Adelaide man lost life savings in one elaborate phone scam

An Adelaide man has revealed the elaborate scam that cost him his life savings as he attempts without success to get the money back.

An Adelaide man has revealed the elaborate scam that cost him his life savings as he attempts without success to get the money back.

Michael Edwards is the victim of a phone scam so sophisticated that it appeared he received a call from National Australia Bank before handing over $36,000.

The scam from earlier this month started when he received a call on a Friday afternoon.

Speaking to the ABC, Mr Edwards said the caller claimed to be a fraud investigator working at NAB who had noticed some suspicious activity in his accounts.

The caller claimed there had “been three transactions of over $700” linked to cryptocurrency and told the victim that the best thing to do was to “cancel those bank accounts now and set up a new account”.

Mr Edwards became suspicious and asked for proof that the caller was who he said he was.

The call was coming from NAB, but the scammer went further and sent him the following texts from the same number.

“Hi Michael your card ending 0960 will be cancelled shortly please await further instructions from adviser.

“VERIFY: You are currently speaking to Mark Jacobs at the fraud department. Please ask your adviser to confirm the following code: 8601”

Mr Edwards followed the instructions and, not wanting to lose his money, transferred his entire savings into two new accounts.

A sinking feeling set in almost immediately so Mr Edwards called NAB. He spent hours waiting to talk to NAB’s fraud investigator who told him “I think you’ve been scammed”.

The efforts to recover the money have so far been fruitless, despite Mr Edwards detailing exactly what happened.

He told the ABC that NAB have “never called, never acknowledged what I’m going through”.

Former South Australian senator and lawyer Nick Xenophon has taken Mr Edwards’ case and says NAB needs to do more.

“The scam was bad enough – extremely sophisticated and I think that 99.99 per cent of the population would have fallen for it the same way Michael did — but what’s even more shocking is that the bank has really done nothing, has a ‘couldn’t care less’ attitude to this,” he said.

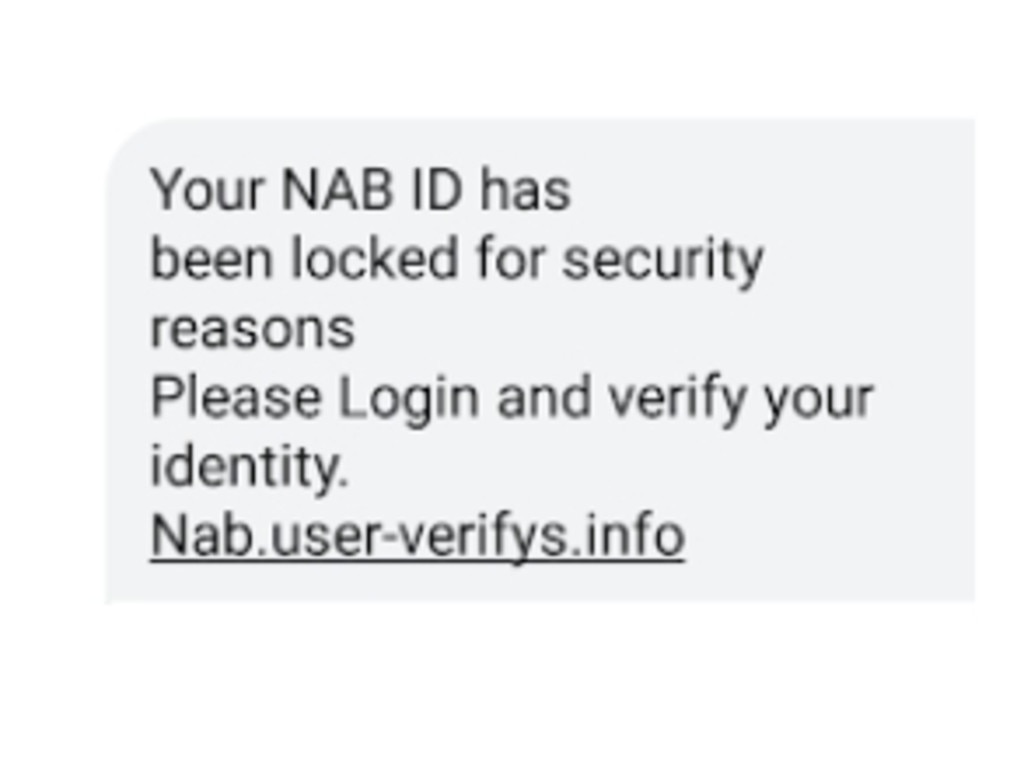

NAB this month shared details of a current SMS phishing campaign “targeting NAB customers”.

On its website, NAB wrote that an SMS message “claims to be from NAB stating that you requested a password change and provides a security code”.

“It directs you to click on a link if you didn’t request the code, which leads to a fake NAB website asking for personal and banking information.

“Do not click on the link. NAB will never ask you to confirm, update or disclose personal or banking information via a link in an email or text message.”

News.com.au previously reported on a scam that saw a widow lost more than $700,000 to a sophisticated scam.

Melbourne mum-of-two Jacomi Du Preez lost her husband in a car accident just weeks before Christmas last year.

The 48-year-old widow and her two teenage children were still grieving their beloved husband and dad Zak when they were dealt another devastating blow.

In April, a scammer stole the sum total of Zak’s life insurance policy — a whopping $760,000.

Zak ran his own business and had taken out a hefty life insurance policy so his family could be provided for in the event of his death.

Ms Du Preez said she wanted to be a responsible “custodian” of the money and didn’t wish to take any risks so she was looking for a very safe term deposit account to put the cash in — a sentiment she said is “ironic” in hindsight.

More Coverage

Her financial planner mentioned that Macquarie Bank had better interest rates than most so she plugged that into Google.

Unfortunately, unknown to her, she actually clicked on a fake website expertly posing as Macquarie Bank. Over several days, they convinced her to transfer across the entire amount of cash.

Through tears, Ms Du Preez told news.com.au: “These people are evil”.