Claims of overwork at Big 4 financial services firm after EY employee found dead at work

The death of a young woman at her Sydney office has ignited a conversation around the gruelling hours employees at big firms are subjected to.

Warning: Confronting

The suspected suicide of a 33-year-old female Ernst and Young employee, who was found at the financial services firm’s Sydney offices, has sparked a conversation around workplace culture.

Apart from Ernst and Young, which trades under the name EY, Australia has three other major financial services firms including KPMG, PricewaterhouseCoopers (PwC) and Deloitte.

According to The Australian, the EY worker was found just after midnight on Saturday. The woman’s identity and position have not been revealed, however, police are not treating the incident as suspicious and believe her death was related to self harm.

Before her death, the woman attended an EY social function at The Ivy bar and nightclub from 5.30pm, before returning to the offices from 7.30pm onwards. Police were called to the Sydney CBD office about 12.20am following a concern for welfare report.

Although there are reports she was escorted out of The Ivy for being intoxicated, security footage from EY did not suggest visible intoxication, The Australian reported.

In a statement shared with news.com.au, the CEO of EY and the Regional Managing Partner David Larocca said the firm is “deeply shocked and saddened by the tragic events of the weekend”.

“We are assisting the police with their ongoing investigation, which has confirmed there were no suspicious circumstances,” said Mr Larocca.

“Our hearts go out the family and we have been in contact to offer our support and condolences.”

A “comprehensive and wide-ranging internal review encompassing health and safety, security, social events” has also been initiated, and counselling has been offered to all staff and team members.

In the aftermath of the death, posts on online forums have highlighted the “high pressure and workaholic culture” at Big 4 financial services firms.

“Had a lot of late nights and weekends so can definitely see what she may be experiencing. Took six months leave to mentally reset myself. Ultimately quit after that,” wrote one Reddit user, who claimed to be a former employee at a Big 4 firm.

“Working for B4 (Big 4) can often feel like working in a sweat shop. They don’t care about your wellbeing. They just care about output, output, output,” another comment read.

News.com.au is not suggesting the work culture at EY contributed to the employee’s death.

12-hour work days

Currently in their peak period, employees in financial auditing teams are at their busiest from July to September.

According to a report from auditing software company Caseware, auditors can work 12-hour days during this time as ASX-listed companies prepare to release their annual reports by September 30.

Hours worked by junior employees were also questioned during a 2019 parliament inquiry into audit quality. Senior members at KPMG, EY and PwC were asked by Labor Senator Deborah O’Neill about the practice of “burning the midnight oil as they come to reporting periods”, with “young people carrying the can”.

However, senior members from the firms maintained employees worked about 7.5 to 8.4 hours a day.

PwC’s managing partner of assurance Matt Graham said records from the financial services firm place the average hours worked per week between 40 to 42 hours.

“That includes the peaks, time off and all of that,” he said, via the Australian Financial Review.

Deloitte’s Jamie Gatt also disagreed with Sen O’Neill’s claims, saying: “I don’t think that’s the reality”.

Similarly, EY’s audit partner Sarah Lowe said while there was “sometimes work outside of the standard 7.5 hours,” this didn’t occur “throughout the whole year”.

In 2021, EY’s Hong Kong arm came under fire after a leaked email reported employees were told by one manager to work from 9.30am to 11.30pm, as well as on weekends.

“I think midnight is common in peak seasons – it counts on the discipline and responsibility of yourself,” the email read.

“For weekends, I expect at least one day we are spending the whole day (from 10.00am-7.30pm) in office.”

‘Devote your life to them’: Big 4 pay released

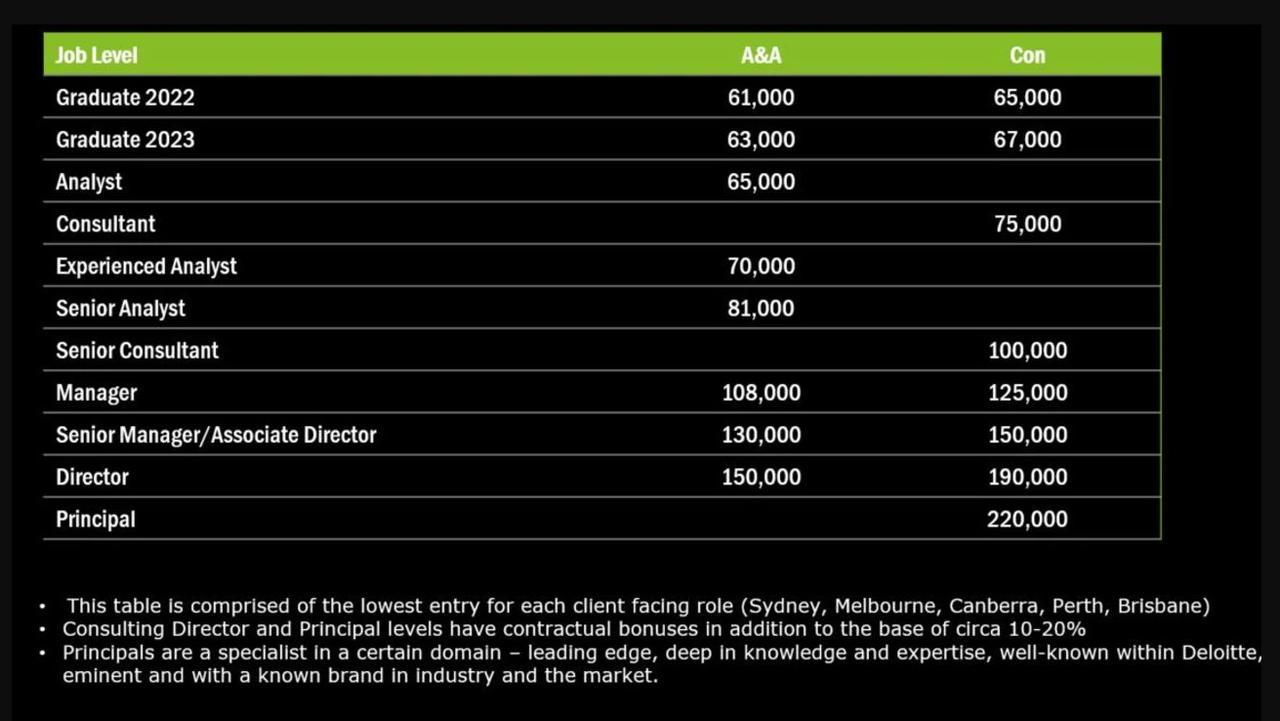

Earlier this month, TikTok user @gowokegobrokeaus lashed Deloitte for “modern day slavery” after they released their pay rates for employees in their Audit & Assurance (A & A) and Consulting teams.

2023 A & A graduates can expect a salary of $65,000, while consultant graduates make $67,000. Once they’ve completed the program, analysts receive $65,000, while consultants are paid $75,000. The numbers are based on the lowest entry in each category and apply to client-facing roles in Sydney, Melbourne, Canberra, Perth and Brisbane.

However, TikTok user @gowokegobrokeaus said the pay rates do not amount to the “12 to 14 hour” working days expected of graduates.

“They demand basically to devote your life to them,” she said.

“And how much do they pay them – $20 an hour? Tell me how it makes sense.

“This is why I hate big business and why people are flocking away from large corporations in record numbers – because they’ve realised they are getting absolutely rorted.”

In April this year, PwC also disclosed the pay bands for roles in their financial services team. Graduates got paid a minimum of $69,000, with that figure increasing to $74,400 for senior associates and $97,600 for manager roles.

Revelations from the PwC transparency report

Earlier this month, it was revealed PwC Australia had investigated 31 allegations of workplace misconduct during the 2022 financial year. The Big 4 firm reported nine dismissals and 21 substantiated claims, including 11 cases of bullying, harassment and misconduct, six cases of sexual harassment and four data breaches, the company’s second transparency report revealed.

PwC also spoke about allegations made by a whistleblower during a Senate inquiry into job security, which claimed migrant staff from its Parramatta-based Audit Skills Hub were made to work 80 to 120 hour work weeks. They also said the company offered its largely migrant employee base lower salaries and less training than their colleagues.

Dubbed as ‘Worker X’, their submission said that it was “as if an offshore team has been created, which is residing in Australia”.

More Coverage

Responding to these claims, PwC said they’ve since taken a “detailed review of this hub”, identifying a key finding that people “felt disconnected from the opportunities that people in other PwC offices had”.

“We implemented a number of changes including a greater onsite presence from PwC partners and business leaders at the hub, and introduced a number of initiatives to better align the employee experience with that of all our people across Australia,” they wrote in their transparency report.

News.com.au reached out to EY, PwC, Deloitte and KPMG for comment, however, they did not respond at the time of publishing.