‘Let this be a lesson’: 22-year-old worker’s tax bill warning

A young Aussie has issued a warning to her fellow Gen Z workers after being hit with a brutal tax bill because of one mistake she made during the year.

A young Aussie worker has issued a warning to anyone with a HECS debt after being hit with a big tax bill because of one mistake.

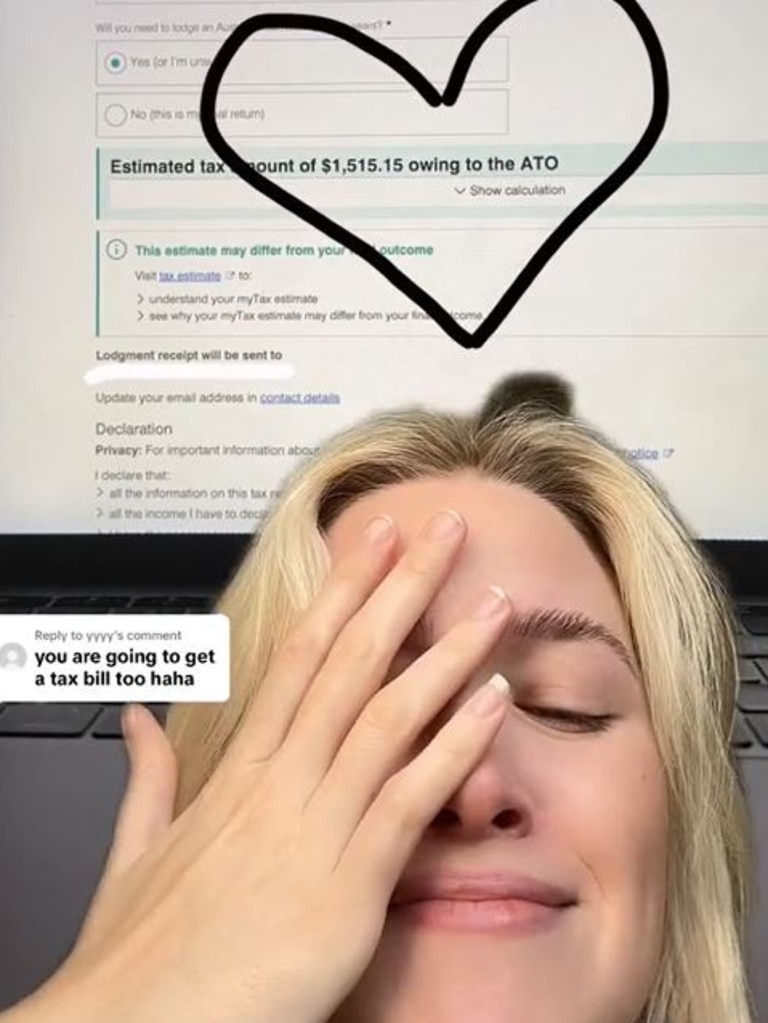

Queensland woman Cassidy was less than impressed after completing her tax return only to discover that, instead of a nice cash boost, she actually owed more than $1500 to the ATO.

“Let this be a lesson to make sure your employer is taking mandatory HECS debt repayments out of your pay so you don’t end up with a tax bill,” she said in a recent TikTok video.

Speaking to news.com.au, the 22-year-old revealed she hadn’t ticked the student loan box on her TFN declaration form when starting her job, an oversight she described as “totally my fault” and not her employers.

Cassidy works in recruitment and it is her first job out of university where repayments for her $38,000 HECS debt are required to be deducted from her pay.

After realising her error, she thought she would be able to make up for it by making a voluntary repayment at the end of the financial year, which she did, putting $2000 towards her debt.

“It turns out voluntary repayments don’t work like that,” she said.

While she has never had a tax bill, the young worker wasn’t too surprised when she received one due to posting a previous video about her HECS debt. In the comment section of the video, where she explained her plan to make voluntary repayments, she was told by multiple people that she would likely be getting a bill this tax time.

“It’s definitely something people with HECS debt need to be careful of,” Cassidy said.

“Make sure the student loan box is ticked and your employer is aware you have a HECS debt.”

She also thinks it is “crazy” voluntary repayments towards HECS debt are not viewed in the same light as mandatory repayments.

“Even though I didn’t make mandatory repayments each week to my HECS debt, I still paid over the minimum requirement in voluntary repayments,” she said.

“It shouldn’t matter how you pay it, as long as you meet the threshold. Makes sense why they’re called mandatory repayments … but oh well, I know now.”

The worsening cost of living pressures means young people are feeling the burden of their HECS debts now more than ever.

On June 1 this year, 2.9 million people were hit with a brutal increase to their student debts.

While HECS-HELP debt does not accrue interest, it is indexed for inflation every year on June 1, with those impacted seeing their debts rise by a significant 4.7 per cent this year.

It comes after debts rose by a 7.1 per cent last year – the biggest jump seen in 30 years.

The way in which HECS debt is paid off has also been a point of contention, with people branding the process as “unfair”.

While payments towards your HECS debt are taken out of your pay in real time, that money is not coming off your debt at the same rate.

Instead, the Australian Taxation Office (ATO) holds these funds as a credit until you file your tax return on or after July 1.

But, because indexation occurs before this on June 1, your past contributions are actually applying to the higher indexed rate, despite coming out of your pay much earlier.

This is why so many people are – despite making thousands in repayments – finding themselves in the same position or even worse off than they were the previous year.

A recent Finder survey of 1071 respondents – 271 of whom have student debt – revealed more than 3 in 5 are slightly or extremely concerned about their ability to repay their interest-free loan – up from 54 per cent last year.

The research found 12 per cent don’t think they’ll ever be able to repay their student debt.

That’s more than 354,000 people who have no confidence that they will be able to pay off their student loan.

In response to the growing concerns around Australia’s HECS system, the Federal Government recently announced a plan to wipe $3 billion in student debt for just under three million Aussies.

The proposed change, included in the May budget, will see the lower of either the Consumer Price Index (CPI) or the Wage Price Index applied to the indexation process. Currently, indexation is done in line with CPI.

Legislation still has to pass in order for the change to be applied but, once it does, it will be backdated to June 1, 2023 and the revised indexation rates will automatically be added by the Australian Taxation Office to people’s loans.

This means, last year’s 7.1 per cent indexation will be reduced to 3.2 per cent and this year’s will be reduced to 4 per cent, instead of 4.7 per cent.

Finder money expert Richard Whitten previously told news.com.au that, even with the government changes to indexation, it is still going to “hit many Australians hard”.

“Four per cent this year is still a fairly high indexation rate. If your debt is in the tens of thousands you’re looking at a hefty increase,” Mr Whitten said.

“Student debt is still a less urgent debt compared to credit card debt, personal loan debt or even buy now pay later charges. You always want to focus on those high interest debts first.

“But with the cost of university rising, and future indexations likely to be higher than in the many low inflation years we’ve had before 2022, people with student debt should consider paying some of it off if they can.”