Italy’s Prada agrees to buy rival Versace for $2.2 billion

The acquisition will create a luxury group with revenues of more than $10 billion.

Italian fashion house Prada announced Thursday it had reached a deal with US group Capri Holdings to buy its flashy rival Versace for 1.25 billion euros (AUD$2.2 billion).

The acquisition will create a luxury group with revenues of over six billion euros (AUD$10 billion) that could better compete with industry giants such as the French conglomerates LVMH and Gucci owner Kering, amid a slowdown in the sector worldwide.

“We are delighted to welcome Versace to the Prada Group and to build a new chapter for a brand with which we share a strong commitment to creativity, craftsmanship and heritage,” Prada group chairman and executive director Patrizio Bertelli said in a statement.

In 2018, Capri paid 1.83 billion euros (then AUD$3.2 billion) to acquire Versace, which was previously owned 80 per cent by the Versace family and 20 per cent by the US investment fund BlackRock.

Amid declining sales at the Milan-based label, it put Versace up for sale, and began exclusive negotiations with Prada at the end of February.

Capri, which also owns Jimmy Choo and Michael Kors, had to accept a reduced price from Prada amid the market turmoil caused by US President Donald Trump’s tariffs.

The Financial Times reported that the price was initially expected to be about $1.6 billion but had been negotiated downwards in recent days.

Last month, Donatella Versace stepped down as creative director after more than 30 years, a move widely seen as a prelude to the accord.

She took over in 1997 following the murder of her older brother Gianni, who founded the label in 1978.

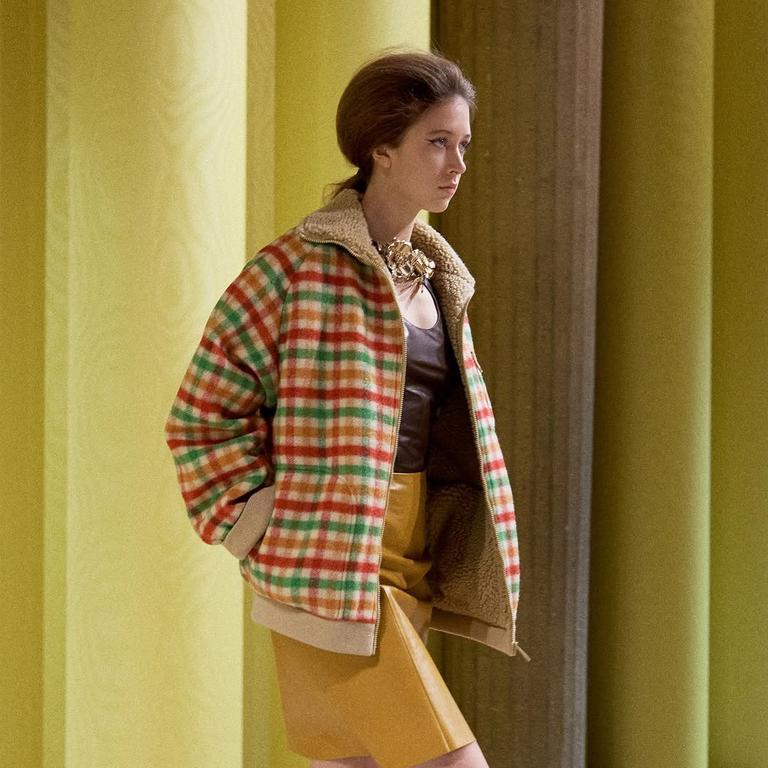

But on April 1 she was replaced as creative director by Dario Vitale, who has overseen soaring sales at Miu Miu, Prada’s sister brand targeting a younger clientele.

Donatella Versace, who turns 70 in May, is now the label’s chief brand ambassador.

Long journey

While still a label associated with the jet set, some of Versace’s lustre has waned in recent years.

It posted AUD$309 million in revenue in its fiscal 2025 third quarter, down 15 per cent.

By contrast, Prada, under the creative helm of Miuccia Prada, the 76-year-old granddaughter of group founder Mario, is in robust health.

Despite the global slowdown in sales of luxury goods, Prada’s net profit jumped 25 per cent to 839 million euros in 2024, with revenues up 15 per cent to 5.4 billion euros.

Andrea Guerra, Prada’s group chief executive officer, said on Thursday that Versace had “huge potential” but warned there was work to do.

“The journey will be long and will require disciplined execution and patience. The evolution of a brand always needs time and constant focus,” he said.

The deal, funded through 1.5 billion euros of new debt, is expected to close in the second half of 2025.

‘Complementary addition’

The two fashion labels have starkly different styles, with Versace’s exuberance contrasting with Prada’s sophisticated minimalism.

Prada said its new acquisition “constitutes a strongly complementary addition” to its portfolio.

It said Versace will “maintain its creative DNA and cultural authenticity”, while benefiting from Prada’s “industrial capabilities, retail execution and operational expertise”.

The deal bucks the trend of recent years, which has seen major names in Italian fashion such as Gucci, Fendi, and Bottega Veneta fall under the control of their French competitors.

“Prada will be able to bring light back into a brand that was dying and infuse it with new life,” Antonio Bandini Conti, a design consultant, told AFP.

However, a previous attempt to expand the Prada portfolio - which also includes luxury footwear brands Car Shoe and Church’s - offers a cautionary tale.

In 1999, the family group acquired the German brand Jil Sander and the Austrian label Helmut Lang before selling them in 2006 as they were weighing down its financial results.

In 2000, Prada jointly acquired a 51 per cent stake in the Roman label Fendi with LVMH, but sold its 25.5 per cent stake to the French luxury giant a year later.

With the Versace acquisition, “I see a risk for Prada to become distracted from its core business,” Luca Solca, an analyst at Bernstein, told AFP.

- With AFP