‘Want to cry’: Aussies hit by brutal tax debt reality

Multiple Aussies expecting a welcome cash boost this tax time have been left horrified after finding out they owe the ATO thousands instead.

Multiple Aussies hoping to receive a healthy tax return this year have been left severely disappointed after finding out they have been hit with a bill instead.

Rushing to do your tax and expecting to receive a nice cash boost, only to be told you actually owe the ATO money is an unpleasant revelation – and one an increasing number of Australians particularly young people, seem to be dealing with.

It has only been a matter of days since people have been able to lodge their returns for this financial year and, already, many have taken to social media to share their shock at receiving debt instead of a refund.

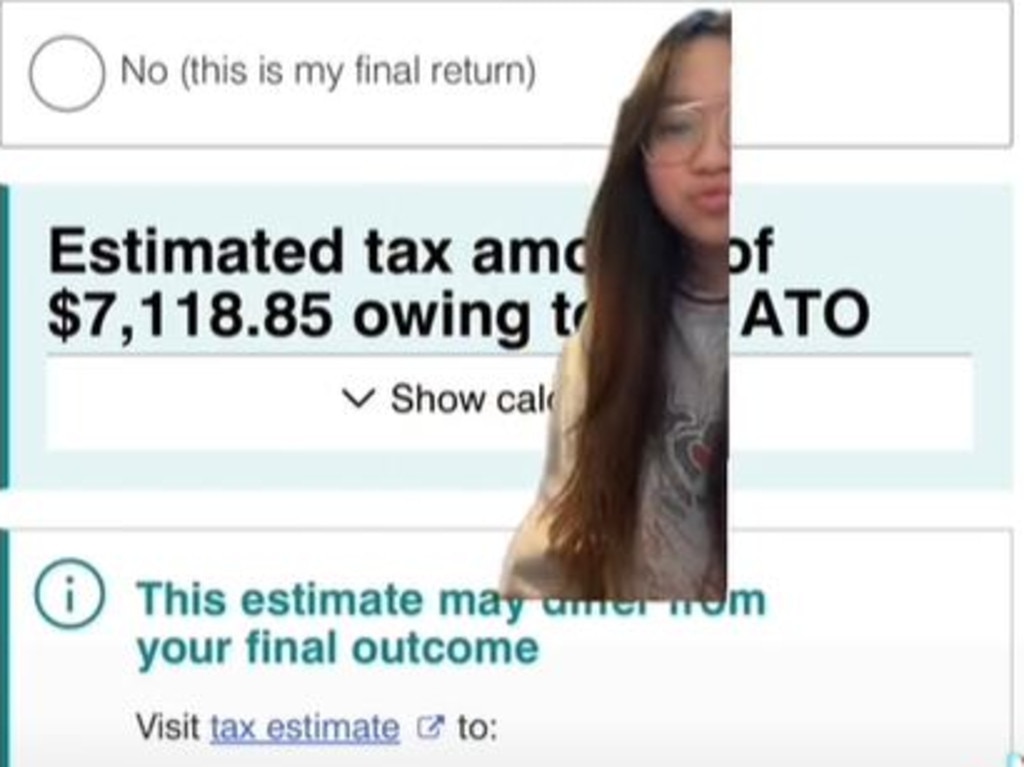

One young person, who goes by tisadoyeng on TikTok, revealed she had been hit with a whopping $7118 bill after completing her tax return.

Sharing the figure online, she revealed she has two jobs and works seven days a week.

“And this is what I get,” she wrote in the caption of the video.

In the comment section, the young worker revealed where she thinks she went wrong, believing she accidentally claimed the tax-free threshold twice.

Most Australian residents can claim tax-free threshold on the first $18,200 of income they earn during the financial year.

If you have more than one payer at the same time, generally, you only claim the tax-free threshold from one payer.

She said she was going to see an accountant about her debt and confirm where she went wrong, but she was still not thrilled about the prospect of owing money, writing: “I want to cry so bad.”

The young worker isn’t alone in her tax struggle, with people flocking to the comment section to share their own debts.

One person claimed she also worked two jobs but was careful to only claim the tax-free threshold once, but was “still getting a bill”.

Another person said they were still paying off a previous tax debt of $3700 but were expecting to owe a further $2000 – $3000 this year.

They said this was due to having “more than one job, study etc messing things around the last few years”.

“Can we all cry about our debt,” they wrote.

One person said: “Happened to me last year. I didn’t know about the 2 job thing. It was so painful to pay back. I felt scammed by the gov cause where are u supposed to read this rules.”

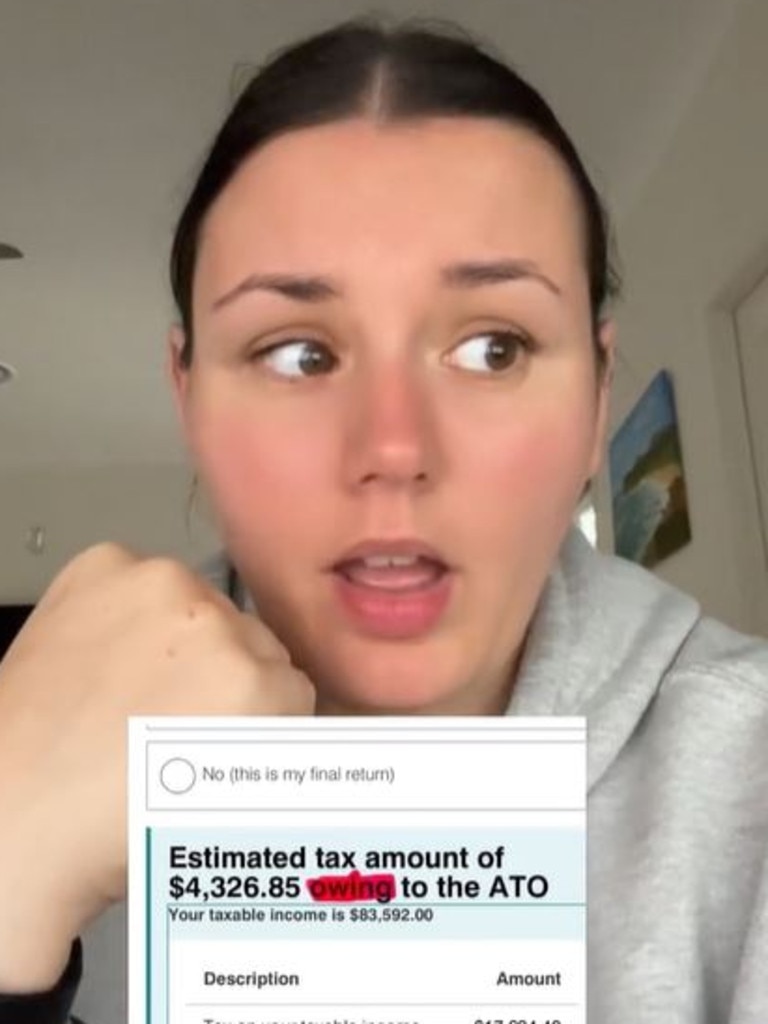

Another creator, who goes by WeightlossWestbrook online, revealed she owed an estimated $4326 to the ATO.

Sharing her situation on TikTok, she wrote: “My toxic trait is thinking I was going to get money back and be able to go on a holiday.”

It comes amid a warning from Australian tax lawyer Harry Dell, who claimed anyone who received an unexpected tax bill last year may be at a higher risk of receiving one again this year.

“Most people who received surprise tax bills last year will probably get them again, unless they have found the cause and fixed it,” he told news.com.au.

There are multiple reasons someone may receive a tax bill.

One reason may be your employer not withholding your HECS-HELP repayments, which means that, at tax time, you are left with a big chunk of money you need to pay towards that debt.

The Medicare levy surcharge threshold, which is $90,000 for individuals and $180,000 for couples, is another area where people tend to get tripped up.

Mr Dell said people can get stuck with bills because they are just over threshold, don’t include their partners income when lodging their return or have the wrong private health cover.

He said that not budgeting for capital gains tax is another area people need to look out for.

“This could be crypto, shares, or anything, as amounts aren’t withheld for tax like your salary and wages,” he said.

For people who lodge their returns this year to find they owe money to the ATO, Mr Dell said their priority needs to be finding out why they have been hit with a bill.

“The Pay As You Go Withholding system is designed so you overpay a little and get a refund at the end of the year – without any deductions,” he said.

“If you can’t see why enough wasn’t withheld, get a professional to explain your tax return and what caused the surprise bill.”

He also urged people to claim all the deductions they are entitled to and to ensure they are including the correct information on their return.