Sydney dad loses job before start date after company collapses

An Australian dad has been left fuming after he was cut from his job before he had even worked his first day in the office, with a new baby on the way.

EXCLUSIVE

An Australian dad has been left fuming after he was dropped from his job before he had even worked his first day in the office.

Earlier this year, Lucas*, from Sydney, was poached for a new role at a technology start-up called Zenbly Pty Ltd, which created and serviced operating systems for Australian gyms.

The soon-to-be father had worked at his previous tech and sales job for six years but decided to take the leap of faith as Zenbly had given him an “attractive offer” in excess of $150,000.

He signed the contract and put in his six weeks’ notice at his former workplace.

But a week before he was due to start, he discovered that Zenbly had collapsed.

The company had gone under owing $2.6 million to more than a dozen creditors, with administrators warning him that there was no job for him anymore.

By then it was too late to retract his resignation and he was left jobless, with a new baby on the way.

Lucas had become the latest victim in Australia’s struggling tech industry, as Zenbly had collapsed suddenly and unexpectedly because of tough market conditions.

“It appears that they may have forgotten I had signed a contract as I wasn‘t notified until the start of May 2022 … that the company had gone into administration and I was out of a job,” Lucas told news.com.au.

“My previous employer was good and they extended my notice period by a few weeks, unfortunately once you hand in your resignation and see out the majority of your notice period it is hard to come back from that.”

Want to stream your news? Flash lets you stream 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

ASIC records obtained by news.com.au show that Zenbly went into administration on April 7 this year and went into liquidation shortly afterwards.

The company’s failure appeared a surprise to everyone, including the company’s director, because Lucas signed his contract with Zenbly on March 25 — less than a fortnight before administrators were appointed on April 7.

Lucas was meant to start on May 16 but the company had ceased to operate.

“I only found out when I received the notice of administration in the mail,” he recalled.

“I tried reaching out to the CEO who hired me. Unfortunately I didn’t get any response. I also reached out to the recruiter who assured me I was still starting on May 16.

“I went back and forth with her for about a week before I reached out to the administrators directly.

“It was only then I found out that I was not going to start on May 16, the administrators filled me in and advised there was no role to go to and they were going to liquidate the company.”

In another blow, Lucas had negotiated a two-week paid paternity leave period with Zenbly for when his partner was due to have their baby — but instead found himself unemployed during that time and scrambling for a job to support the family.

There were 17 Zenbly employees owed $221,000 at the time it collapsed, according to the liquidator’s report.

However, as Lucas had not worked there yet, he was not owed any entitlements and had no recourse for his ruined job prospects.

He engaged an employment lawyer who told him there would be no way to pursue the company for his lost income.

“It didn’t feel real,” he added. “I knew it was a bit more of a risk with a start-up, but I didn’t think it would happen before it started. It was a bit stressful, bit of a shock.”

Zenbly’s liquidators, Alan Walker and Glenn Livingstone of WLP Restructuring, wrote that the company’s sudden collapse was brought on by demand of a large debt to be paid.

An early investor in the company, Vicex Holdings Proprietary Limited, wanted its stock converted into dollars in April.

Although its convertible notes was valued at $1.85 million, Zenbly was unable to gather together the funds and appointed administrators soon after.

Zenbly collapsed owing $2.6 million to 18 creditors, according to the administrator’s report.

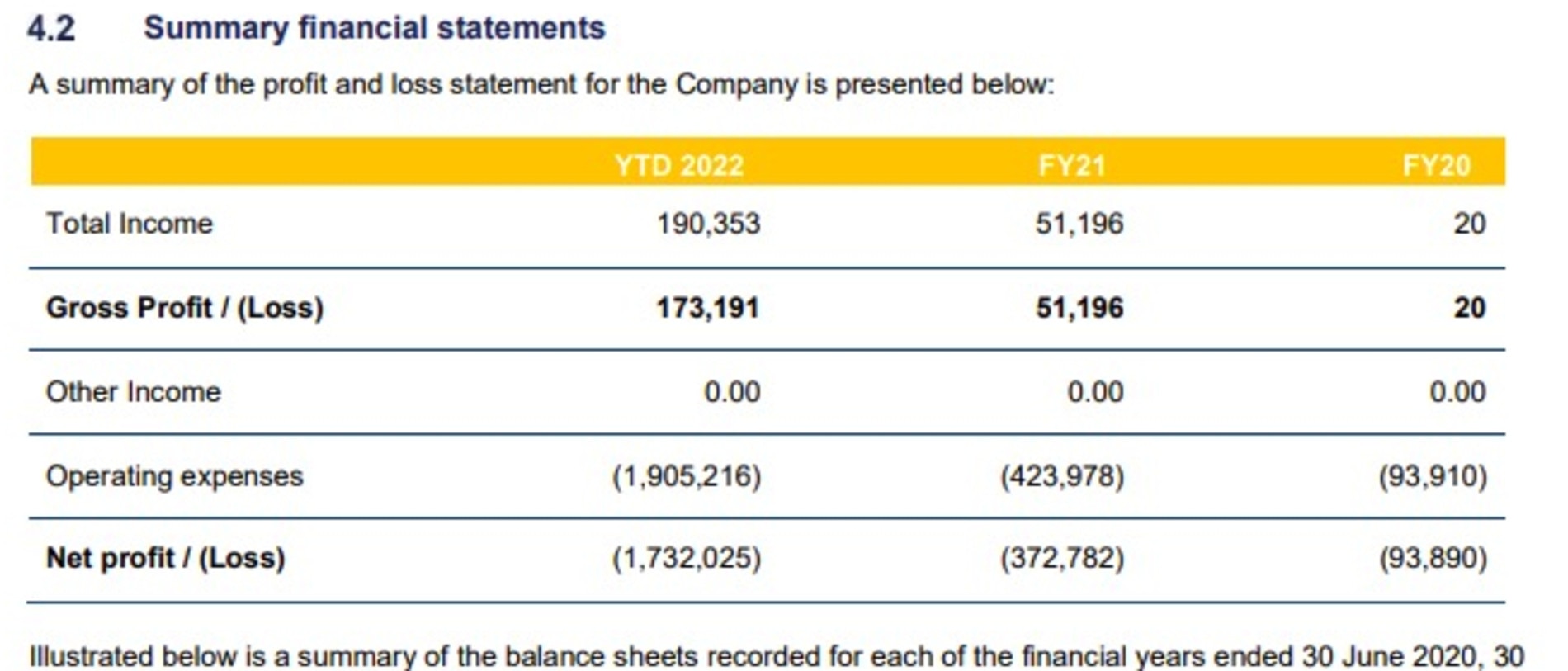

The company was founded in mid-2019 and didn’t make a profit for the last three years.

In 2020, Zenbly had a net loss of $93,000. The following year, it had a larger liability of $372,000.

The last financial year, it made $173,000. Its operating expenses were $1.9 million and the firm made a net loss of $1.7 million.

Zenbly’s failure occured due to several reasons, according to the report, including launching an expensive software that took too long to turn a profit, poor management of expenses and reliance on outside funding to keep the company afloat because it was undercapitalised.

At its peak, Zenbly’s director valued the company’s intellectual property at between $8 and $12 million.

However, administrators ended up selling Zenbly’s software for just $500,000 to another tech outfit.

The liquidators Mr Walker and Mr Livingstone did not respond to repeated requests from news.com.au for comment.

Luckily, several months after the bizarre ordeal, Lucas landed back on his feet, scoring another job and enjoying time with his newborn child.

Ironically, he said he is working at another start-up.

Tech companies are struggling across Australia as investors have been left spooked by dramatic plunges in valuations making funding harder to find.

The latest tech outfit to be impacted was Metigy, an artificial intelligence platform that now owes an eye-watering $32 million to investors.

A Melbourne-based e-sports company called Order, which raised $5.3 million in funding last year, collapsed just days earlier with liquidators seeking to sell the business urgently.

In July, Australia’s first ever neobank founded in 2017, Volt Bank, went under with 140 staff losing their jobs, while 6000 customers were told to urgently withdraw their funds.

Other failed businesses include grocery delivery service Send, which went into liquidation at the end of May, after the company spent $11 million in eight months to stay afloat and a Victorian food delivery company called Delivr that styled itself as a rival to UberEats and Deliveroo also collapsed in July as it became unprofitable.

In August, news.com.au reported on a governance and risk management tech firm called FirmGuard which went bust owing $2.3 million to creditors.

In July, news.com.au raised questions about another Sydney-based tech firm, D365 Group, which builds software for health, real estate and accounting services.

More Coverage

Staff claim they haven’t been properly paid for months and a contractor has taken the company to court saying his debts were not paid. D365 Group is due back in court later this month.

*Name withheld for privacy reasons

Have a similar story? Continue the conversation | alex.turner-cohen@news.com.au

Read related topics:Sydney