Man slams ‘pathetic’ decision from ANZ superannuation fund

With Australians paying out millions for this service, one man has slammed the lack of transparency and is calling on people to ask more questions.

An Australian man has described a major bank’s move to refund $97 after he forked out hundreds of dollars in fees as “pathetic”.

Greg*, who did not want his real name used due to concerns surrounding his employment, has been a loyal member of superannuation fund ANZ Smart Choice Super for 17 years.

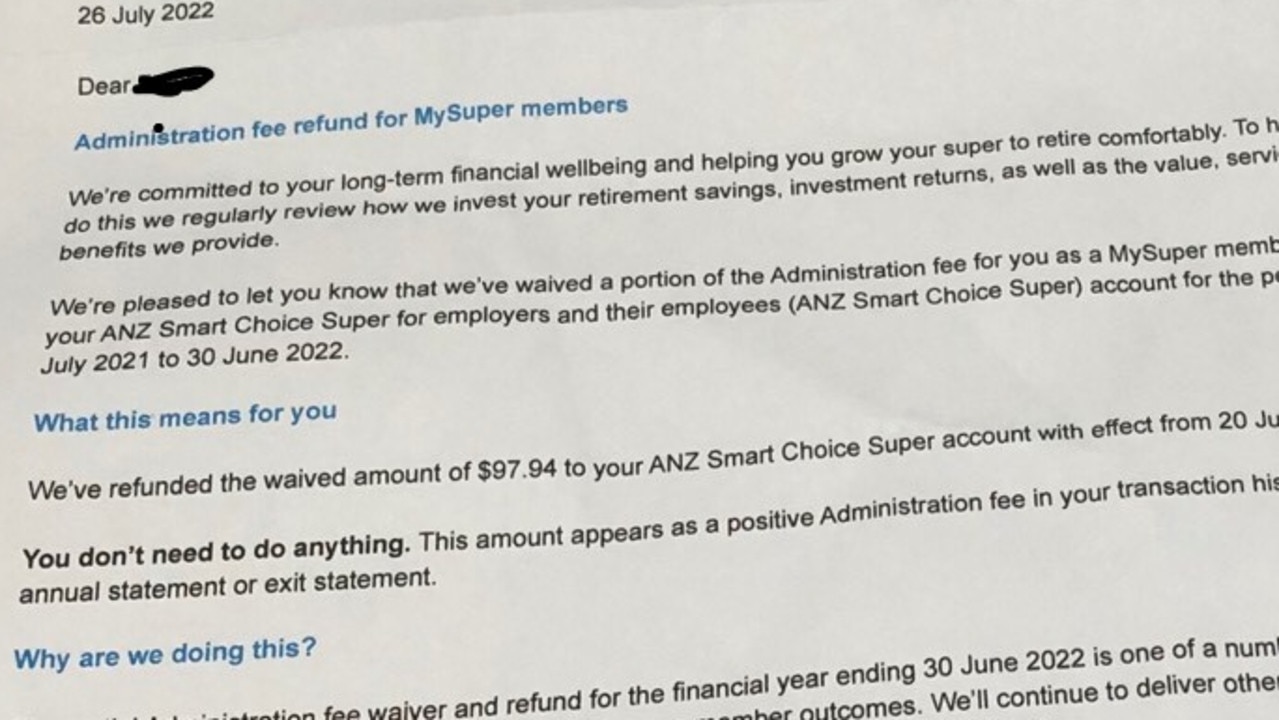

But he was “offended” to receive a letter from the fund last month that revealed he would be getting back $97.94 amid concerns the fund would fall foul of the financial regulator’s super performance test.

But Greg, who is in his 50s and has around $400,000 in his super fund, described the move as “joke”.

“I was offended by the $97 refund and them portraying themselves as the hero and look what we have done,” he told news.com.au.

“This will not help improve the bad performance over the last 12 months. What’s $90 on $400,000?

“If they are interested in making a difference to members then refund all of the administration fees. I am disappointed.”

Want to stream your news? Flash lets you stream 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

The Australian Prudential Regulation Authority started assessing MySuper products last year based on a comparison of fees versus performance over seven years.

In 2021, there were 13 big name funds that failed the financial watchdog’s test and last week it released a scathing review of five superannuation funds, forcing some to close to new members after failing a performance test.

The ANZ Smart Choice Super fund passed this year’s test but in a letter to members in July, it flagged the APRA assessment and said the fee refund “would improve overall returns” for members in the past financial year.

“While it’s likely that ANZ Smart Choice Super would have passed the performance test for the financial year ending June 30, 2022 without waiving a portion of the administration fee, the trustee has determined to proceed with the fee waiver and refund … to improve member outcomes,” it read.

‘Save hundreds a year’

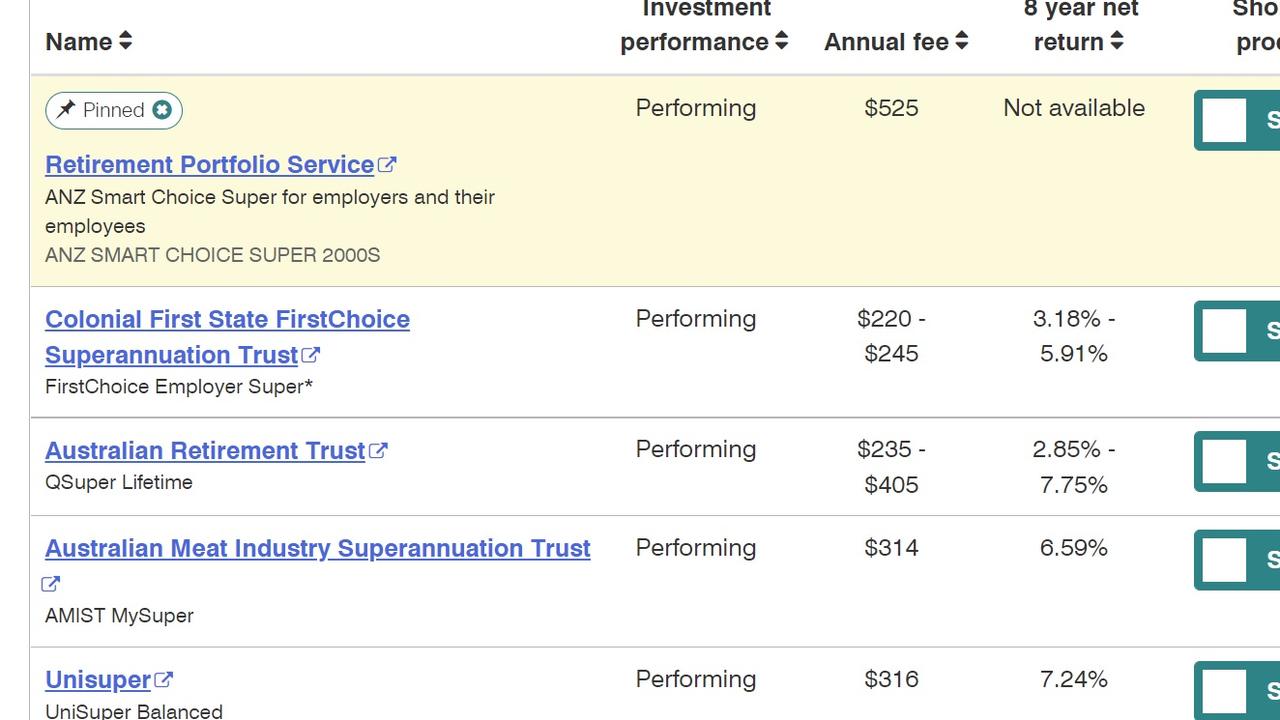

The Australian government’s superannuation comparison website shows the fees charged by ANZ Smart Choice Super are higher than many of its competitors, despite claiming it has “below average” fees on its website.

It slugs customers between $465 and $525 in fees annually, while a number of others in the list were between $220 and $405. However, some funds charge over $600.

But Greg said he pays $720 in total fees, which includes an 0.2 per cent administration fee on rolling balances alongside the annual charge.

He added he had been “loyal” to the ANZ super fund but now felt cheated.

The Brisbane man is now looking at switching out of the fund, which has nearly 700,000 members and over $15 billion under management, according to its website.

“By swapping I could save hundreds a year in fees but the bigger picture is about longer term performance,” he said.

“I might leave some with them and then move some to another super fund. I also have insurance attached to the super fund so it makes moving it a bit harder. You can’t have insurance cover if you don’t have super with them and they know it.”

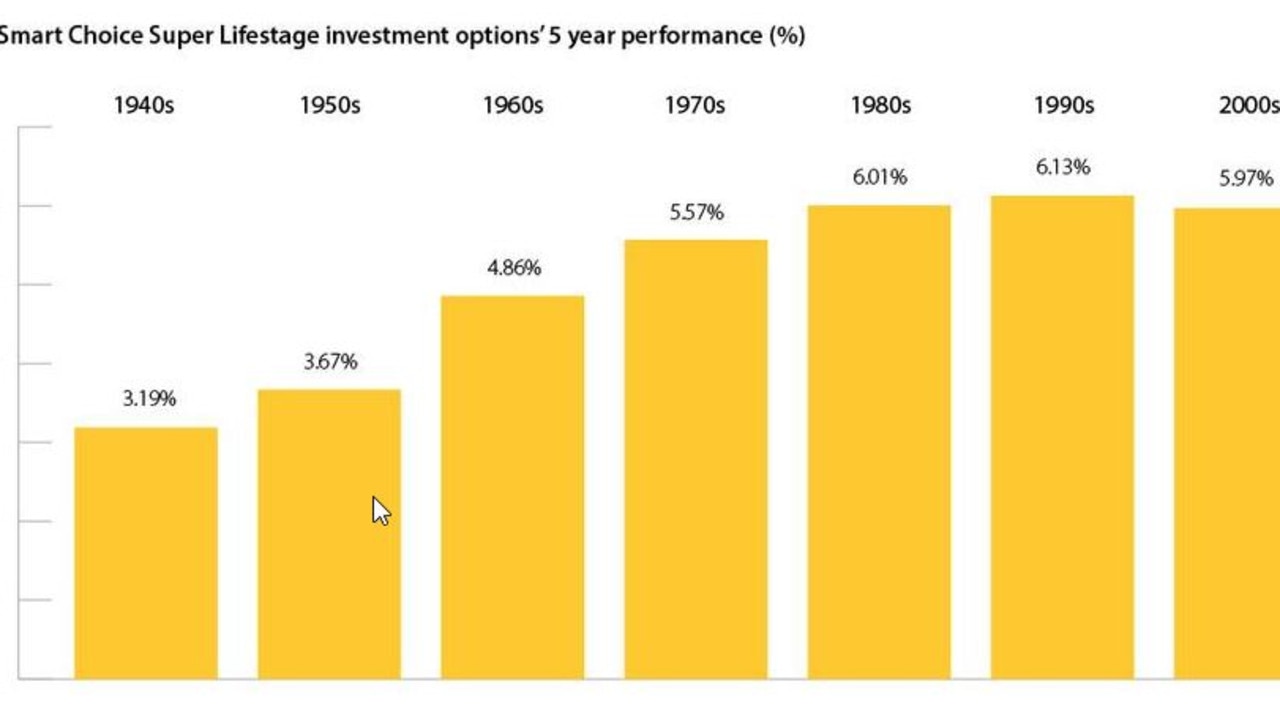

The top-performing super funds over the past decade had an average annual return of 10.2 per cent for members, data from research house Chant West.

‘More scrutiny’

While ANZ distributes the product, it no longer owns that arm of the business having sold it to Insignia Financial in early 2020.

A spokesperson for Insignia Financial said it’s committed to the long-term financial wellbeing of its super members and helping them grow their retirement pot.

“The partial administration fee waiver and refund for the financial year ending 30 June 2022 is one of several initiatives we’ve introduced over the past year to improve member outcomes,” they said.

“We can confirm ANZ Smart Choice Super would have passed APRA’s MySuper performance test for the financial year ending 30 June 2022 regardless of this initiative.”

ANZ Smart Choice Super ranked 29th out of the 69 MySuper products on the annual fee basis, sorting the cheapest to most expensive, they added.

But Greg said that high superannuation fees is an issue “largely ignored” by Australians but more people should be questioning it.

“Because it’s not like they are managing individual counts, so they are managing the bulk of it, but there’s hundreds of thousands of people paying millions in fees,” he added.

“I think there needs to be a bit more scrutiny about what is reasonable on fees. There are hidden fees like an account handling fee, service fee and others – it’s not as transparent.

“A lot of people don’t know, super funds just deduct the fees from the balance and you don’t hear about it.”

500,000 million Aussies impacted

The most recent APRA test examined 69 super funds across Australia using the MySuper test.

Although 13.1 million Australians have put their super in funds that meet basic standards, several funds alarmingly failed regulations.

Four super funds, in fact, failed the benchmark test twice which boasts over half a million Aussie members and are not able to take on any new members as punishment.

Ten of the 13 products that failed the test last year are either planning to or have already merged with a performing fund.

“The bright line test means funds can no longer dress up their underperformance with marketing spin. Instead funds have been forced to face reality and act in their members’ best interests by merging or finding other improvements like reducing fees,” said Xavier O’Halloran, director of Super Consumers Australia.

“According to the regulator, mergers since 2019 have delivered combined total fee savings of $60 per person per year to approximately 350,000 MySuper members.

“And due to the test’s scrutiny on fees, over 5.1 million MySuper members are now paying lower fees than last year.”