Melbourne home pain hits grim six-month milestone, units now cheaper than in Adelaide: PropTrack Home Price Index

Melbourne’s property market has sunk below Adelaide’s on a key home value metric after the city’s spring selling season got off to a grim start. Experts reveal what to expect next.

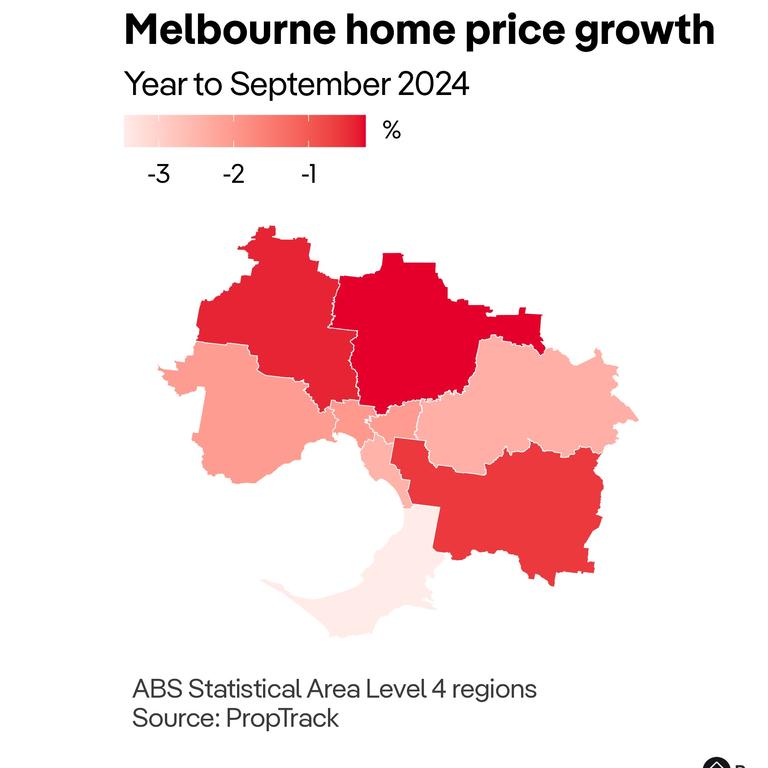

Melbourne homeowners have had a grim start to spring with a sixth straight month of falling home values, with the city's typical unit price now below Adelaide’s.

PropTrack’s latest Home Price Index shows that by the end of September the Victorian capital’s $606,000 median value for apartments, townhouses and flats was down by close to $5000 compared to the same time in 2023.

It’s enough to put Melbourne behind Adelaide’s $607,000 median unit price.

RELATED: Melbourne’s overlooked suburbs where analysis says they’re ready to boom

Melbourne median home price falls below Adelaide and Perth, experts blame Vic government

Melbourne home prices: 245 suburbs where rises are outpacing interest rate hikes | PropTrack

And in good news for homebuyers it is now Australia’s fifth-cheapest capital to buy a unit in, also behind Sydney, Brisbane and Canberra.

Melbourne’s $909,000 median house price fell about $18,000 (1.97 per cent) in the past year, but remains the nation’s fourth most expensive behind Sydney, Brisbane and Canberra.

A prominent buyers advocate has already noticed “affordability refugees” looking to relocate to Melbourne from Sydney as the two city’s house prices diverge.

The PropTrack figures come a month after separate CoreLogic data found Melbourne’s overall dwelling price, a combination of both house and unit values, had fallen to the nation’s sixth cheapest — with even Perth moving ahead of the Victorian capital at that time.

That drop was in part a result of Melbourne’s higher prevalence of units than many other major capitals, though is not yet reflected in PropTrack figures.

PropTrack senior economist Eleanor Creagh said Melbourne’s median unit price falling below Adelaide’s was a first “in recent history”.

“It’s clear that we have seen growth in Melbourne is significantly lagging, and that continues to be the case with Melbourne now recording a sixth straight month of price declines,” Ms Creagh said.

The economist said the falls were in large part being driven by Melbourne’s relatively higher supply of homes for sale than other capital cities, in part led by large numbers of investors selling up in response to an increase in land tax in Victoria this year.

MORE: Suburbs set to lose most from Albo housing change

Ms Creagh said this was providing a lot more choice for buyers, and in the short term Melbourne would “continue to underperform” with ongoing small declines.

While an interest-rate cut or reduction in the number of homes for sale could improve Melbourne’s real estate fortunes, Ms Creagh said there would also be a tipping point where the city just began to look like good value and prices would rise — particularly with the gap between house prices in Sydney and Melbourne now at a “historical extreme”.

Property Home Base buyer’s advocate Julie DeBondt-Barker said she had three prospective purchasers from Sydney already looking to buy homes in Melton, Werribee and Craigieburn as they looked to escape the NSW capital’s impossibly expensive house prices.

“We are starting to attract affordability refugees,” Ms DeBondt-Barker said.

“But there are very, very few investors — the unit market is almost bereft of investor buyers.”

She added that while the figures for units overall did not look great, they were being exaggerated by a “flood of crappy one- and two-bedroom apartments in high-rises”.

“They are completely distorting the figures,” Ms DeBondt-Barker said.

“If I can steer someone away from an apartment at the moment, I will.”

For those who cannot afford anything other than apartment, the buyer’s agent advised looking to smaller complexes and away from high-rise towers.

Outside of Melbourne, Ms Creagh said Geelong had just notched its 30th month in a home price correction, with values in the regional area having trended downwards since April 2022.

Across the wider state the median house price fell 1.44 per cent to $598,000 in the past year, while the typical unit was relatively flat after 0.19 per cent growth to $422,000.

Sign up to the Herald Sun Weekly Real Estate Update. Click here to get the latest Victorian property market news delivered direct to your inbox.

MORE: Dubai-style Melb home decked out with $50k+ crystal inside

Coastal ‘top of the town’ house rebuilt after bushfire

Isla Fisher’s post-divorce setback

Originally published as Melbourne home pain hits grim six-month milestone, units now cheaper than in Adelaide: PropTrack Home Price Index