How to slash up to $500,000 off your mortgage

Homebuyers will be able to earn more and borrow more under Labor’s pre-election pitch for housing affordability.

Eligible families and single parents can now slash up to $500,000 from their mortgage for a new home under a pre-election expansion of Labor’s shared equity housing affordability scheme.

It’s one of the biggest issues in the federal election and now in a bid to woo people trying to enter the housing market the Albanese Government is set to lift the income and property price caps for a shared equity scheme known as Help to Buy.

News.com.au can reveal that the Help to Buy scheme’s eligibility income caps will be lifted from $90,000 to $100,000 for individuals and from $120,000 to $160,000 for joint applicants and single parents.

Under the Help to Buy program, the federal government makes an “equity contribution” of up to 40 per cent of the cost of a new home or 30 per cent of existing homes.

That means you only need to take out a mortgage for 60 to 70 per cent of the property and as a result you have much lower interest rate payments.

Buyers still need to pay a mortgage for their share of the property but won’t need to pay rent on the stake owned by the government. The government will retain the stake until you sell or buy the government out.

The changes announced on Friday night mean that single parents earning up to $160,000 will now be eligible for the scheme for the first time, and the value of the house you can buy will rise to $1.3 million in Sydney. When you factor in a 40 per cent equity stake that means you would need to cover a mortgage of $800,000 – or less depending on your deposit – to buy the home.

For example in Hobart, you could buy a house worth $700,000 with the government taking a 40 per cent equity stake worth $280,000. Your mortgage after you paid a deposit would be closer to $400,000, not $700,000.

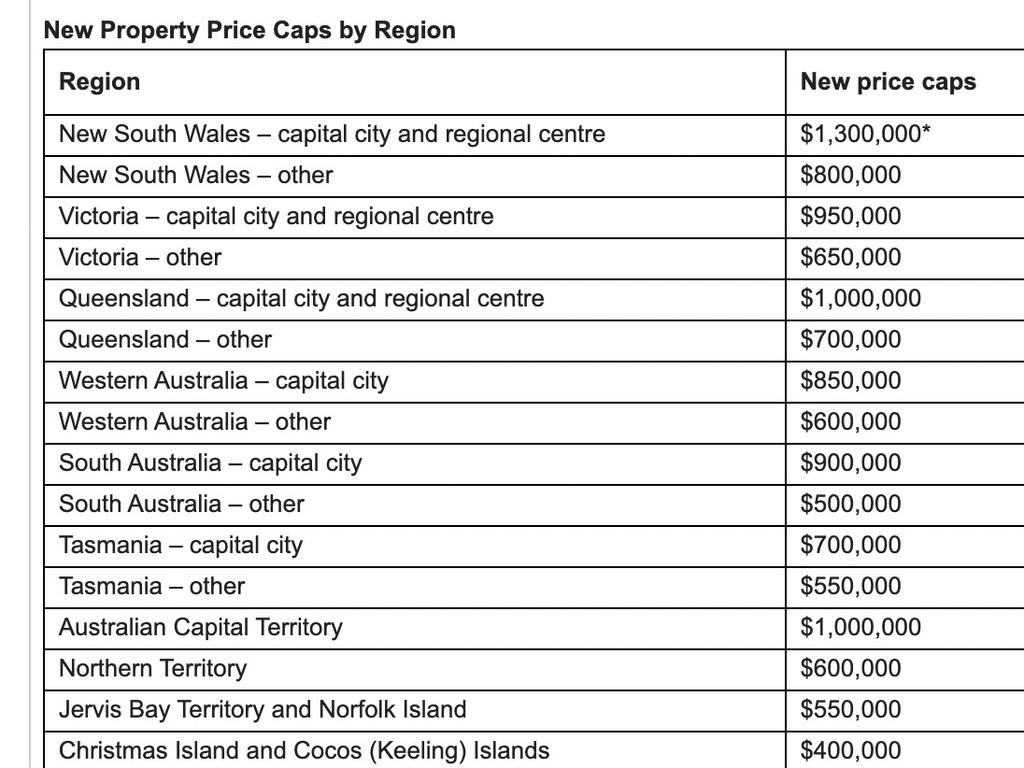

Different price caps exist for homes in each state with families in Melbourne able to buy apartments and homes up to the value of $950,000 in Melbourne, up to $1 million in Brisbane and up to $900,000 in Adelaide.

The new changes to Help to Buy

Under the changes the Prime Minister announced on Friday night, those caps will be lifted to take into consideration inflation.

The Help to Buy scheme by increasing income caps will be lifted from $90,000 to $100,000 for individuals and from $120,000 to $160,000 for joint applicants and single parents.

Property price caps will also be increased and linked with the average house price in each state and territory, not dwelling price, so first-home buyers have more choice.

“We’re tackling the housing crisis head-on by building more homes, using new technologies, and making it easier for Australians to buy them,’’ Housing Minister Clare O’Neil told news.com.au.

“This budget lifts our commitments in housing to $33 billion, and there’s more to come.”

“We’ve got a big goal to build 1.2 million new homes in 5 years and to reach that we need to build homes in new ways – using methods like prefab we can build homes up to 50 per cent faster.

“I’ve got a pretty straightforward goal here – to make sure that ordinary, working class Australians can buy a home of their own. That’s why we’re expanding Help to Buy so that most first home buyers are eligible.

“Peter Dutton has committed to cutting $19 billion from housing and 110,000 homes if he’s elected. We can’t wind the clock back and repeat the decade of inaction seen under the Coalition.”

But the big investment comes with a serious price tag. To support the expansion, the government will increase its equity investment in the Help to Buy program from $5.5 billion to $6.3 billion – an $800 million increase.

Who is eligible for Help to Buy?

If you’re interested in the Help to Buy scheme there’s a couple of criteria you need to fit.

Firstly, you need a deposit. The scheme will allow eligible homebuyers to buy property with a 2 per cent deposit, with the government acting as a ‘buying partner’ for a 30-40 per cent equity stake.

Because of the shared equity component, you won’t be paying lender’s mortgage insurance (LMI) on your home loan under the scheme. In practice, this would allow eligible buyers to buy a $600,000 house with a deposit of as little as $12,000, excluding other buying costs.

The Federal government will retain ownership of 30-40 per cent of your property until you either sell it or buy back some equity later on. The government will recover its initial investment when you sell the property or buy back its equity.

In order to be eligible you must:

– Be an Australian citizen and at least 18 years of age

– Have an annual taxable income of less than $100,000 for individuals and $160,000 for couples (you may be asked to provide a Notice of Assessment from the ATO)

– Be buying a home valued below the price cap in your area

– Live in the purchased home (i.e. it cannot be used as an investment property)

– Not own any other land or property in Australia or overseas when you apply.

Big injection for modular houses

The Albanese Government will also devote $49.3 million into supporting state and territory governments to supercharge prefabricated and modular home construction.

Prefabricated and modular homes can be built up to 50 per cent faster than traditionally built homes. This investment supports progress toward the government’s national target of building 1.2 million homes in the next five years.

“We need to build more quality homes quickly – and help make great manufacturing jobs along the way,’’ Labor frontbencher Ed Husic said.

“Making a house in a factory instead of onsite can cut construction time in half.

“For the first time, manufacturers and home-owners will have a national certification process to cut the red tape that has been holding back use of these techniques.

“And they will see federal and state governments working together to invest in growing our capability to make factory-built quality homes

“That will help create a steady and predictable pipeline of demand for the industry, boosting investment in the plants and skills we need to grow those capabilities.”

More Coverage

The Albanese Government estimates that more than 5 million properties in Australia will fall under the new property price caps.

According to Labor, around 150,000 Australians have been helped to buy a home with lower deposits under the scheme that was originally proposed by the Coalition.

Help to Buy will be open for applications later this year, following registration of the Program Directions, passage of state legislation, and implementation by Housing Australia.