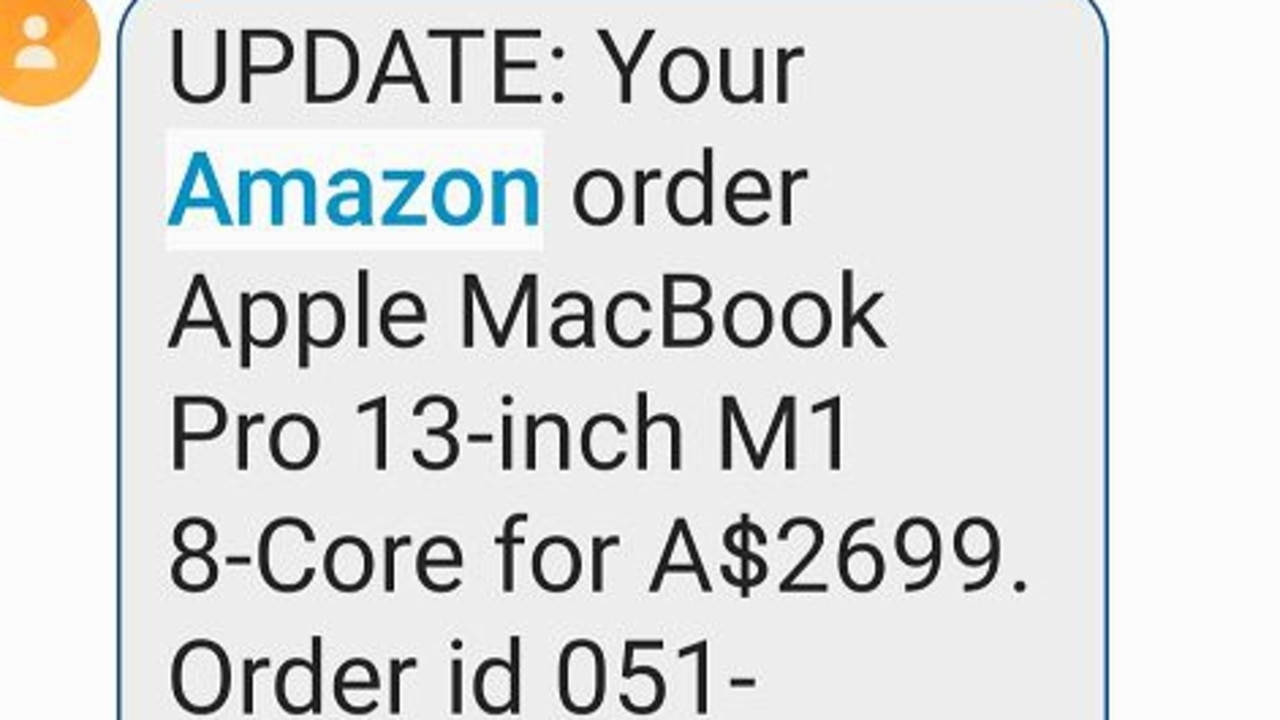

The measure aims to limit payments to high-risk channels and alert customers to potential scam payments, with lack of identification playing a key factor in the loss of millions to the scam crisis.

In a statement, the ABA said “confirmation of payee will help reduce scams by ensuring people can confirm they are transferring money to the person they intend to”.

“With 15.4 billion transactions worth $2.5 trillion occurring every year across the banking sector, the design and build of an industry-wide confirmation of payee system is a major undertaking,” it said.

“Design of the new system will start straight away and it will be built and rolled out over 2024 and 2025.”

ABA chief executive officer Anna Bligh called the industry-wide agreement a “new offensive on the war on scams”.

“Recent data from banks shows that $600m in stolen funds has been returned to customers over the last year,” she said.

“To keep up this effort it is critical that government, banks, telcos, social media and crypto platforms work together to stay one step ahead of sophisticated criminal gangs.”

The $100m “name-checking” system is one of six measures to be introduced in a sweeping slew of changes.

Aussies will also be subject to “biometric checks” such as facial recognition when opening a new bank account in order to prevent identity fraud and account misuse.

The change is part of a core agreement to raise the bar on technology and systems protections to thwart increasingly sophisticated scammers.

A major expansion of intelligence across the sector will also be rolled out by mid-2024, with all banks set to share real-time scam intelligence through the Fraud Reporting Exchange and Australian Financial Crimes Exchange.

More Coverage

Customer Owned Banking Association chief executive officer Mike Lawrence celebrated the changes as a win for customers.

“The initiatives we launch today are a significant step forward and demonstrate the banking industry’s commitment to fight scams,” he said.

“Preventing scammers from taking the hard-earned money of everyday Australians is a shared responsibility. As scammers work hard to devise new ways to steal money, it’s critical that governments, industry and consumers remain vigilant to make Australia a hard target.”