Almost two dozen Chinese cities forced to ration electricity after Australian coal ban

Almost two dozen cities across China are now forced to ration electricity as demand surges. And Beijing’s harsh ban on an Aussie product may have something to do with it.

Two dozen cities across China’s industrial heartland are rationing electricity.

Homes and businesses are having to cope with shutdowns and extreme heat.

And politically-motivated bans on Australian coal are to blame.

Things are a bit uncertain in Guangdong province.

Summer has come early. Temperatures are soaring. And so are tempers.

Meanwhile, business is booming. But factories face forced closures as pent-up consumer demand is unleashed by the end of pandemic lockdowns.

The problem: sufficient supplies of electricity.

China Southern Power Grid Co has issued a statement saying demand was up 24 per cent over the same time last year. And May 21 represented an all-time high.

But Beijing’s unofficial ban on coal imports from Australia is choking power generation. Which means power must be rationed.

RELATED: ‘Wiped out’: Fears over new China threat

The state-run power company says it is prioritising home cooling over the wheels of industry. That’s resulted in a mad scramble by businesses to buy their portable emergency generators. Others have switched to night shifts to take advantage of off-peak supplies.

And there’s no end to the turmoil in sight.

Chinese state media is reporting many Guangdong factories have been restricted to operating just three days a week. Expectations are such measures will be necessary for at least another three months.

Power outages have been affecting industry and offices in cities including Guangzhou, Foshan, Shantou and Dongguan.

Tense climate

The heat is on China’s power generation capacity. But also that of Japan and Taiwan.

All are experiencing unseasonably hot weather. Then there are technical issues. And a lack of rain.

But the fallout of China’s “Wolf Warrior” diplomacy is also having an impact.

Attempts to punish Australia for advocating an international investigation into the origins of Covid-19 included restrictions on coal imports.

But it’s proven not to be a great time to do so.

JZ Energy president Zhang Chuanming told the state-controlled Global Times that “surging prices of bulk commodities, including coal used for power generation, have raised the cost of generating electricity and limited the capacity of power plants”.

“For example, at the largest power generation group – Guangdong Energy Group Co – 16 of its 18 power plants lost money in the first quarter of 2021,” said Zhang.

RELATED: China’s big move ridiculed online

Part of the problem is a lack of supply of high-quality Australian coal.

“Domestically produced coal can meet the market demand, but bulk commodities need supervision by the relevant authorities to prevent higher prices being felt along the industry chain,” he said.

Securing supplies

Power outages began to strike Chinese cities in December during the peak winter months. Beijing and Shanghai did not escape unscathed. Industrial provinces such as Hunan, Jiangxi and Zhejiang imposed power-saving policies. Compulsory shutdowns became commonplace.

But the change in the seasons has not brought the expected relief.

Beijing has sent trade delegations to Russia and South Africa in search of similar quality coal to that from Australia. Indonesia also has been approached to help make up the shortfall.

Thermal coal is used in power generation.

High-quality coking coal is used for industry, such as the production of steel.

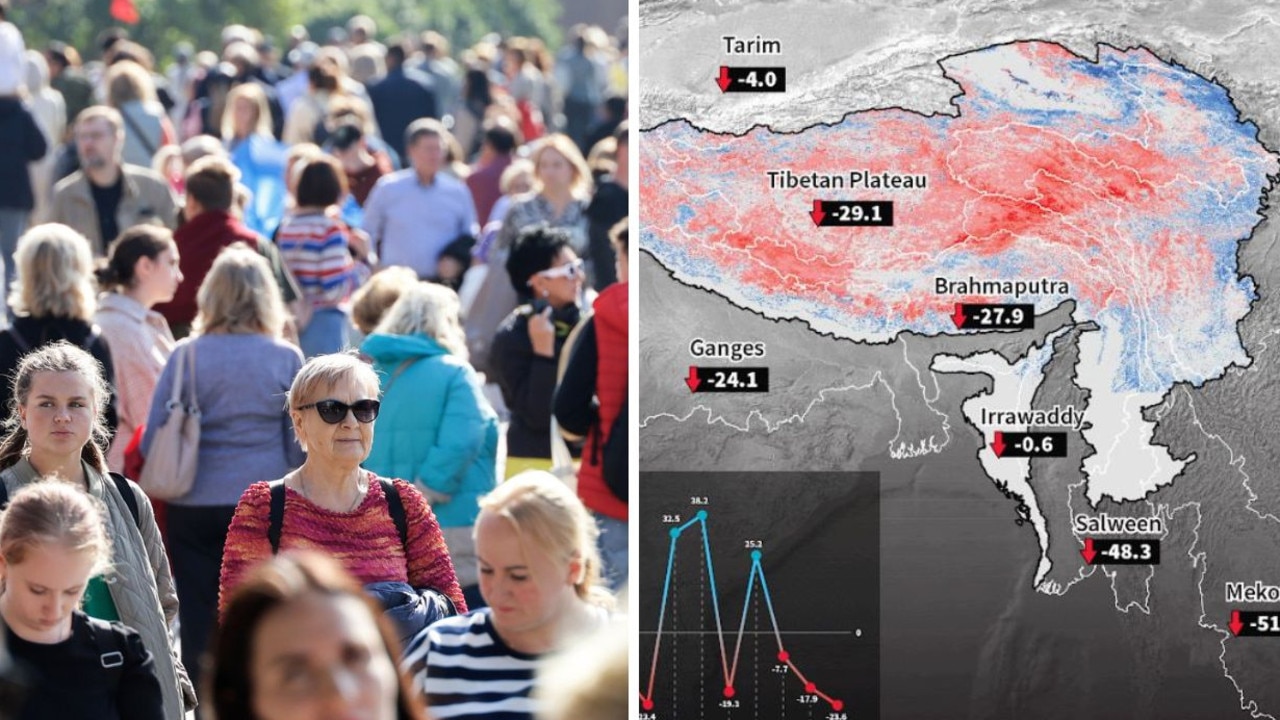

Australia was China’s number one supplier of coking and number two of thermal coal. Until Beijing’s coercive trade restrictions reduced its market share to zero.

But China’s attempts to switch to US and Canadian suppliers have seen prices soar. And that’s even before higher shipping costs are taken into account.

Production in neighbouring Mongolia has been ramping up as a result. It has leapt from 17.7 per cent of China’s coking supplies to 61.7 per cent in less than a year. But it is not enough to meet demand.

RELATED: China’s eye-popping vaccine rate

Indonesia is supplying more thermal coal. Russia and South Africa are being asked to offer their higher quality product.

“But boosting supplies from these countries appears to have done little to lower domestic prices, meaning Chinese users are still paying substantially more for the fuel than what they were prior to the ban of Australian coal,” Reuters reports.

Going dark

China’s woes are being mirrored in Japan and Taiwan.

But for more natural reasons.

Hot weather is having a severe impact.

Lakes and dams in Taiwan are drying up. And that’s hurt more than just hydro-electric generation. Power stations and heavy industries – including silicon chip manufacturers – are struggling to get enough cooling water to stay operational.

Taipei is reviewing its earlier decision to close all its nuclear power plants as a result.

Demand for airconditioning has also skyrocketed in Japan. Meteorologists there warn unexpectedly high temperatures will likely persist until August.

It’s also come at a bad time.

Several coal power plants remain offline, even though some have been restored to operation, after a damaging magnitude 7.3 earthquake off Fukushima in February.

The Tokyo government is urging businesses to stock up on emergency generator fuel supplies and launched an advertising campaign to promote energy conservation.

Beijing points to the experiences of its neighbours while denying its power restrictions have anything to do with Australian coal bans. It also blames “routine maintenance” and “anti-corruption” drives in the nation’s power industry.

Despite a promise to slash CO2 emissions by 2030, China is building large numbers of new coal-fired power plants.

Feeding them, however, will likely remain a problem for as long as its unofficial embargo remains.

Jamie Seidel is a freelance writer | @JamieSeidel