Aussies cities bucking home price trend

Property prices in Australia are falling for the first time since before the pandemic but a few capital cities are bucking the trend.

Australian property prices fell for the first time since the start of the pandemic but some cities are bucking the trend.

Across the country, home prices (including houses and units) fell in May, down 0.11 per cent month-on-month, according to the PropTrack Home Price Index, as homeowners saw their first interest rate rise in more than a decade.

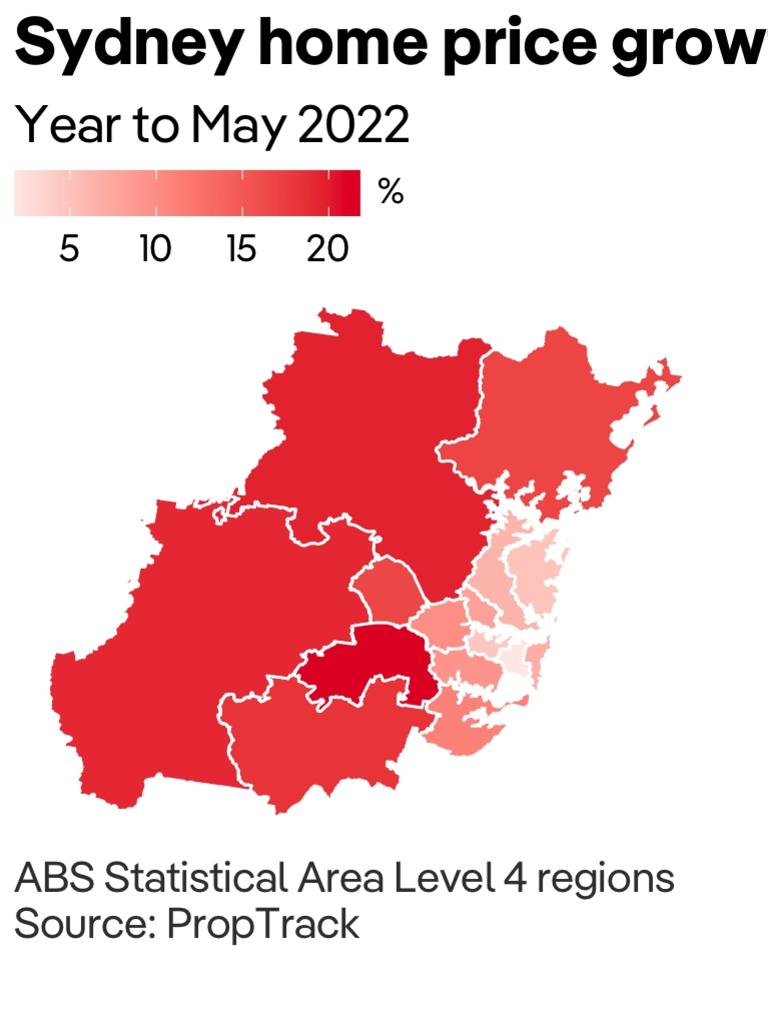

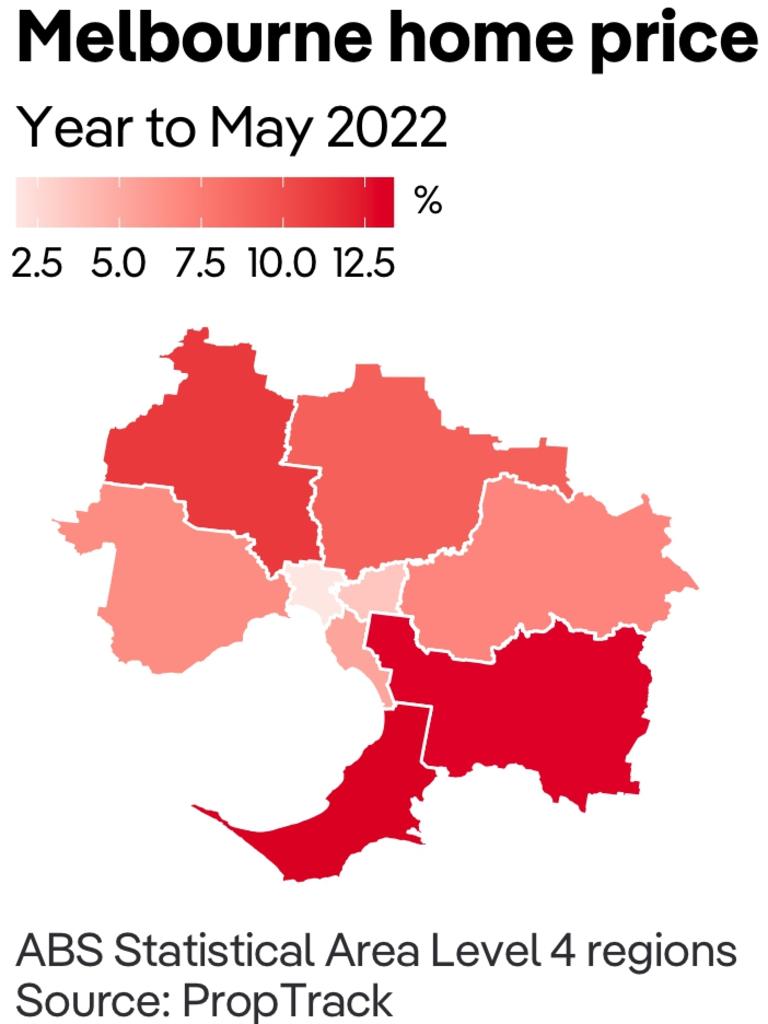

Overall the biggest fall in prices was in Sydney, which was down 0.29 per cent, followed by Melbourne -(0.27 per cent), the Australian Capital Territory (-0.12 per cent) and Hobart (-0.05 per cent). It was the first time in three years that prices in the ACT fell.

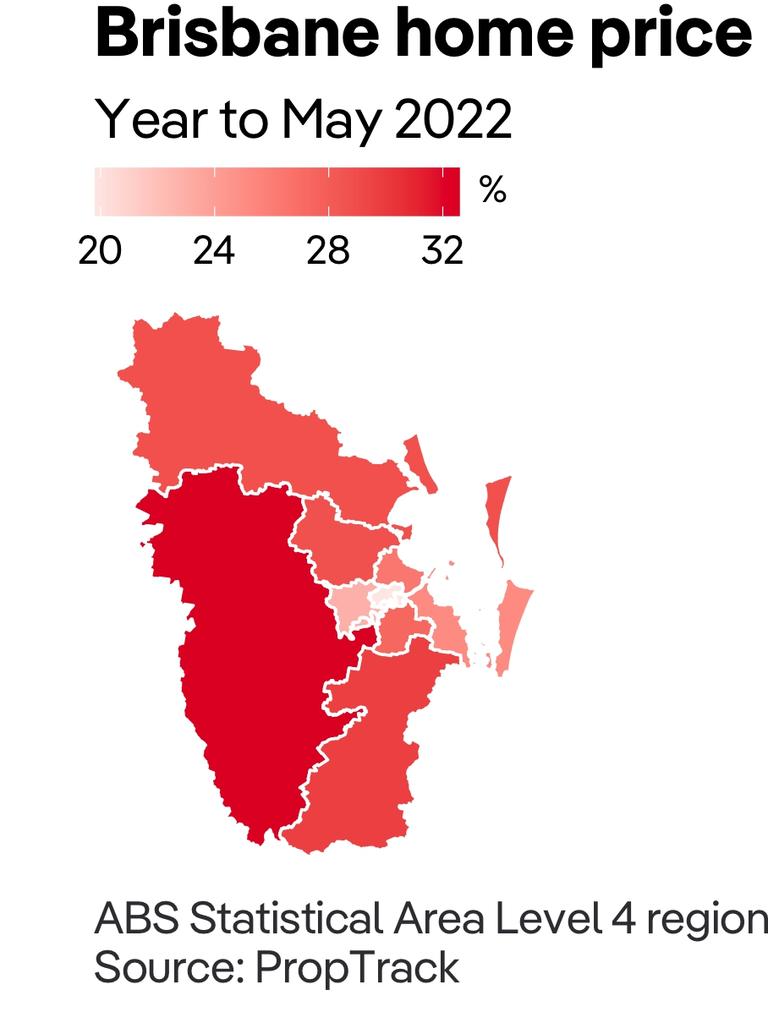

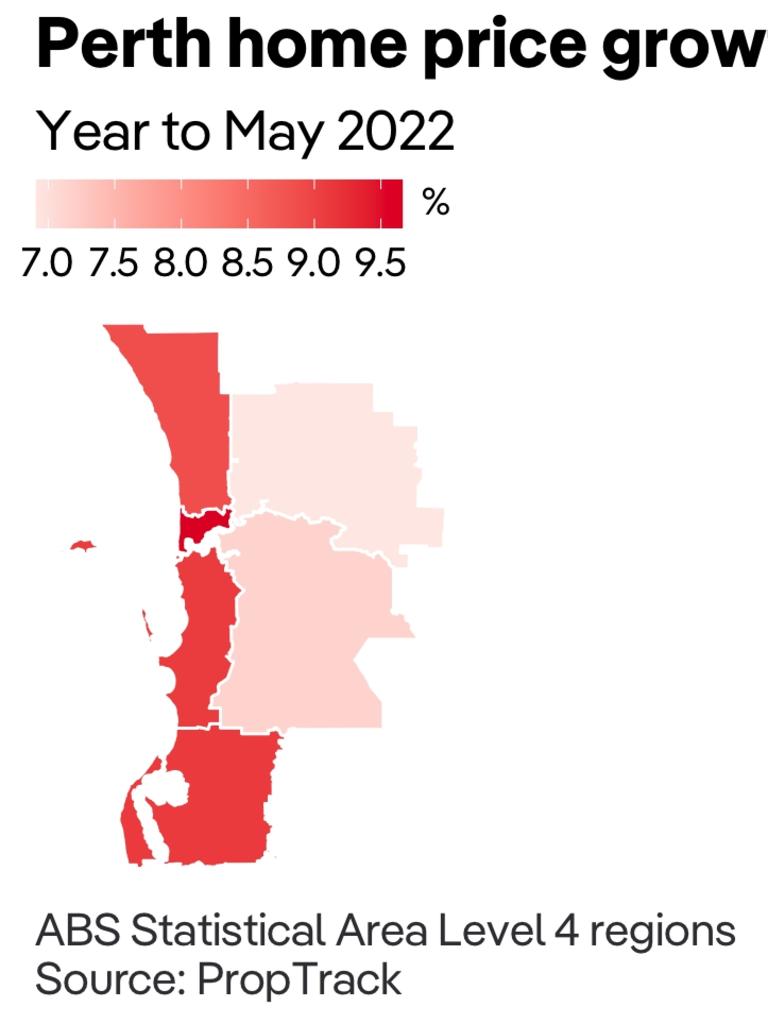

But other capitals continued to record growth with Adelaide prices increasing by 0.58 per cent, followed by Brisbane (0.35 per cent), Perth (0.19 per cent) and Darwin (0.05 per cent).

Data for the year to May 2022 also shows the picture can vary depending on the suburb and whether people are looking for houses or units.

In Adelaide for example, the highest price growth in the past year has been for houses located in the inner north-eastern suburb of Manningham, which increased in price by 63 per cent. Just a few kilometres away, units in the nearby suburb of Walkerville saw the biggest declines, falling in price by 27 per cent.

In comparison, house price growth in the Sydney suburb of Bundeena, an oceanfront area in the city’s southern outskirts, also grew by a massive 60 per cent, and price drops for units were more modest with Milsons Point in the lower North Shore, showing the biggest dip of 21 per cent.

Stream more property news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

Regional areas also continued to see growth in May compared to the slowing conditions experienced in the rest of the country.

Regional Tasmania (0.47 per cent), regional South Australia (0.34 per cent), regional Northern Territory (0.20 per cent) and regional New South Wales (0.24 per cent) were the strongest performing regional areas in May.

PropTrack economist and report author Paul Ryan said it was clear a two-speed housing market had emerged.

“Affordable, lifestyle regions of Brisbane, Adelaide, regional NSW and Tasmania continue to see solid growth, with flat or falling prices elsewhere,” he said.

He said the May housing market activity was disrupted by the federal election but price growth had been slowing for some time.

“Annual price growth has fallen from 24 per cent only six months ago to 14 per cent now.”

It comes after Sydney prices also fell slightly in April, down 0.10 per cent – which was its first fall since early in the pandemic. Prices in Hobart also fell for the first time since early 2018, down 0.44 per cent. April home prices grew just 0.13 per cent nationally.

“Conditions have now shifted rapidly from 2021,” Mr Ryan said.

“This follows expectations of sharply higher interest rates in 2022, which will erode the affordability of existing prices.

“The speed of official interest rate hikes and wages growth remain the key unknowns for price growth moving forward.”

Two of Australia’s major banks have also tightened their lending standards after raising interest rates in line with the Reserve Bank of Australia’s decision to increase the cash rate by 0.25 percentage points in May, making it even harder for homebuyers to get a loan.

While interest rate rises will likely help bring house prices down, they also lower the amount of money people can borrow, and the gap between the two may not be as beneficial to buyers as first hoped.

Overall people could see their borrowing capacity reduced by almost 18 per cent if interest rates rose by 2 per cent, which means property prices would need to drop by more than this amount to leave them better off.

Experts are predicting substantial house price drops of anywhere between 5 per cent and 15 per cent, but these falls would not be enough to compensate for the reduced borrowing capacity.

Originally published as Aussies cities bucking home price trend