Aussie trading firm rescinds $150k graduate offers right before Christmas as it chalks up $9m loss

A Sydney worker has been left fuming. He was dropped from his $150,000-a-year job before he had even worked a single day in the office, right before Christmas.

A Sydney worker has been left fuming because he was dropped from his $150,000-a-year job before he had even worked a single day in the office, right before Christmas.

News.com.au can reveal that Australian trading firm Tibra Capital has rescinded some of its employment offers, including for its interns, graduates, and some senior roles, leaving those who had accepted the jobs stranded.

Harry*, a recent university graduate who did not wish to share his real name, said he had been deep in the interview process at other trading firms but withdrew when the Tibra offer came in earlier this year.

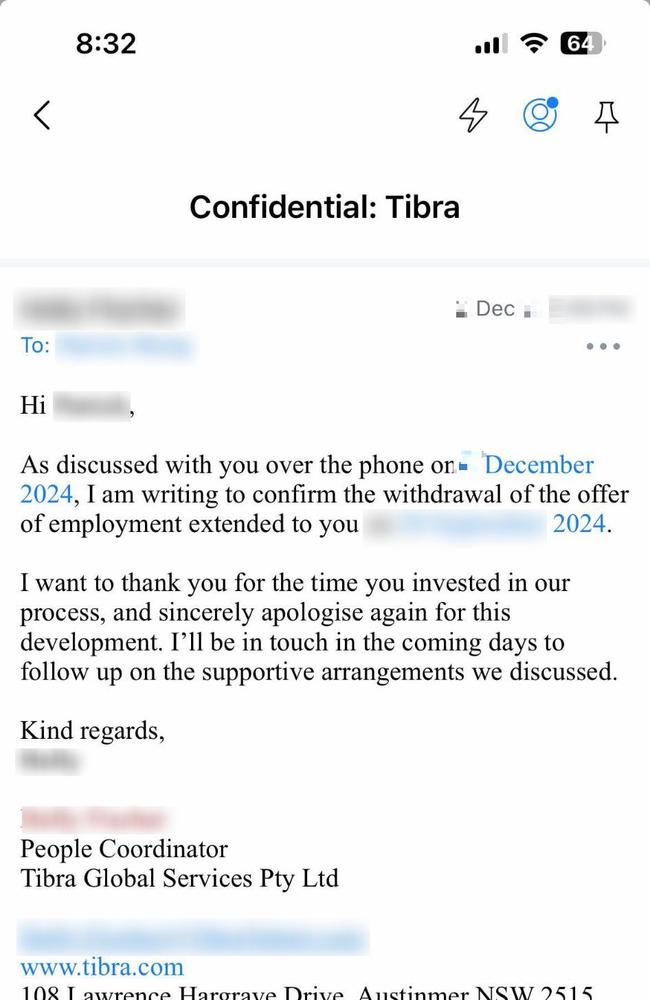

However, he received a call from Tibra’s HR team last week that turned his world upside down, informing him he would not have a job there next year.

“I had other job interview processes still going,” Harry lamented. “Some of them were extremely promising, I had to pull out of them because of this. The timing is terrible, it’s Christmas, no-one is hiring.”

Tibra Capital told him the “company has had to restructure for the long term” and a financial report obtained by news.com.au from ASIC paints a grim picture of the firm’s profit, as the broader sector faces headwinds amid the economic downturn.

MORE: 5 signs your workplace is toxic – and what to do about it

According to Harry, Tibra picked around a dozen graduates, including him, to start next year. All of them are now jobless.

Some were international residents and have lost the visa to work in Australia along with the job, news.com.au understands.

Tibra has agreed to pay out their notice period — so they will receive four weeks of pay.

The trading firm also rescinded job offers for senior hires. Because of their high level, these people had to quit their jobs at rival firms, then spend months unemployed working out their non compete period. They, too, are jobless.

News.com.au has contacted Tibra Capital for comment.

Do you know more or have a similar story? Get in touch | alex.turner-cohen@news.com.ay

MORE: How to quit a new job if something better comes up

Tibra Capital has offices in Sydney, Wollongong and London, and was established in 2007 by seven young founders who went on to become some of the richest young entrepreneurs in Australia.

The firm trades derivatives, foreign currencies, commodities and securities.

Before Covid-19, Tibra Capital made the news for staggering profits. In 2016, it posted a $79 million net profit, up from $56 million the year before.

But in the post-pandemic economic downturn, the company has suffered.

It lost $9 million in the most recent reporting period, after a $42 million loss posted the year before that, according to ASIC documents.

The company spent $31 million on staff in its most recent financial year.

Tibra is not the only firm in the industry being pummelled by the economic downturn.

Another trading firm, VivCourt, based in Sydney’s eastern suburbs, recently laid off staff several months ago.

Its founder and chief executive, Rob Keldoulis, confirmed to news.com.au that they had slashed headcount but said it was “par for the course in trading”.

“We’ve been around for 12 years and in that time there has always been turnover,” he added. “Desks that lose their edge close and new ones open all the time.”

Competitor trading firm Akuna Capital, which pays graduates $200,000 before bonuses, rescinded graduate offers last year and also made 40 per cent of its APAC workforce redundant.

*Name withheld over privacy concerns

alex.turner-cohen@news.com.au

Read related topics:Sydney