Iron ore price: Fears Australian property will suffer after China move

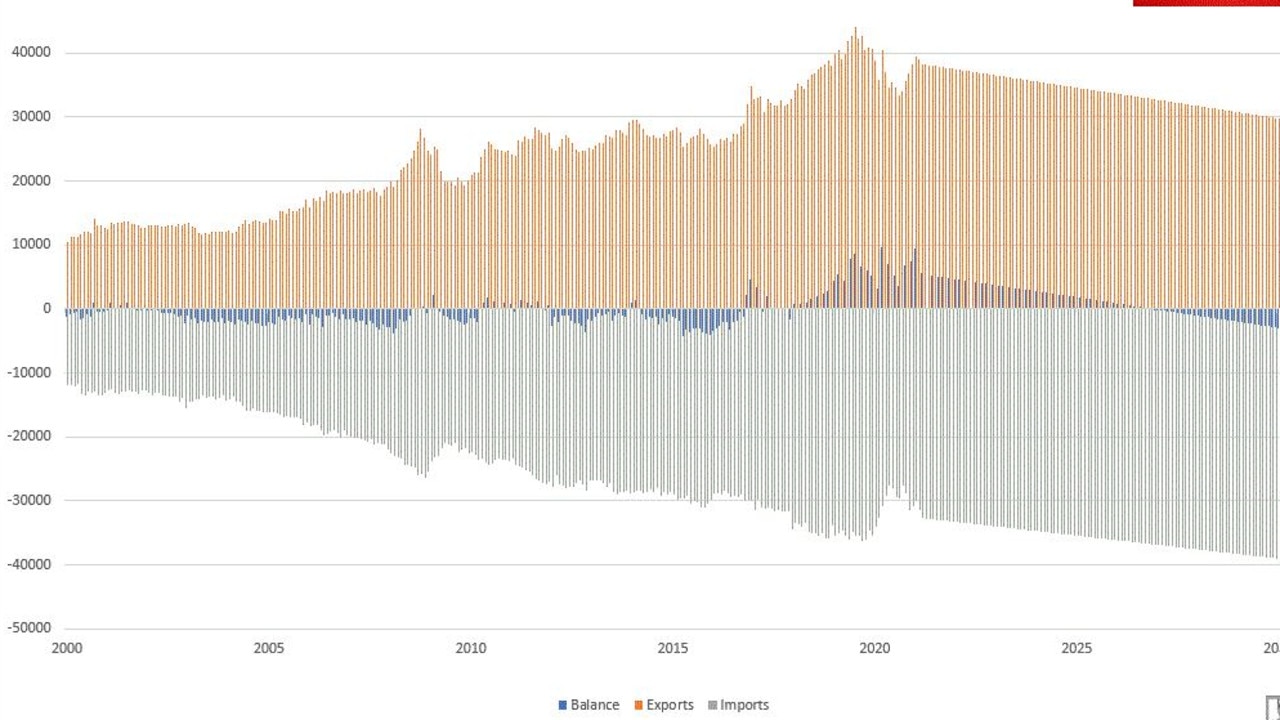

China’s latest threat to cut off Australian iron ore has raised major questions about the future of our nation’s housing market.

China has revealed its intentions to diversify its supply of iron ore – and now, experts are warning that “not if, but when” they do pull the pin on Australia’s biggest export earner, our house prices will go tumbling with it.

In its monthly briefing a fortnight ago, the National Development and Reform Commission (NDRC) recommended Chinese firms boost domestic exploration for the steelmaking input, explore overseas ore resources and widen their sources of imports.

Adding iron ore, Australia’s biggest export earner, to the raft of curbs already in place on commodities like coal and wine could be a risky move, energy research and consultancy firm Wood Mackenzie told Bloomberg at the time – given the near-record prices and China’s dependence on Australia’s high-quality supply for about two-thirds of its imports.

“While an outright ban would be almost unimaginable, various forms of restrictions, delays or increased administrative burdens on Australian iron ore imports could yet happen,” Wood Mackenzie warned.

MB Fund and MB Super Chief Strategist David Llewellyn-Smith echoed a similar sentiment in a piece for his publication MacroBusiness today.

“Whether China cuts off Australian iron ore is not in question,” he wrote.

“Only the timing of it is. As well as what it will do to the Australian economy when it does.”

RELATED: China’s threat could wipe $32 billion from economy

‘Three main drivers’ behind cut-off

According to Llewellyn-Smith, there are “three main drivers” behind the cut-off.

First, he writes, is the “US/China cold war” which is dividing the world into “liberal and illiberal economic blocs”.

Australia siding with America makes Chinese reliance upon our iron ore “strategically unviable”.

“Second, the Chinese economic development model is running out of rope. Its urbanisation is all but complete in construction volume terms,” he wrote.

“It can continue to overbuild but this is now hurting its long-term growth prospects as misallocated capital and debt kill off productivity. It must shift away from building as its primary growth driver.”

China – which buys 60 per cent of our iron ore – is buying it up like never before to create steel for its massive infrastructure projects in a bid to recover from the pandemic.

RELATED: China’s mind-bending megadam plan

The third driver, he says, is the combination of these two factors, “most forcibly in Chinese politics”.

“CCP legitimacy will fail as the economy slows. It is already being replaced with deliberately stoked nationalism. This makes external conflict inevitable, most particularly in Taiwan,” Llewellyn-Davis said.

“Yet Australia has a virtual veto over Chinese military aggression so long as China relies upon it for iron ore.”

The CCP must therefore, he said – probably over the “second half” of the 2020s – break the Chinese economy’s reliance “via a combination of structural decline in steel output, a shift towards a greater share of scrap output and by seeding new iron ore developments worldwide”.

Days of Australian iron exports to China numbered?

— David Scutt (@Scutty) May 26, 2021

CapEco: "[With] increased supply from other sources, greater use of recycled steel and a structural decline in Chinese steel demand, it may be feasible for China to cut off Australian iron ore...by the middle of the decade." pic.twitter.com/DIgCciU0Mn

What will happen to Australia then?

As “unimaginable quantities of Aussie iron ore flood ex-China markets”, global iron ore prices will collapse, writes Llewellyn-Davis.

“China absorbs more than a billion tonnes of seaborne iron ore. Australia ships around 700mt there every year. Some large slice of this will be progressively dumped on other markets,” he added.

The bigger hit, however, will be to national income – Australia will reap at least $150 billion this year in export revenue from iron ore, “nearly all” of which will “be wiped out by the combination of volume and price pressure”.

While the hit to our total exports will be big, he advises it will remain manageable, likely returning to 2015 external conditions.

RELATED: ‘Seeking to divide’: PM swipes China

“That also gives us a very good guide to what will happen: Nominal growth will be crunched; Inflation and wages will be hit for years; The budget will be a sea of red; Mining stocks will fall; Bonds yields will plunge; AUD will crash,” Llewellyn-Davis warned.

On top of that, Australian house prices “would tumble”, “radically devaluing versus the world via the collapsing currency”.

“How long that would last is the more interesting question. Presuming that AUD can keep on falling without creating inflation then there is no obvious immediate limit to it,” he said.

China warns of ‘Australia’s pain’

Currently skyrocketing iron ore prices are putting China’s economic recovery from the pandemic at risk, with companies and everyday Chinese citizens bearing the cost.

Chinese government mouthpiece The Global Times said companies have already raised prices for a wide range of products, including refrigerators, washers and bicycles, citing rising costs.

However, analysts told the paper that China’s latest moves to crack down on “speculations and other market manipulation” is about to send “chilling waves across the globe”.

The Global Times singled out Australia as the nation that will be hit hardest by the crackdown – given iron ore is such a dominant force in our exports – and accused us of “profiteering” from the rising prices.

“Among the most affected could be iron ore exports from Australia, which has benefited massively from the sky-high prices in its main export – emboldening officials in Canberra to continue on their relentless provocation against China,” the paper stated.

“While China’s reliance on Australian iron ore will likely continue in the foreseeable future, despite its efforts to diversify sources, sharp drops in iron ore prices would mean heavy losses in export revenue for Australia, which is already seeing declining trade with China in areas such as wine and seafood.”

It said that iron ore prices have dropped $US9.25 ($A11.93) per tonne since Beijing took action earlier this month. That could translate into a loss of over $US2 billion ($A2.58 billion) in extra revenue for Australia based on the amount of exports to China in the first four months of 2021.

– with Ben Graham