Peter Dutton vows to make mortgage repayments tax deductible

These are the Aussies that will be eligible to tax deduct their mortgage repayments under Peter Dutton’s bold new plan - but not everyone is impressed.

First home buyers earning under $175,000 will be eligible for Peter Dutton’s new mortgage tax deduction scheme.

As the major parties go head to head with new policies to tackle the housing crisis the Liberals are expected to announce the policy at the campaign launch in Western Sydney on Sunday.

The tax break scheme will also be means-tested at $175,000 income for singles and $250,000 for couples.

The “first home buyers mortgage deduction scheme” will be limited to the first five years and the first $650,000 of a mortgage.

The deductions will be capped at $650,000.

That means you can have a larger mortgage but not claim a deduction beyond that threshold.

The Coalition will pledge that for families on average incomes you could be up to $11,000 a year better off — or $55,000 over five years.

The move comes as the Albanese Government pledges to extend the 5 per cent deposit scheme to every first homebuyer in Australia.

Every first homebuyer in Australia will secure access to a 5 per cent deposit scheme if the Albanese Government is re-elected allowing them to get into the market with a smaller downpayment.

The Prime Minister will announce the huge move on Sunday in a bid to tackle the housing crisis once and for all and make it easier for younger Australians to buy their first home.

But the new polices have been savaged by economist Chris Richardson as “dumb and dumb”.

“The Coalition is promising a tax cut for a year and the ability to deduct mortgage payments for first homebuyers, while Labor will subsidise first homeowners to be able to buy with just a 5% deposit,” he said.

“That’s two different dumbs, both released today.

“The one-off handing of money to the public to “help with the cost of living” has been massively used by the current government – think electricity rebates.

“And the opposition is set to do the same with its one off fuel tax cuts and tax rebates.

“Except none of those policies – from either side – actually helps.

“Inflation is caused by too much money chasing to little stuff. So when politicians give us extra money, that makes the fight against inflation harder and slower than it’d otherwise be.

“Yet we’ve conditioned the Australian public to believe in this Magic Pudding stuff, rather than focusing on reforms that can help lift productivity – meaning we are simply reallocating shares of the pie, rather than growing it.

“And making it easier for first homebuyers to buy is the go to policy of governments who are avoiding doing the hard yards. The same equation applies: Australian housing suffers from too much money chasing too few homes, so adding to the extra money going in results in ever higher prices.

“Ditto the opposition’s plan to allow first-time buyers of newly built homes to be able to deduct mortgage payments from income taxes.

“More money chasing the same amount of housing is the most well worn path to failure in Australian policymaking, and both the government and the opposition seem intent on proving that they can double down on that dumbness yet again.

“The campaigns of both major parties are a dumpster fire of dumb stuff. Meantime, the world is on fire, and we here in Australia need smart policies way more than we need smart politics.”

News.com.au can reveal that, when Mr Albanese announces the 5 per cent deposit scheme on Sunday, there will also be higher property price limits to access the offer and no caps on places or income, in a major expansion of the existing scheme.

Under the new scheme, a Sydneysider and first homebuyer will be able to purchase a $1 million apartment with a $50,000 deposit as long as the bank determines they can service the loan.

A Queenslander and first homebuyer will be able to purchase an $850,000 home with a $42,500 deposit.

Mr Albanese will also unveil the Albanese Labor Government’s commitment of $10 billion to build up to 100,000 homes which will only be for sale to first home buyers.

The huge move is not means tested and is designed to help young couples and singles who have a good incomes but are locked out due the size of the deposit required

“I want to help young people and first home buyers achieve the dream of home ownership,’’ Mr Albanese told news.com.au.

“When a young person saves a 5 per cent deposit, my government will guarantee the rest with their bank.

“This will help people buy their first home faster, without paying the burden of Lenders Mortgage Insurance.

“We will also invest $10 billion to build 100,000 homes to be set aside and kept affordable for first home buyers.

“We have a plan to get more Australians into their own homes – this is in stark contrast to Peter Dutton who wants to cut billions from housing.”

How the current scheme works

The Albanese Government’s First Home Guarantee (FHBG) already allows eligible first home buyers to purchase a home with a deposit of as little as 5 per cent without needing to pay Lender’s Mortgage Insurance (LMI).

This is because the guarantee provided by the Australian Government covers up to 15 per cent of the loan value.

However, to be eligible to access the existing scheme you need to be earning under $125,000 for individuals or $200,000 for joint applicants.

How the new scheme will work

If re-elected, the Prime Minister will pledge on Sunday to extend this to all first home buyers to give them a chance to access the 5 per cent deposit scheme.

The Albanese Government will guarantee a portion of a first homebuyer’s home loan, so they can buy a home with a 5 per cent deposit and not pay Lenders Mortgage Insurance.

“Labor is backing in first home buyers. We will build 100,000 homes, just for them. And back in a generation of young people to get into home ownership with just a 5 per cent deposit,’’ Housing Minister Clare O’Neill said.

“Young Australians are bearing the brunt of the housing crisis, and our government is going to step up to give them a fair go at owning their own home.

“We want to help young Australians pay off their own mortgage, not someone else’s.”

Ms O’Neil said to build up to 100,000 homes for first home buyers, Labor will work with states and industry partners to identify suitable projects, including use of government land that is vacant or underutilised.

To get projects moving quickly, States and Territories will fast-track land release, upzoning and planning approvals.

New homes just for first homebuyers

The $10 billion investment will be made up of $2 billion in grants and $8 billion in zero-interest loans or equity investments primarily to States and Territories. States and Territories will be required to match the $2 billion Federal Government grant contribution.

Construction on the first projects will start in 2026-27, with buyers moving in from 2027-28.

What about the help to buy scheme?

The help to buy program is a separate scheme offering shared equity loans to low and middle income families.

Under the Help to Buy program, the federal government makes an “equity contribution” of up to 40 per cent of the cost of a new home or 30 per cent of existing homes.

That means you only need to take out a mortgage for 60 to 70 per cent of the property and as a result you have much lower interest rate payments.

Eligible families and single parents can now slash up to $500,000 from their mortgage for a new home under a pre-election expansion previously announced.

The Help to Buy scheme’s eligibility income caps will be lifted from $90,000 to $100,000 for individuals and from $120,000 to $160,000 for joint applicants and single parents.

Buyers still need to pay a mortgage for their share of the property but won’t need to pay rent on the stake owned by the government. The government will retain the stake until you sell or buy the government out.

Single parents earning up to $160,000 will now be eligible for the scheme for the first time, and the value of the house you can buy will rise to $1.3 million in Sydney. When you factor in a 40 per cent equity stake that means you would need to cover a mortgage of $800,000 – or less depending on your deposit – to buy the home.

For example in Hobart, you could buy a house worth $700,000 with the government taking a 40 per cent equity stake worth $280,000. Your mortgage after you paid a deposit would be closer to $400,000, not $700,000.

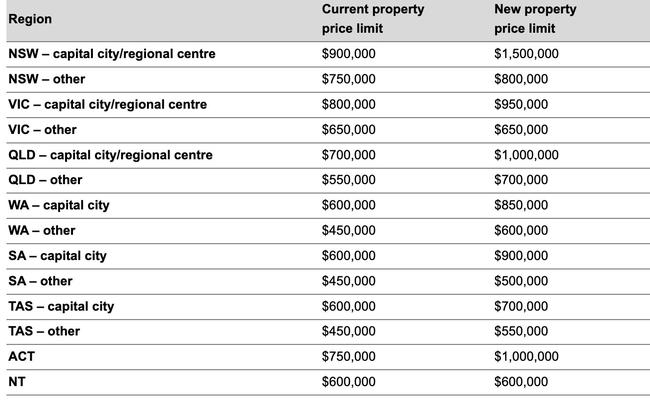

Different price caps exist for homes in each state with families in Melbourne able to buy apartments and homes up to the value of $950,000 in Melbourne, up to $1 million in Brisbane and up to $900,000 in Adelaide.

The new changes to Help to Buy

Under the changes the Prime Minister announced earlier this year, those caps will be lifted to take into consideration inflation.

The Help to Buy scheme by increasing income caps will be lifted from $90,000 to $100,000 for individuals and from $120,000 to $160,000 for joint applicants and single parents.

Property price caps will also be increased and linked with the average house price in each state and territory, not dwelling price, so first-home buyers have more choice.

“We’re tackling the housing crisis head-on by building more homes, using new technologies, and making it easier for Australians to buy them,’’ Housing Minister Clare O’Neil told news.com.au.

“This budget lifts our commitments in housing to $33 billion, and there’s more to come.”

But the big investment comes with a serious price tag. To support the expansion, the government will increase its equity investment in the Help to Buy program from $5.5 billion to $6.3 billion – an $800 million increase.

Who is eligible for Help to Buy?

If you’re interested in the Help to Buy scheme there’s a couple of criteria you need to fit.

Firstly, you need a deposit. The scheme will allow eligible homebuyers to buy property with a 2 per cent deposit, with the government acting as a ‘buying partner’ for a 30-40 per cent equity stake.

Because of the shared equity component, you won’t be paying lender’s mortgage insurance (LMI) on your home loan under the scheme. In practice, this would allow eligible buyers to buy a $600,000 house with a deposit of as little as $12,000, excluding other buying costs.

The Federal government will retain ownership of 30-40 per cent of your property until you either sell it or buy back some equity later on. The government will recover its initial investment when you sell the property or buy back its equity.

In order to be eligible you must:

– Be an Australian citizen and at least 18 years of age

– Have an annual taxable income of less than $100,000 for individuals and $160,000 for couples (you may be asked to provide a Notice of Assessment from the ATO)

– Be buying a home valued below the price cap in your area

– Live in the purchased home (i.e. it cannot be used as an investment property)

– Not own any other land or property in Australia or overseas when you apply.