Older Aussies are exposed by shift to online banking

A perfect storm has led to a specific group of Aussies losing millions to scammers in the last few months alone.

As bank branches continue to close, online banking has increasingly become adopted by Aussies, but one expert says it’s leaving the our most vulnerable exposed.

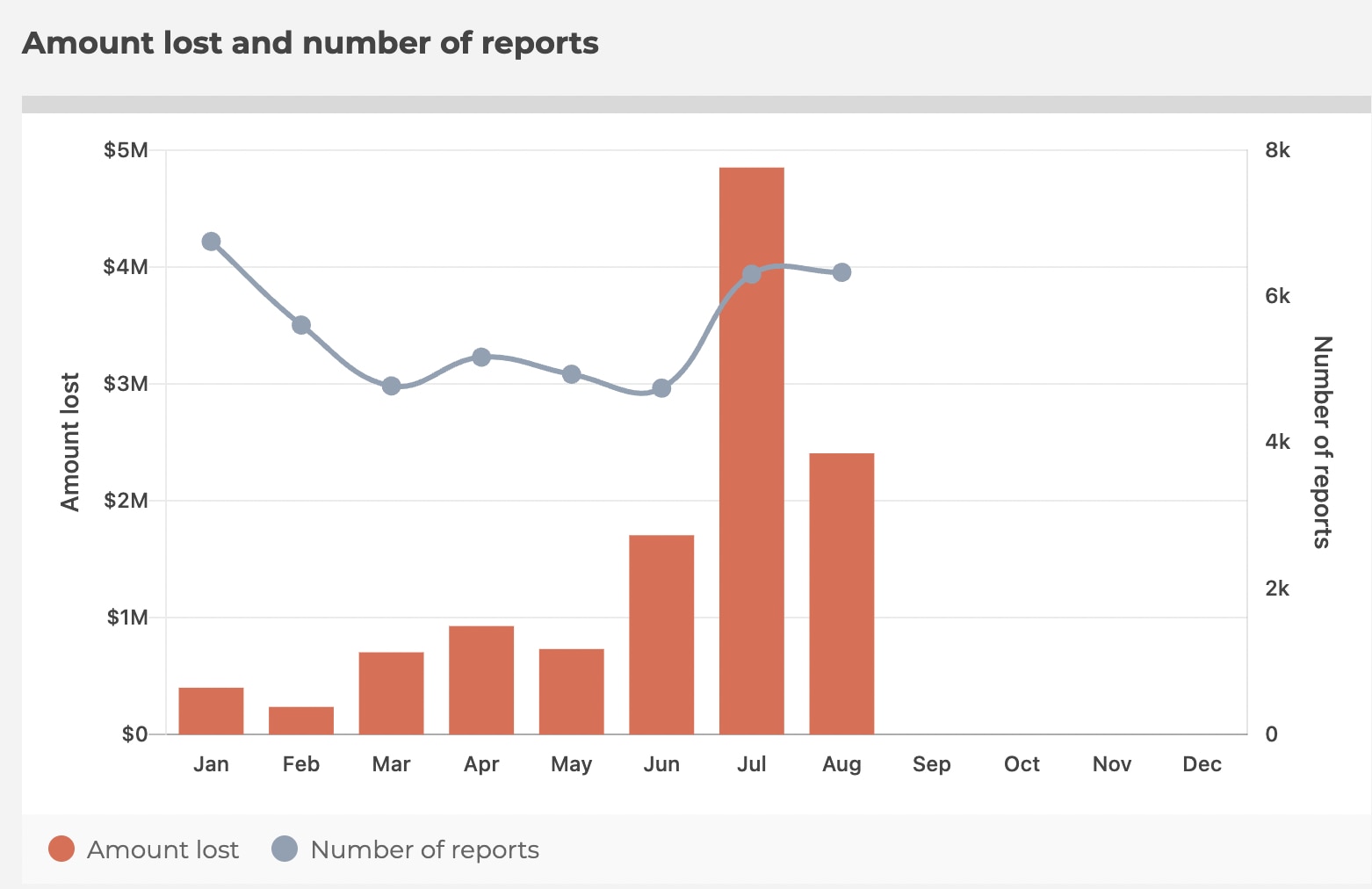

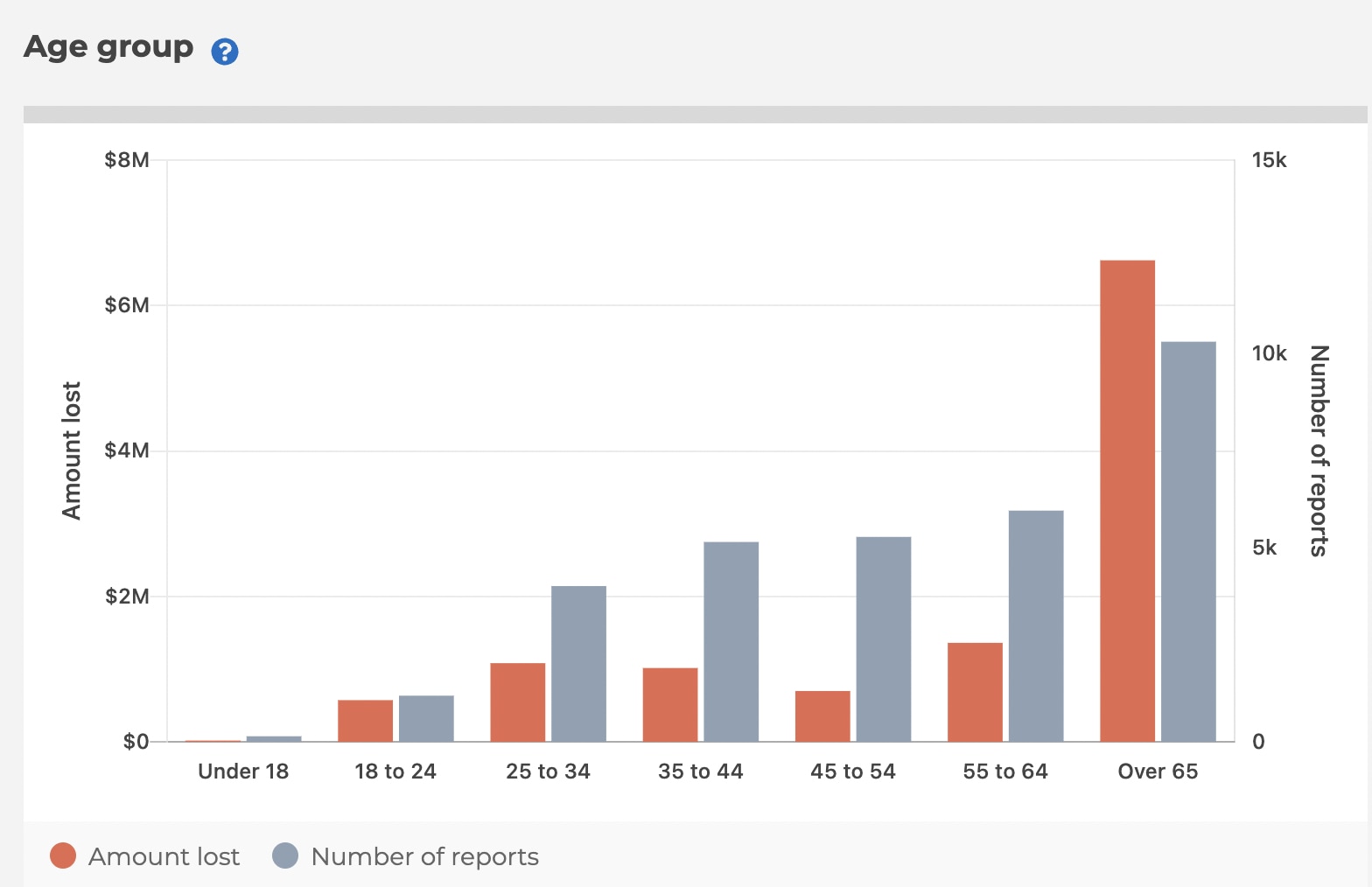

Data shows phishing attacks on senior Australians are on the rise in a big way, with the ACCC’s Scamwatch reporting Australians over 65 have lost more money to phishing scams this year than all other age groups combined – totalling over $6.5 million in the first eight months of the year. And that could just be the tip of the iceberg.

Aaron Bugal is an Australian cybersecurity industry veteran with 15 years experience on the frontline, defending Australians from scammers.

Now a global solutions engineer with security company Sophos, he believes a drive by banks to get people banking online combined with an increase of seniors using smartphones, and tablets, makes creates a perfect storm for phishing scammers.

“The drive by banks and requiring people bank online, including the elderly, has also been exacerbated by grandkids and children of the elderly buying smartphones and tablets for their grandparents and ‘getting them online’,” he explained.

“The ubiquity of owning a smart device has penetrated all age groups, however, the older generation are, literally, left to their own devices … sometimes not understanding that a simple click of a link in an SMS or response to a ‘sounds like a great deal’ email could have disastrous consequences.”

The amount of money lost to phishing scams in 2022 has almost tripled last year – and it’s only September.

So far Aussies have lost $11,965,331 this year – in comparison to $4,324,128 for the entire 2021 calendar year.

In 2022 so far, 10,318 over 65-year-olds reported losing a combine total of $6,621,995 to phishing scams. The losses are split almost evenly between men and women.

Mr Bugal said elderly and retirees were “prime targets”.

“Given that many retirees have access to their life savings, whereas the younger generation need to dip into super to sustain themselves thanks to the pandemic, unfortunately makes the elderly and retirees are a prime target for scammers,” he explained.

A sentiment report by ANZ Bank released earlier this month claimed which 83 per cent of Australians over 65 feel confident they can recognise suspicious links in emails, websites, social media, messages, and pop ups.

But the stats from the nations’s consumer watchdog and Sophos’ industry observations tell a different story.

Mr Bugal said awareness and education are key and to “start a conversation” around online banking and cybersecurity awareness as senior Australians bank online.

“It’s getting to a point where those with large balances and or access to large amount of capital that are new to the online banking scene should perhaps have limitations of daily transfer and withdrawals,” he suggested.

“At least this could limit the immediate damage a scammer could do”.

The troubling evolution of Phishing scams

Scammers are getting more brazen, personal, and convincing.

The are preying on people’s trust and emotions more than ever, according to Mr Bugal.

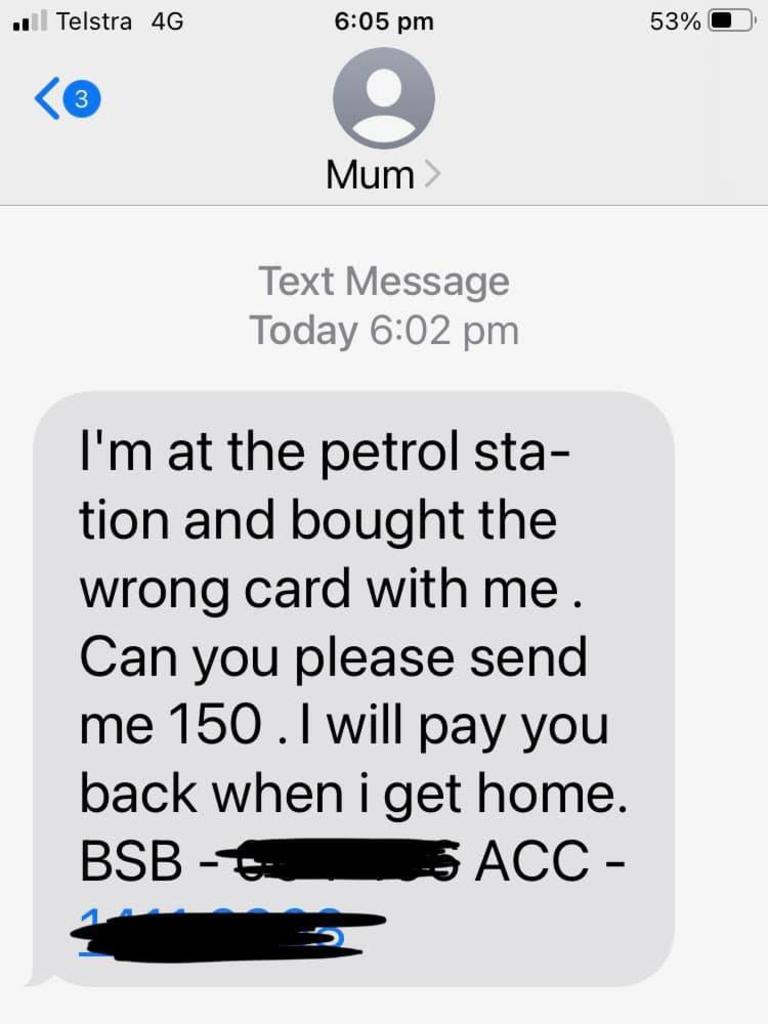

“We’ve seen this with the recent spike in “Hi mum” text scams, call-back scams, and the crypto-rom scams that plagued social media and dating apps in 2021,” he said.

“Scammers will continue to look for innovative ways to make contact with victims, with the trend to continue into whatever has the most success.

“We’ll see phishing scams continue to become more personalised and harder to spot.”

The cybersecurity expert said “spray and pray tactics” are being replaced with targeted attacks that are tailored to the individual, seen recently released phone recordings from Westpac, of a scammer claiming to be from its fraud prevention team.

The chilling audio showed the moment a cunning and cruel scammer deceived a woman into handing over her banking details.

The man claimed he was from the Westpac fraud prevention team and was calling over a purchase made on the New Zealand woman’s card in Mexico.

Luckily the attempted scam failed after Westpac detected the suspicious transaction before any funds were sent, with the bank saying it demonstrated some of the warning signs customers should watch out for.

“Scammers are doing their research and accessing their victims’ data before making contact, more effectively lulling them into a false sense of security,” Mr Bugal warned.

“Expect cybercriminals to leverage any data you put onto the public internet against you

Scammers use a sense of urgency to get people to act quickly and without thinking.”

And scammers are “constantly sharing tactics” with one another and coming up with new ways to fool their victims.

“It’s so important for Aussies to stay vigilant of all suspicious activity online and over the phone,” he said.

What are the red flags?

Scammers will email you claiming to be from a reputable business, and they may already know your personal information, such as your name, ending digits on your credit card, or even your location, which can make them appear genuine. Generally, they will want you to action something, such as clicking a link to complete a task, updating your banking details, downloading an app or sending money to a fake account.

Red flags to watch out for in a Phishing email or text include:

• A sense of urgency or threatening language

• Unfamiliar or unusual senders or recipients

• Spelling or grammar errors

• Request for money or personal information

• Call to action, such as clicking a link or downloading an attachment

Some of the most popular phishing scams will impersonate:

• State and territory police or law enforcement (fake fine scams)

• Utilities such as power and gas (fake bills and overdue fines)

• Postal services (parcel pick-up scams)

• Banks (fake requests to update your banking information online)

• Telecommunication services (fake bills, fines or requests to confirm your details)

• Government departments and service providers such as the ATO, •Centrelink, Medicare and myGov.

• Relatives, or close friends claiming to need money in a hurry (often through text messages)

What to do if you’ve been scammed

If an email, text or other online notification that doesn’t seem right, it’s probably not.

It’s recommended you report suspected scams to Scamwatch via the ACCC website.

“Whether it’s your bank, insurance company, or even a member of your family. If it doesn’t feel right, trust your gut, and don’t take things at their initial face value,” Mr Bugal said.

“When people report scams, government bodies learn more about new tactics being used by scammers and can immediately work on a response to get scams blocked, raise awareness, and warn of red flags that people need to look out for.

Sadly the ACCC estimates only 13 per cent of victims actually report scams to authorities. However, phone scams have almost halved in the past twelve months, suggesting the telecommunications industry was slowly getting on top against scammers.

While scam calls have reduced, they’re becoming more targeted, and the best defence is to be aware of how they work so you can spot any telltale signs early on.