‘I’m buying as much as I can’: Property experts brace for boom

There’s a lot going on right now in the economy and landlords are reacting hard and fast, claiming they know exactly what is around the corner.

Homeowners are increasingly likely to get some mortgage relief, but property experts say a rate drop could see the already inflated market explode.

Around $100 billion was wiped off the value of the Australian share market this year, sparking recession fears.

ANZ is now starting to forecast four 0.25 per cent interest rate cuts.

ANZ’s chief economist Richard Yetsenga went as far as to say that he wouldn’t rule out a double rate cut in May, and RBA Governor Michele Bullock confirmed the possibility that interest rates could be cut to defend the Aussie economy amid US President Donald Trump’s tariff mayhem.

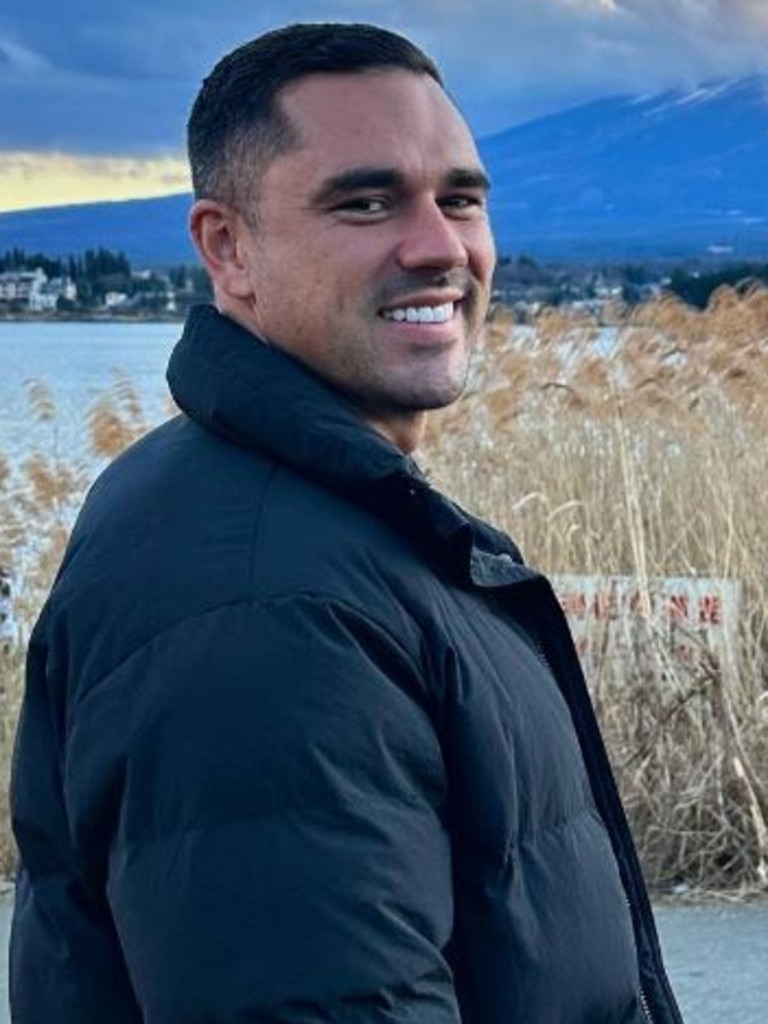

Daniel Walsh, 34, the director of buying agency Your Property Your Wealth, told news.com.au that Aussies need to brace themselves for rising property prices.

Mr Walsh owns 25 properties, and his property portfolio is valued at a staggering $35 million. He recently went on a property purchasing spree because he believes prises are going to boom.

“I bought $10 million worth of property in January, and I’m buying as much as I can because I know if interest rates go down, there’s going to be more people jumping into the market,” he said.

“The more there’s a fear of recession, the more likely interest rates are going to go down.”

MORE: Huge prediction for Aussie house prices

Mr Walsh believes the market is perfectly positioned for a boom because Australia has seen a fair amount of immigration in the last few years, which has increased demand. He also noted there has been less property being built because of inflation.

“We have an under supply in properties and there could be a big boom,” he said.

The 34-year-old property expert has already seen the “crazy” difference in the market since the interest rate cut in March.

“One interest rate drop has shown such a positive sign in the property. It is crazy stuff because houses are selling within a week,” he said.

MORE: Where the population has boomed most and why

Mr Walsh said a house in southeast Melbourne recently received 26 offers. Eight months ago, “no one would have touched” that property and, now, people are fighting over it.

“If you have the ability to get into the market, do it. You’re not going to get a property cheaper in 12 months,” he said.

“If interest rates go down you’ll just end up paying more for the same property.”

Mr Walsh said his advice to anyone who already owns is to “hold onto” their properties, and anyone who can afford to pull equity out of their home to buy another should seriously consider it.

“It is what I’ve been doing,” he said.

Property expert Sam Gordon, who owns Australian Property Scout, also believes that interest rates are going to come down.

“The more interest rates come down the more affordability comes back into the market. The more rates come down the more people can service a mortgage,” he said.

Mr Gordon, also 34, believes certain areas are about to “surge”, saying major cities will see a small uplift, but regional areas could boom.

The property expert also claimed he has seen an “uplift” in the market since the rate cut in March.

“I think it is always time to buy if you’re able to buy, but I think people that have been sitting on the sidelines waiting to buy, now is the time,” he said.

“If you’ve got the ability to buy you should buy. Get it now before rates start coming down drastically.”

Mr Gordon is following his own advice. He previously owned 108 properties and has already purchased 14 more in 2025.

“If we see a bigger cut, it is going to inject confidence into the market. I’ve had a very active three to six months and I’ve been buying commercial and residential properties,” he said.

The property investor now has 122 properties in his portfolio and he said he keeps buying because he is in the game and gets more opportunities.

“I’ve got no intention of stopping,” he said.

While Mr Gordon doesn’t think we will see a surge like we did during the pandemic where “everything went up”, he thinks Aussies still need to brace for a smaller boom, and he certainly wants to benefit from it.