Warning house prices could soar by $100k after election

A political party has claimed that both Labor and the Liberals’ first time homebuyer schemes could end up adding huge amounts to house prices.

The Greens have warned that house prices could soar by over $100,000 next year as both the major parties throw everything but the kitchen sink at first home buyers.

Amid predictions that the policy changes could simply fuel inflation in the housing market, a new analysis has warned of projected increases.

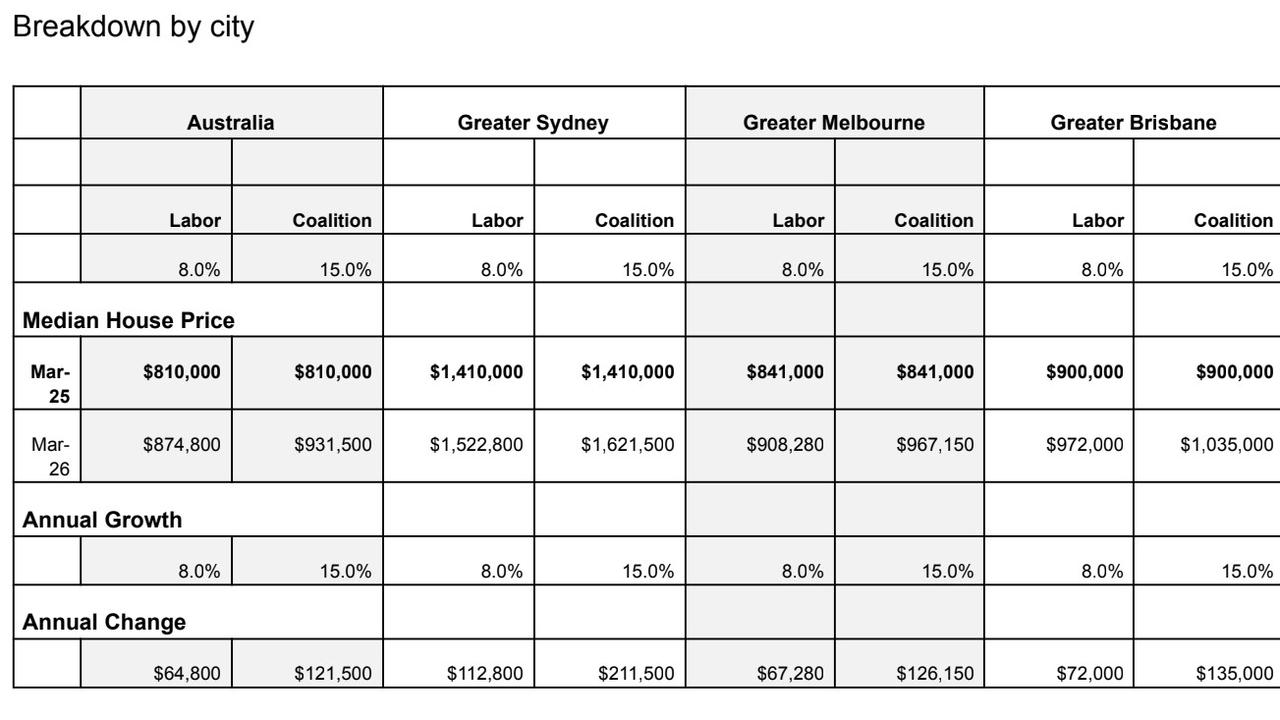

It’s based on SQM economist Louis Christopher’s prediction that house prices will rise by 8 per cent this year under Labor’s recently announced policies, or 15 per cent under the Coalition.

“They’re both inflationary. You need to model this stuff up but for a finger-into-the-wind guess, you would see prices rise 8-15 per cent, 12 months after the policies were enacted,” Mr Christopher said.

MORE: Home loan trap taking years to escape

If he’s right, a typical house in Brisbane would increase by $72,000 this year under Labor, or by $135,000 under the Coalition.

In Sydney, there are predictions of a median house price rise of $112,800 under Labor or $211,500 under the Coalition.

“House prices have risen more than double the rate of wages in the past 5 years, and now Labor and the Liberals want them to grow even faster. It’s beyond belief,’’ the Greens housing spokesman Max Chandler-Mather said.

“House prices growing even faster than before means heartbreak for renters as homeownership falls further out of reach.

“While banks and property investors make massive profits out of housing misery, a generation of renters are now wondering if they will die without ever owning their own home.”

John Howard’s first home buyers grant

In 2000, John Howard introduced a $7000 first homeowners’ grant scheme as compensation for the introduction of the GST.

It proved instantly popular but it also drove up house prices.

The Productivity Commission has warned that stamp duty concessions and first homebuyer grants, on which state and territory governments last year alone spent $2.7 billion, can push up dwelling prices and should be wound back.

MORE: Aussie couple in 30s turn $60k into $153m

Negative gearing

The Greens remain a proponent of dumping negative gearing – a move that has been ruled out by both the ALP and the Liberal Party.

“Labor and the Liberals plan to give property investors $180 billion in tax handouts, turbocharge house prices, and destroy the home ownership dreams of millions of renters,’’ Mr Chandler-Mather said.

“You can’t solve the housing crisis without fixing the enormous tax handouts to property investors that make it easier for an investor to buy their 10th house than for you to buy your first home.

“Under the Greens plan for renters, we’ll cap rent increases, and phase out negative gearing and the capital gains tax for investors with more than one investment property, to instead invest those billions of dollars in building hundreds of thousands of homes to be rented and sold at prices people can actually afford.

“In a minority parliament, we’ll keep Dutton out and push Labor to take real action on the housing crisis.”

How Liberals housing policy would work

First home buyers earning under $175,000 will be eligible for Peter Dutton’s new mortgage tax deduction scheme.

The tax break scheme will also be means-tested at $175,000 income for singles and $250,000 for couples.

The “first home buyers mortgage deduction scheme” will be limited to the first five years and the first $650,000 of a mortgage.

The deductions will be capped at $650,000.

That means you can have a larger mortgage but not claim a deduction beyond that threshold.

The Coalition will pledge that for families on average incomes you could be up to $11,000 a year better off — or $55,000 over five years.

How Labor’s scheme would work

Every first homebuyer in Australia will secure access to a 5 per cent deposit scheme if the Albanese Government is re-elected allowing them to get into the market with a smaller down payment.

Under the new scheme, a Sydneysider and first homebuyer will be able to purchase a $1 million apartment with a $50,000 deposit as long as the bank determines they can service the loan.

A Queenslander and first homebuyer will be able to purchase an $850,000 home with a $42,500 deposit.

Mr Albanese will also unveil the Labor Government’s commitment of $10 billion to build up to 100,000 homes which will only be for sale to first home buyers.

The huge move is not means tested and is designed to help young couples and singles who have a good incomes but are locked out due the size of the deposit required

“I want to help young people and first home buyers achieve the dream of home ownership,’’ Mr Albanese told news.com.au.

How the current scheme works

The Albanese Government’s First Home Guarantee (FHBG) already allows eligible first home buyers to purchase a home with a deposit of as little as 5 per cent without needing to pay Lender’s Mortgage Insurance (LMI).

This is because the guarantee provided by the Australian Government covers up to 15 per cent of the loan value.

However, to be eligible to access the existing scheme you need to be earning under $125,000 for individuals or $200,000 for joint applicants.

How the new scheme will work

If re-elected, the Prime Minister will pledge on Sunday to extend this to all first home buyers to give them a chance to access the 5 per cent deposit scheme.

The Albanese Government will guarantee a portion of a first homebuyer’s home loan, so they can buy a home with a 5 per cent deposit and not pay Lenders Mortgage Insurance.

“Labor is backing in first home buyers. We will build 100,000 homes, just for them. And back in a generation of young people to get into home ownership with just a 5 per cent deposit,’’ Housing Minister Clare O’Neill said.