Young Aussie reveals how she paid off her HECS debt

A young Aussie has revealed the amount of HECs she owed and why she was desperate to get rid of it.

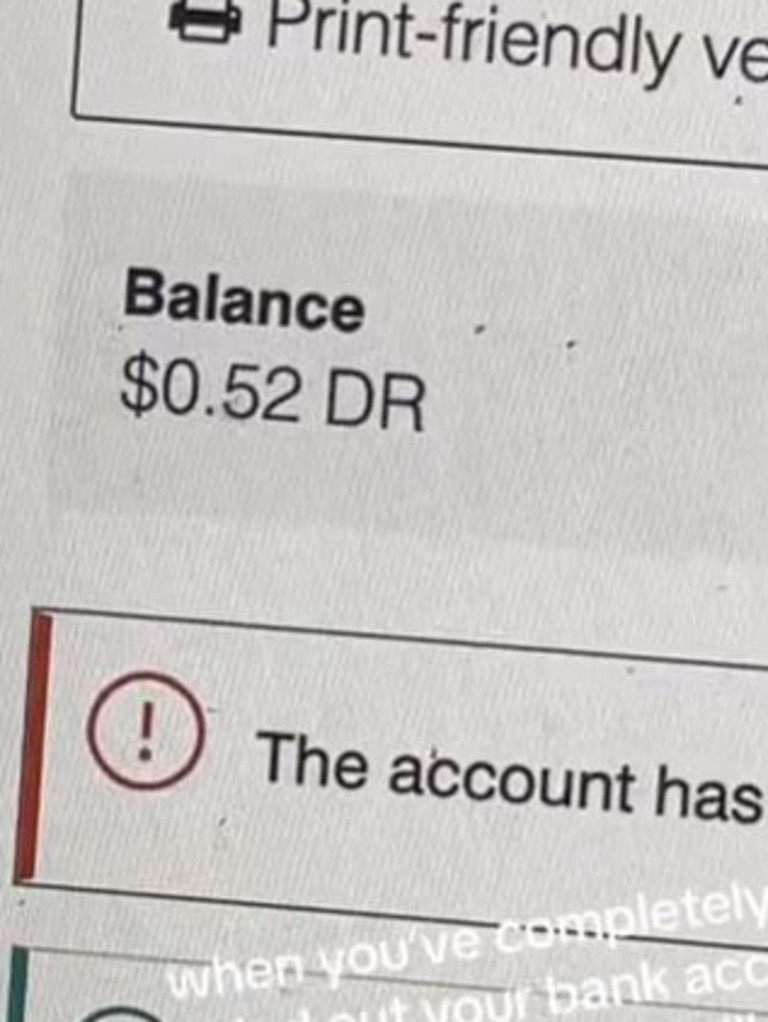

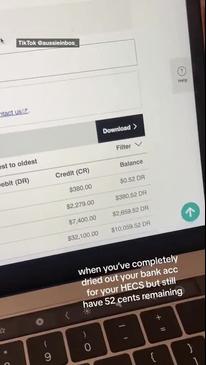

Alex Pantos has just wiped out her HECS debt of $43,000 in one big swoop, but her bank account has “dried out” because of it.

HECS-HELP debt used to be seen as the best kind of debt anyone could have. It is a loan from the Australian Government that you can use to pay your university fees.

It doesn’t accrue interest, but rather is indexed based on inflation, and you can pay it off slowly over time.

But since inflation has started to rise and people’s loans have been hit hard by indexation, suddenly, the HECS debt is no longer seen as harmless.

Almost 3 million Aussies currently saddled with HECS debt saw their loans increase by a significant 4.7 per cent in June 2024.

Last year, those with student loans saw their debts rise by a whopping 7.1 per cent – the biggest jump seen in 30 years.

Plenty of young Aussies have shared their horror at seeing their debts rise online. Not wanting to be one of them, Ms Pantos decided she had the means to eliminate her debt and didn’t want to live worrying about it growing.

“It is such a great feeling to be debt free at 23,” she told news.com.au.

Ms Pantos, 23, lives in Melbourne and has a bachelor of business degree from the Royal Melbourne Institute of Technology.

Even though Ms Pantos only completed her degree in 2023, she has already found the funds to pay it off.

She said rather than accruing savings by living off two-minute noodles and not leaving the house, she did it by being strategic.

Even though she studied abroad and lived out of home during her degree (although she’s now moved back in with mum and dad) Ms Pantos said she has always maintained a healthy savings balance.

“I’m a massive saver, and I’m not super into buying materialistic items, and I’ve been working since I was 14 and nine months,” she explained.

Ms Pantos said once indexation hit 7.1 per cent, she could see her HECS debt climbing; she made it her mission to get rid of it completely.

“I just thought there’s no way the government is getting more of my money. I made a goal to eliminate it, and I put everything into it and dried up my bank account,” she said.

The 23-year-old might be a good saver, but it was still a massive decision to sink her entire nest egg into a debt that she could technically pay off over time.

Ultimately, she knew keeping the debt would cost her more money as it increased, and she wanted to pay it off so she could focus on saving up for something like a house.

“It was the smartest strategy,” she said.

“I feel like a new person; I am able to work towards something big now, like buying a house or working towards an investment property.”

According to the financial comparison website Finder, just 12 per cent of Australians have paid off their student debts.

A recent survey revealed that more than 63 per cent of Aussies are slightly or extremely concerned about their ability to repay their interest-free loans.

The research also found that 12 per cent of students don’t think they’ll ever be able to repay their student debt.

That’s more than 354,000 people who have no confidence that they will be able to pay off their student loans.

Ms Pantos said she was only truly broke for about a day, and then some profits came into her account from stocks she’d invested in.

However, she doesn’t have anywhere near as much savings as she did before, which is a “strange” feeling.

Losing her nest egg though, has just made her more “motivated” to recoup her savings again and achieve a new goal.

Her ultimate tip for paying off HECS debt is to do your degree part-time to earn a decent wage while studying.

“Don’t rush your degree. I spaced mine out over four years so I could still get experience in the workplace and manage a high paying job,” she said.

“I just recommend not finishing your degree in a small amount of time.”

Working while completing her degree has allowed her to create savings while still living her best life.

“I have still been able to enjoy myself, and live my 20s and been able to travel. I just do it in a very smart way,” she said.

More Coverage

Finder money expert Richard Whitten previously told news.com.au paying off debt is never a bad idea.

“Student debt is still a less urgent debt compared to credit card debt, personal loan debt or even buy now pay later charges. You always want to focus on those high interest debts first,” Mr Whitten said.

“But with the cost of university rising, and future indexations likely to be higher than in the many low inflation years we’ve had before 2022, people with student debt should consider paying some of it off if they can.”