Australian federal budget 2025: First-time buyers slim chance of govt help laid bare

The possibility that first-time buyers will secure financial assistance from a federal government program to buy a home has been revealed, and the numbers may alarm you.

First-time buyers have less than a one in 10 chance to secure financial assistance from a key federal government program to buy a home.

This year’s budget committed $800m to first-home buyers and single parents struggling to get back into the market, as part of the Help to Buy scheme expected to come into action after the federal election.

It will assist homebuyers by having the government pay for and own up to 40 per cent of a new build, and up to 30 per cent of established properties, reducing the size of their mortgage — and allowing them to purchase with deposits as small as 2 per cent.

RELATED: ‘War-time response’: Aus’ biggest builder’s ominous home crisis call

Critical flaw unravels Albo housing plan

True cost of investment properties revealed

However, the election promise from 2022 is yet to be implemented, and is expected to finally come into force after July 1.

It was costed at $5.5bn in earlier budgets, with 40,000 places to be made available to eligible homebuyers over four years, reiterated in this year’s budget.

The latest financial statement from the government puts it at $6.3bn.

The government expects they will spend $1.315bn of the Help to Buy scheme in the next financial year — about 20 per cent of its allocated funds.

But Australian Bureau of Statistics data shows almost 117,000 first-home buyers made new-loan commitments in the past year. There were 162,000 in 2021.

Based on last year’s figures, fewer than one in 10 first-home buyers nationwide will have access to the Help to Buy scheme.

Real Estate Institute of Australia president Leanne Pilkington said while they were happy to see some extra support for first-home buyers, this year’s budget had not gone far enough.

“People will look at that and think what chance have I got? Is it really even worth the effort if it’s less than one in 10,” Ms Pilkington said.

“We do need to focus on the people that need the help the most, who are unable to get the help anywhere else.”

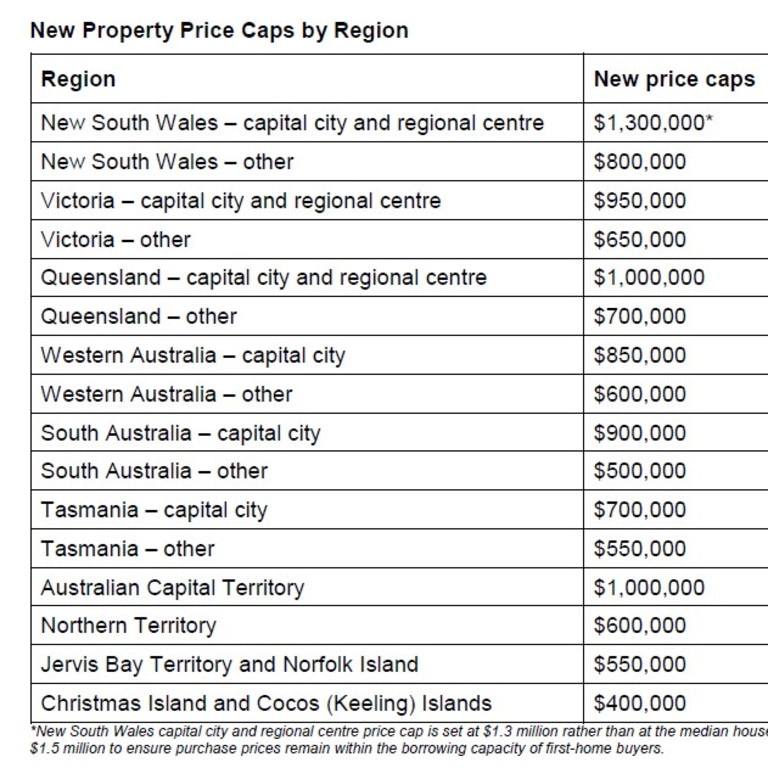

And the cap on purchase prices will also be increased, with NSW homebuyers in metropolitan areas to be able to access $1.3m, and $800,000 in regional areas.

In Queensland the caps will be $1m and $700,000, Victorians will be able to buy homes worth up to $950,000 and $650,000 and in South Australia budgets will be limited to $900,000 and $500,000.

Western Australia’s caps have been set at $850,000 and $600,000, while Tasmanians have access to homes with prices as high as $700,000 and $550,000.

Canberra will have a single $1m threshold, and the Northern Territory $600,000.

Ms Pilkington said that while an increase to the dollar caps on the program had been important, without a boost to the number of places it was “a drop in the ocean”.

PropTrack economist Angus Moore said the higher price thresholds would mean a lot more homes were eligible for the scheme than previously and higher income bands would also expand availability to more first-time buyers than before.

MORE: Money guru slams home move as ‘bulls**t’, ‘window dressing’

‘Time is running out’: Why first-home buyers must act now

“Saving up a deposit can be a real constraint to homeownership. The Help to Buy scheme will allow some first-home buyers to purchase sooner than they otherwise might,” Mr Moore said.

“However, with mortgage rates still quite high, and housing affordability at very challenging levels, servicing a mortgage is also a real constraint for many.”

The Regional First Home Buyer Guarantee and the Family Home Guarantee aimed at helping single parents and those living in regional areas will receive a $4.9m boost over four years from 2025-26.

Their funding had been due to expire at the end of this financial year, but the top up means they will continue.

The two schemes allow eligible home buyers to purchase a home with as little as 2 per cent and 5 per cent deposits, respectively, with a loan from a participating lender, and without paying Lenders Mortgage Insurance.

The First Home Guarantee and the New Home Guarantee had funding extended through earlier budgets.

In last year’s budget, 35,000 new places were added to the scheme aimed at helping first-home buyers which came into effect on 1 July, 2024.

— additional reporting by Nathan Mawby

MORE: Rents up $2600 a year in some cities, down almost $10,000 in others

Originally published as Australian federal budget 2025: First-time buyers slim chance of govt help laid bare