Coronavirus Australia: Workers could face years of lower wages

Australian workers face years of lower wages if the legislated increase to superannuation in the post COVID-economy proceeds, according to a confidential report.

EXCLUSIVE

Australian workers face years of lower wages if the legislated increase to superannuation in the post COVID-economy proceeds, according to a confidential 650-page Treasury report.

Prime Minister Scott Morrison will be handed more ammunition to freeze or scrap the scheduled legislated increase to the superannuation guarantee to 12 per cent in the new report, that warns workers are facing a “trade off” with lower wages if employers are forced to increase super.

The superannuation guarantee is set to increase to 10 per cent in July 2021, before rising to 12 per cent in 2025.

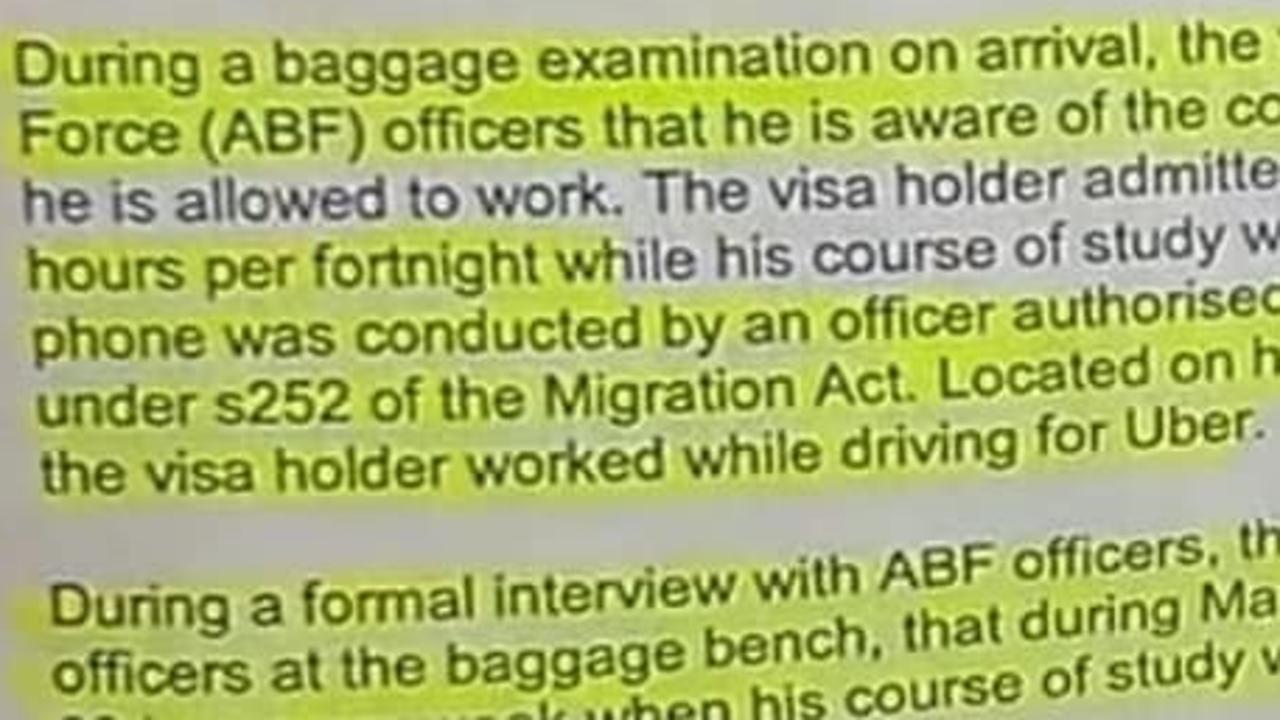

News.com.au has confirmed the Treasury report, which has been completed and handed to Treasurer Josh Frydenberg, does not offer any formal recommendations on retirement income policy but repeatedly raises concerns over the “trade off” between higher super and lower wages.

RELATED: Early superannuation claims pass $25 billion

Grattan Institute economist Brendan Coates said it was clear that increasing super now would cost worker’s wage increases.

“While employers might hand over the cheque for super, workers ultimately pay for almost all of it through lower wages,’’ he told news.com.au.

“And the Reserve Bank agrees: it’s forecasting wages growth to be slower from next year than if compulsory super wasn’t rising.

“Our work shows that 80 per cent of the cost of super comes via lower wages within 2-3 years. And the long-term impact could be as high as 100 per cent. That’s what international studies of similar schemes typically find.”

While workers are free to increase voluntary contributions to super, Mr Coates said compulsory super shouldn’t rise, because it would force Australians to save for a higher living standard in retirement than they have while working, “which is simply a recipe for larger inheritances.”

But he also highlighted another reason why the Treasurer may be attracted to the idea - it would force workers to pay more tax because super contributions are taxed at a concessional rate.

RELATED: Almost 500,000 Australians have cleared out their super

“Raising compulsory super would also cost the budget $2 billion a year in foregone tax, which would vastly exceed any savings from less spending on pensions for decades to come,’’ Mr Coates said.

But there are fears that workers will simply lose the legislated pay rise forever if the Morrison Government moves to scrap the increase, with no guarantee that the promised increases in super will be paid to workers in higher wages.

Industry Super Australia (ISA) has slammed the proposal to allow low-income workers to opt out, saying it would leave workers paying higher taxes now and having lower retirement incomes in the future.

“For an average 30-year-old couple working full time, cutting the super guarantee increase would deprive them of up to $200,000 in super by the time they retire. During retirement they would lose up to 20 per cent of their income or between $7,000 to $10,000 a year,’’ the ISA said.

“More than 2.5 million Australians have accessed the government’s early release of super scheme and at least 560,000 Australian have emptied their super accounts forcing them to start saving for retirement again,’’

“The only way to deliver a dignified retirement is to stick to the legislated increase to the super rate to 12 per cent,” it said.

RELATED: Aussies spending superannuation on plastic surgery

The Treasury report also canvasses the “gender gap” within super and how to help women improve their retirement income strategy.

It examines the role of the family home in planning for retirement and considers the life quality of aged pensioners who own their own home and those who are forced to rent on a fixed income.

The warnings are set to spark a bitter new battle over superannuation policy with Liberal backbenchers calling on the Prime Minister to scrap the planned increases.

One option being pushed among Liberal backbenchers is allowing part-time, casual and low income workers to “opt out” of super and secure wage increases of up to $60-a-week, but the Treasury review makes no recommendation on these proposals.

Liberal Senator Andrew Bragg said he looked forward to the release of the report and the debate it was set to unleash over the superannuation guarantee.

“Superannuation is deferred wages. It’s part of your wages. Australia is an environment where we want to create more jobs. Super is clearly a cost of employment.

“Your super is part of the pay you get. My preferred policy option here is we also allow people to access it for a first home deposit. I’ve had constituents write to me saying this is the only chance they have of getting into the housing market. We all know the best way to avoid poverty in retirement is to own your own home.”

The Prime Minister’s official policy position is that he has “no plans” to dump the super guarantee that governs what percentage of wages employers must put away in compulsory superannuation payments.

But Mr Morrison has moved this week to appoint a champion of super reform to the COVID-19 commission that is working on proposals to boost employment.

Workers would secure a pay rise instead of a superannuation increase under a plan championed by the man Scott Morrison has hand-picked to join his COVID-19 commission.

Former union boss Paul Howes - who briefly rose to fame in Australia during the leadership switch from Kevin Rudd to Julia Gillard as a self-described ‘faceless man’ - has been appointed to the revamped commission to help lead the economic recovery.

Mr Howes has repeatedly called for a rethink of super policy including allowing low income workers to opt out in 2017.

“Even the most ardent superannuation proponent should appreciate what a big deal it is to compulsorily quarantine someone wages,’’ he wrote.

“There’s still the question of whether that supplement is more useful in retirement than the money would have been over the course of a cash-strapped working life.”