‘Way, way worse’: America’s $13 trillion investment fail exposed

It looks like the United States has spectacularly shot itself in the foot, missing out on trillions while Australians have the last laugh.

ANALYSIS

Has America missed out on $US13 trillion through sheer stupidity?

That’s the argument being made by David Friedberg, an American entrepreneur.

Mr Friedberg argues America has shot itself in the foot repeatedly over the last six decades by making an incredibly dumb decision.

The country with the biggest, strongest economy and the most impressive stock market in the world has taken trillions of dollars and invested them in boring old bonds.

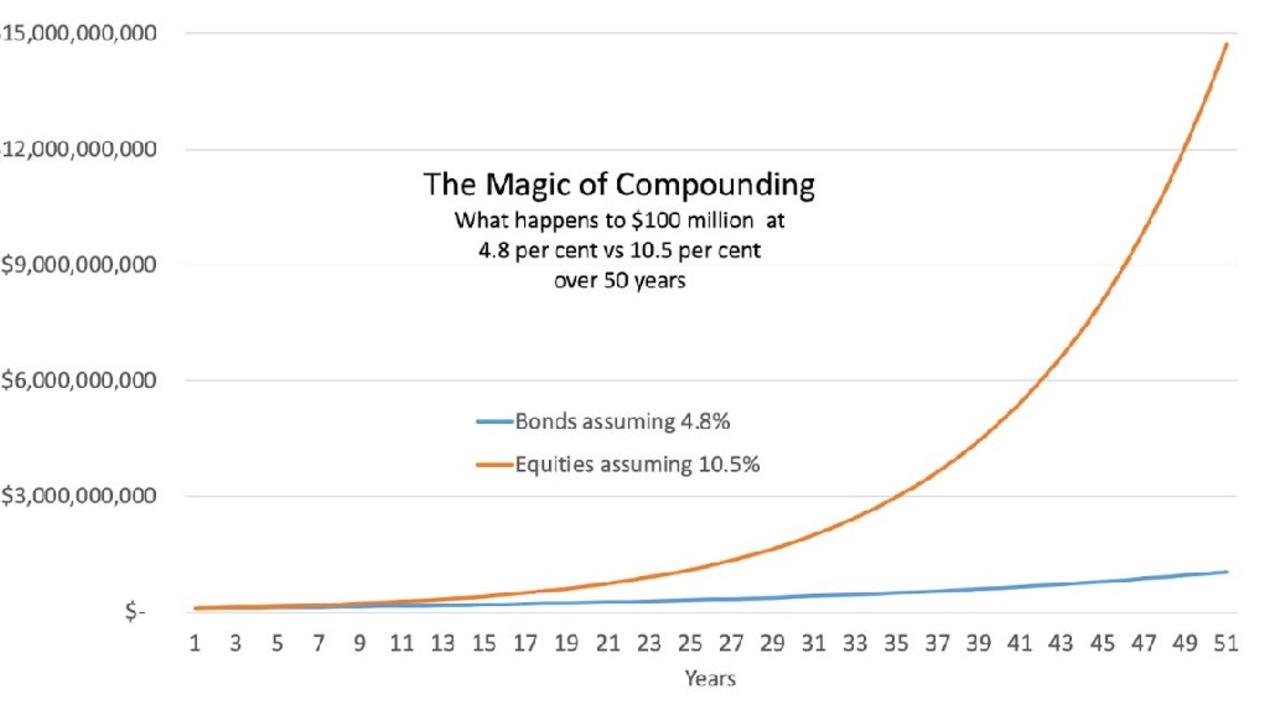

That has led to returns that are way, way worse than if those trillions were invested in stocks, as the next chart illustrates.

Mr Friedberg is worried about Social Security, which is the big American retirement fund.

It has about $US2.5 trillion ($A4 trillion).

The name of the fund that does the investing is the Old Age and Survivors Insurance Trust Fund (OASI).

“Since 1941 OASI has ONLY invested in US treasuries, averaging an annual return of just 4.8 per cent. Meanwhile the S&P500 has been compounding returns at 10.5 per cent per year,” writes Mr Friedberg on X.

“If instead of buying treasuries OASI bought the S&P500 index starting in 1971 … it would have a $15.1T balance today and Americans would share ownership of ~1/3 of America’s best companies.”

Mr Friedberg is the CEO of a company called Ohalo that is involved in … *cleans glasses* … breeding potatoes … so you might question his capacity to make judgments on weighty financial matters.

Except for one thing.

What he is suggesting is exactly what Australia has been doing for ages.

Our superannuation is not stuck in boring old bonds. Far from it.

Our super is invested all over the place.

Not just Australian sharemarket staples like the Commonwealth Bank and Wesfarmers, but also foreign stocks.

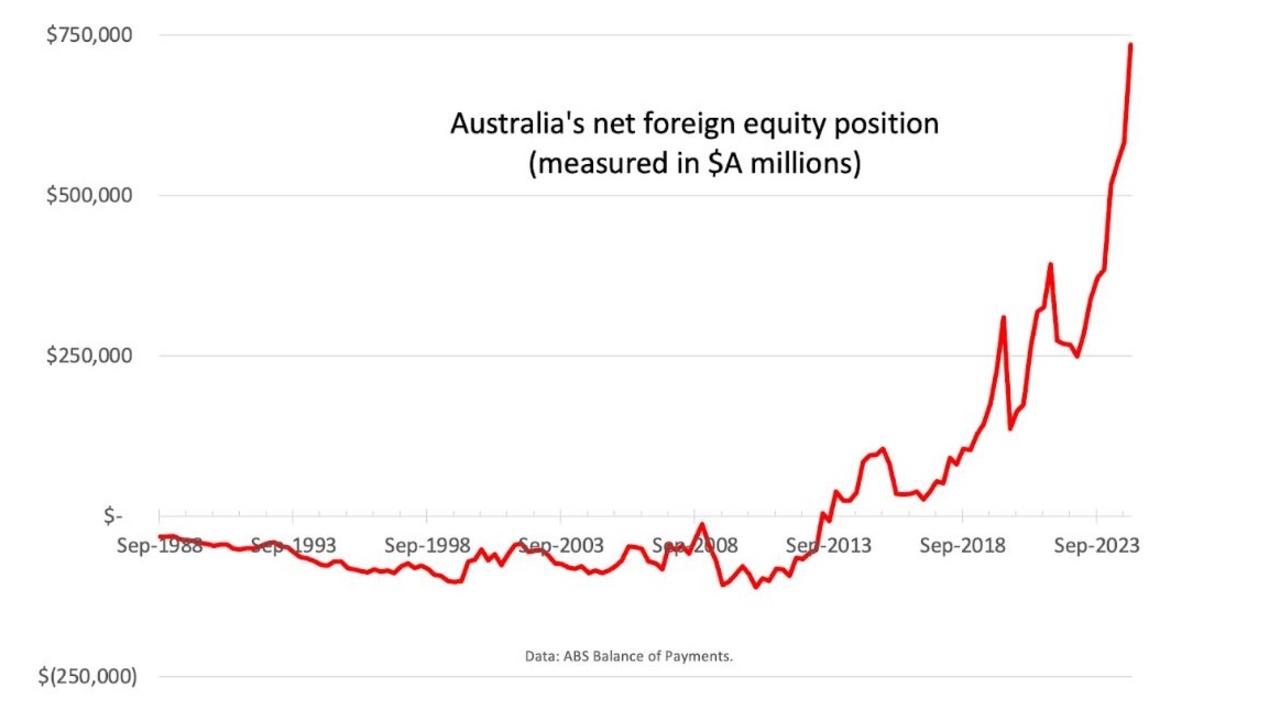

Aussie shares are now less than a quarter of what superannuation funds own.

In fact, they own more foreign shares than Australian shares.

Indeed, Australian superannuation funds own more American stocks than the US Social Security funds do.

We’ve invested so much money into our super – a whopping $4.1 trillion – that we just own a lot of … everything.

We actually have way too much wealth to just own Australian assets.

Some Australians still worry about foreign ownership of our assets, but newsflash – these days, the foreigners should be worrying about us.

Aussies own more of the outside world than they do of us.

Our super is invested in American toll roads and Canadian airlines and French factories, weird currency swaps, a building in the lobbyist district of Washington DC, and millions more things besides.

Overall, Australians have a finger in every pie. (Your personal super may not include these assets, it depends what fund and option you chose.But note – currency fluctuations affect the Australian dollar value of our foreign holdings, so when our dollar falls, the value of our foreign investments rise).

And that’s one reason why our super balances have got so insanely big.

Inflows are huge, sure. But so are returns.

We are highly diversified and we make a killing.

The returns on superannuation last year were a healthy 9.1 per cent and we’ve averaged 7.3 per cent returns over the last 30 years.

And that’s just super.

We also have the Future Fund.

That is a pot of money the government maintains to help fund our future pensions.

You might expect the Future Fund to be more nervous than the superannuation funds, which have to actually compete for members.

You might expect it to be conservative, like the US Social Security system.

Yeah, nah.

It made a 12.2 per cent return last year after blazing away on foreign shares.

That added a lazy $26 billion to its pile of assets.

But here’s an interesting thing.

The government is trying to rein in the Future Fund, getting it to invest not only for the best returns, but also to consider Australia’s national priorities.

Which sounds like a nice idea. Except for one thing: what if you don’t really love the priorities of the current government?

Which brings us neatly back to America and their big pot of Social Security money.

As mentioned, it is all safely invested in US government bonds.

But what happens if that limitation is … removed?

10% of social security needs to be invested into Bitcoin

— David Bailey🇵🇷 $0.85mm/btc is the floor (@DavidFBailey) March 14, 2025

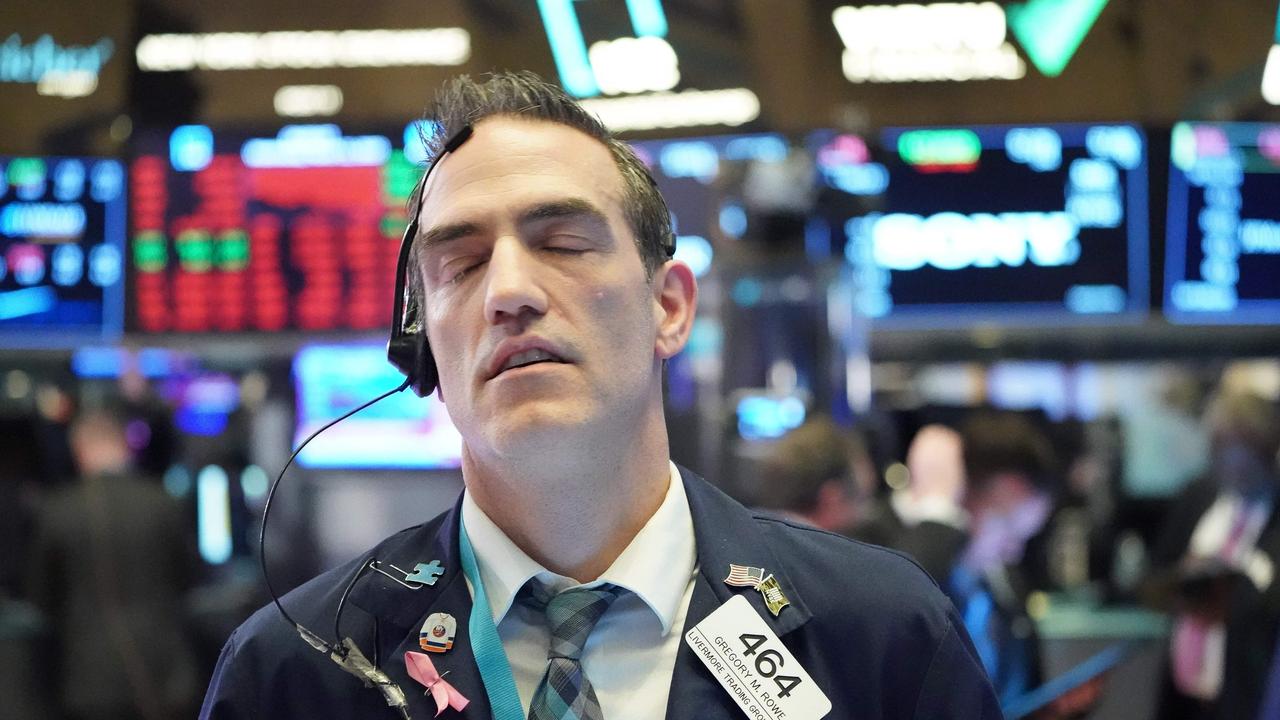

Under the current administration, with its enthusiasm for moving fast and breaking things, the Social Security fund could suddenly look like a big pot of money to be raided and spent on “bright” ideas.

The only thing worse than shooting yourself in the foot repeatedly by investing too conservatively is blowing your whole leg off by investing too boldly.

One big reason America’s Social Security is invested in bonds and not stocks is because it was set up shortly after the big stock market crash of the 1920s.

That made its founders very cautious.

There are times in history where caution is extremely valuable.

It’s possible this is one of them.

Jason Murphy is an economist | @jasemurphy.bsky.social. He is the author of the book Incentivology