Sad reality of Australia’s technology industry exposed in telling photo

A photo of an office chair graveyard has exposed the blistering reality of a major disaster unfolding in Australia.

An eagle-eyed entrepreneur has pointed out how a single photo sums up the crisis tech companies across Australia are currently facing.

On Tuesday, Evan Clark, the founder and boss of education tool ClickView, stumbled across a sad sight on social media.

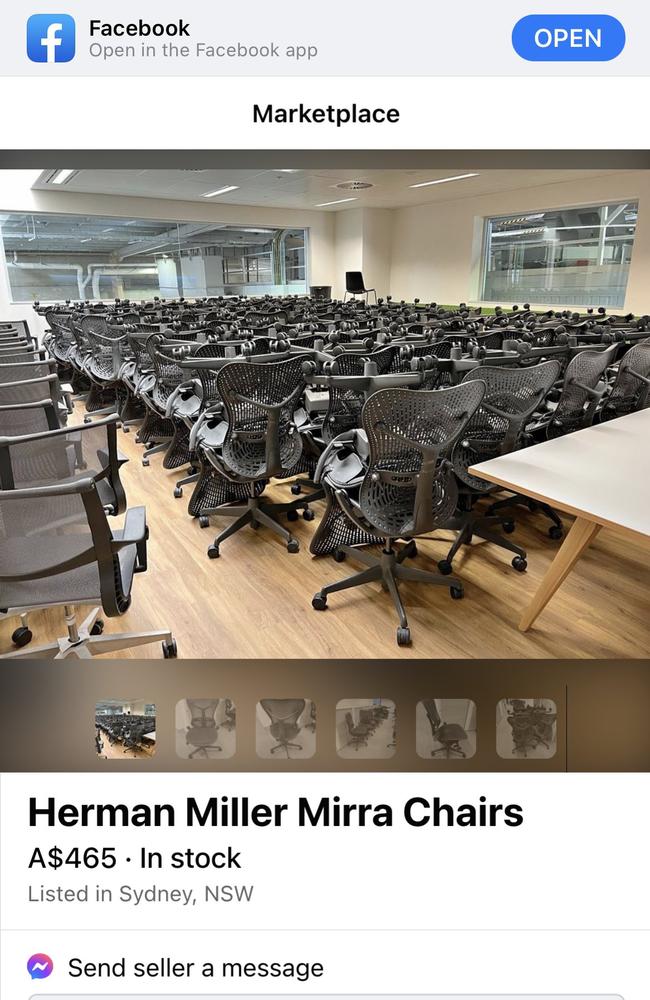

As he perused Facebook Marketplace, he noticed an advertisement for Herman Miller Mirra office chairs.

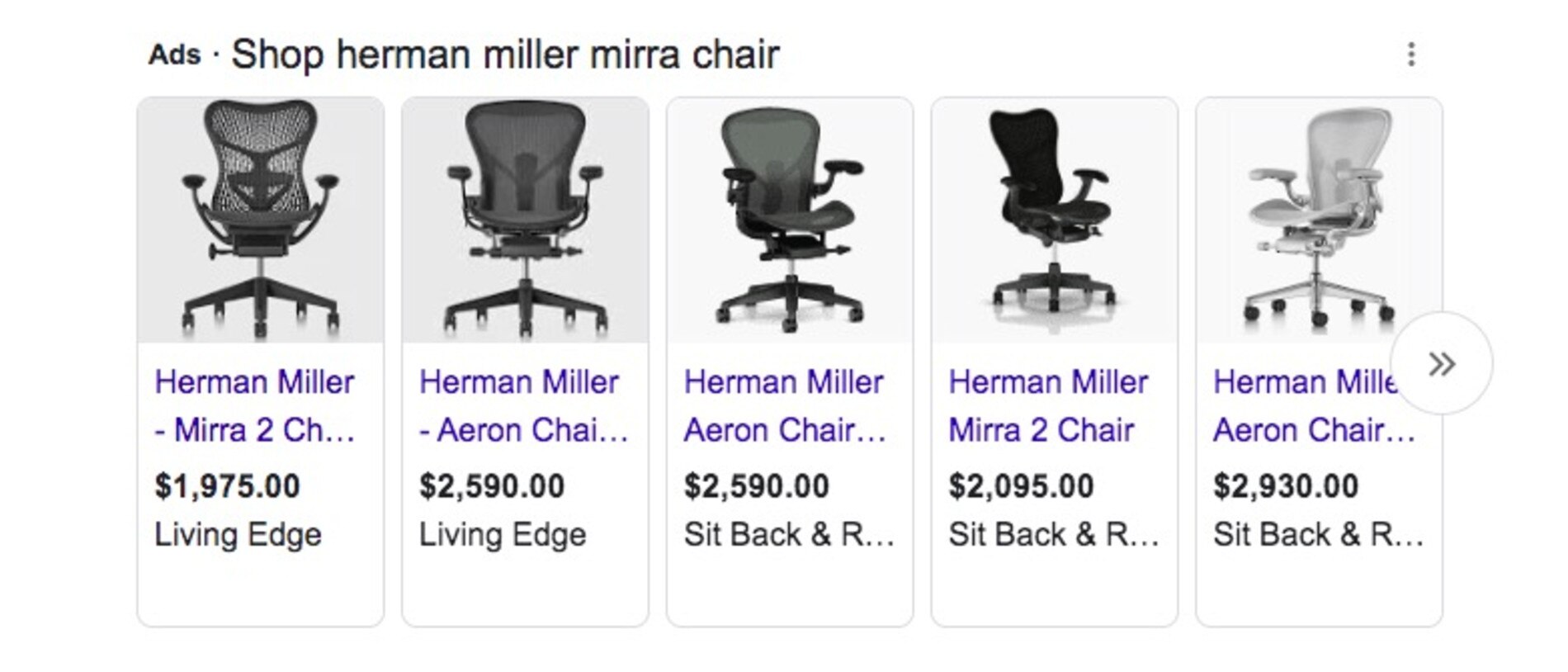

A photograph shows a room full of them in Sydney selling for $465 a piece — when the chairs sell for around $2000 brand new.

Taking to Twitter, Mr Clark wrote: “Nothing says ‘tech meltdown’ like hundreds of Herman Miller office chairs on Facebook Marketplace”.

“That’s a heavy discount if they are legit!” he added.

“The many office chairs for sale on online marketplaces is one of a few signs that things aren’t good,” Mr Clark told news.com.au.

“Scaled down Christmas parties - and staff being forced to use their accrued leave during December and January are two that I’m already seeing.”

In the past six months, Australia’s tech industry has been caught in the throes of a crisis as investors have been left spooked by dramatic plunges in valuations making funding harder to find.

The current market conditions has seen many companies, big and small alike, cut jobs or go under as they struggle to stay afloat in the turbulent market.

Just last week, delivery giant Deliveroo’s Australian branch went into administration as the firm failed to turn a profit.

Also in the past week, cryptocurrency exchange FTX filed for bankruptcy. News.com.au knows of Australian workers in their mid-20s who went from being worth millions to nothing because of the crypto giant’s collapse.

News.com.au has previously reported on a tech staffer who lost his job before his first day at work and another employee who was sacked, three days before the company went into liquidation.

Nothing says ‘tech meltdown’ like hundreds of Herman Miller office chairs on Facebook Marketplace pic.twitter.com/UmJQztaxCx

— Evan Clark (@EvanClark) November 22, 2022

In August, news.com.au reported on a governance and risk management tech firm called FirmGuard which went bust owing $2.3 million to creditors.

In the months leading up to its demise, a worker was not paid and the company’s CEO started paying staff through his own personal bank account.

Later that same month, an Aussie quit his job of six years to work at a tech start-up called Zenbly but he was devastated to learn there was no job for him to go to as the new firm had been liquidated.

He was unable to return to his old job because he had already worked out his notice and found himself unemployed while a new baby was on the way.

Then there was Metigy, an artificial intelligence platform, which made headlines for owing an eye-watering $32 million to investors due to its collapse.

A Melbourne-based e-sports company called Order, which raised $5.3 million in funding last year, also collapsed with liquidators seeking to sell the business urgently.

In July, Australia’s first ever neobank founded in 2017, Volt Bank, went under with 140 staff losing their jobs, while 6000 customers were told to urgently withdraw their funds.

Other failed businesses include grocery delivery service Send, which went into liquidation at the end of May, after the company spent $11 million in eight months to stay afloat and a Victorian food delivery company called Delivr that styled itself as a rival to UberEats also collapsed in July as it became unprofitable.

In July, news.com.au raised questions about another Sydney-based tech firm, D365 Group, which builds software for health, real estate and accounting services.

Staff claim they haven’t been properly paid for months.

Have you been impacted by Australia’s tech crisis? Get in touch | alex.turner-cohen@news.com.au

Many Australian tech firms have also slashed their workforces in the hopes of saving money.

Cryptocurrency exchange Swyftx sacked one in five of its staff in August while a Brisbane-based business a telecommunications and IT infrastructure company called Megaport revealed that a whopping $1.6 million was spent paying out the 10 per cent of employees who had been made redundant.

An Australian social media start-up called Linktree that was recently valued at $1.78 billion sacked 17 per cent of staff from its global operations.

Another crypto platform Immutable, which was valued at $3.5 billion faced a fierce backlash over sacking 17 per cent of its staff from its gaming division, while continuing to “hire aggressively” after raising $280 million in funding in March.

Then there was Australian healthcare start-up Eucalyptus that provides treatments for obesity, acne and erectile dysfunction, which fired up to 20 per cent of staff after an investment firm pulled its funding at the last minute.

Debt collection start-up Indebted let go of 40 of its employees just before the end of the financial year, despite its valuation soaring to more than $200 million, with most of the redundancies made across sales and marketing.

The growing list of redundancies also included Australian buy now, pay later provider Brighte, that offers money for home improvements and solar power, which let go of 15 per cent of its staff in June, with roles primarily based in corporate and new product development.

Another buy now, pay later provider with offices in Sydney called BizPay made 30 per cent of its workforce redundant blaming market conditions for the huge cut to staffing in May.