Australians lost $260,000 to fake PayID scams last year

An infuriating scam seeks to rip off Australians trying to turn their trash into treasure but who are ultimately being left thousands of dollars out of pocket.

A scam targeting Australians selling second-hand items on Facebook Marketplace is gaining traction, with one of the major banks reporting a spike in activity.

There has been a dramatic rise in Fake PayID scams in recent weeks as thousands of Aussies try to ramp up side hustles to in order to try to deal with the cost of living pressures, an NAB spokesman said.

Australians lost at least $260,000 to PayID impersonation scams last year, according to Scamwatch.

NAB’s executive group investigations and fraud, Chris Sheehan, said the true number of PayID scams impacting the community was expected to be higher given many aren’t reported.

“No one wants to try to sell their old couch, fridge, phone or pram and have it inadvertently end up costing them; unfortunately, that’s what’s happening more and more when people try to sell items online,” Mr Sheehan said.

“Just as online marketplaces have replaced garage sales as the go-to option to sell second-hand items, the way we make and receive payments is also changing.”

PayID is a popular transaction method used by most major banks which allows customers to send money with only a mobile number or email address.

It is a safe and secure method of payment, but if sellers are not familiar with the process, a scammer can take advantage of vulnerable groups.

The scam has lead to countless reports on social media from frustrated sellers using websites like Facebook Marketplace and Gumtree, who have encountered bizarre interactions with potential buyers.

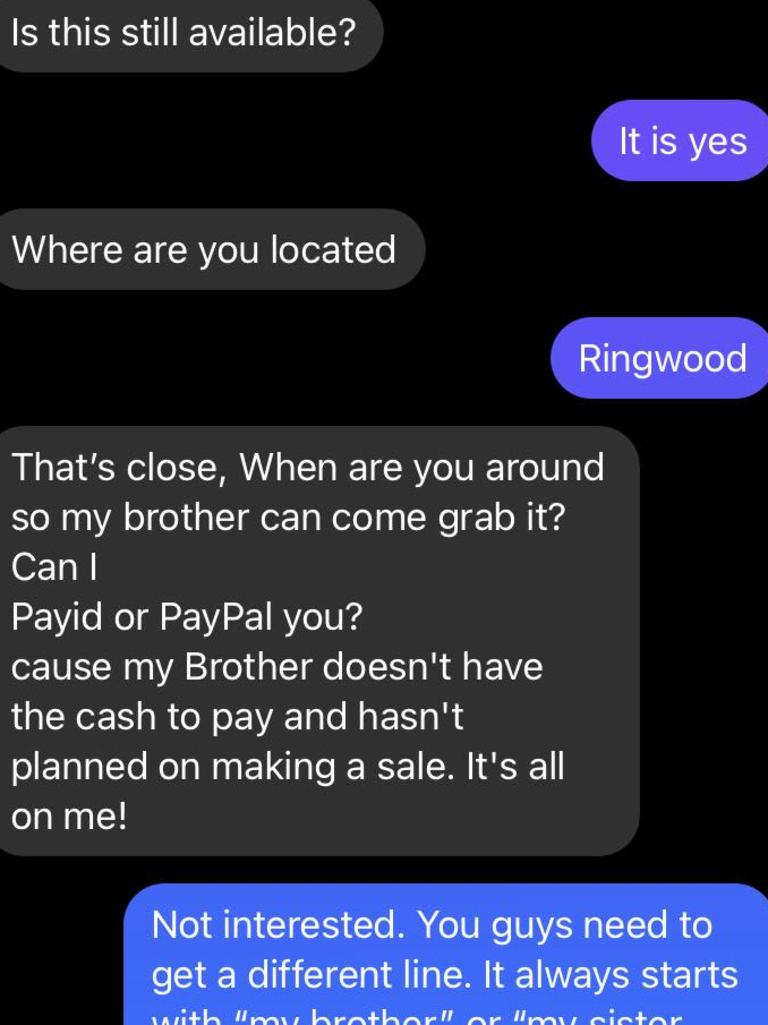

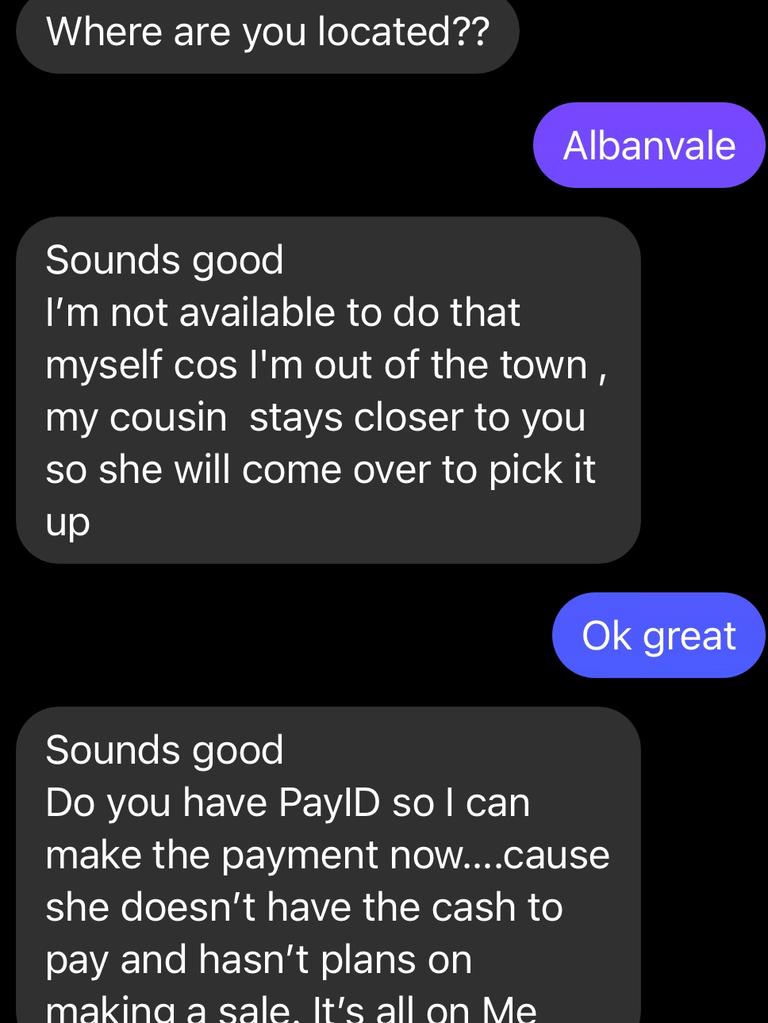

The exchange will start out simple enough: a buyer messages to say they are interested in purchasing the item and asks if it is available.

Once the seller confirms, the scammer will typically reply with two standard responses which should ring alarm bells.

The first is that a relative will come and pick up the product and the second, that they would like to pay in advance by asking for a PayID number.

NAB Economics’ research found more than 25 per cent of people are deterred from selling items because of “social media hassles”.

Mr Sheehan encouraged Australians to learn about PayID so they could see through scams.

“[It’s] a relatively new payment method and is quick, safe and simple. It is also free – and the biggest red flag of any PayID-related scam is often if someone asks you for money to upgrade an account or to access PayID,” Mr Sheehan said.

“There are never any charges related to using PayID.

“It is also important to remember PayID will never send you an email, text or message directly. If you receive one of these, it is a scam.”

PayID will never ask you to:

- Send money to receive a payment via PayID.

- Take any additional action like upgrading your account or paying additional fees before money can be received into your bank account.

- Receive communication directly from PayID via email, text, or messenger. PayID is managed by your bank.

If you think you have been scammed, contact your bank immediately.