Half a million Australians in dud super funds

Some superannuation companies have been forced to close to new members while others have ceased trading after failing a basic test.

Australia’s financial regulator has released a scathing review of five superannuation funds and forced some to close to new members after failing a performance test.

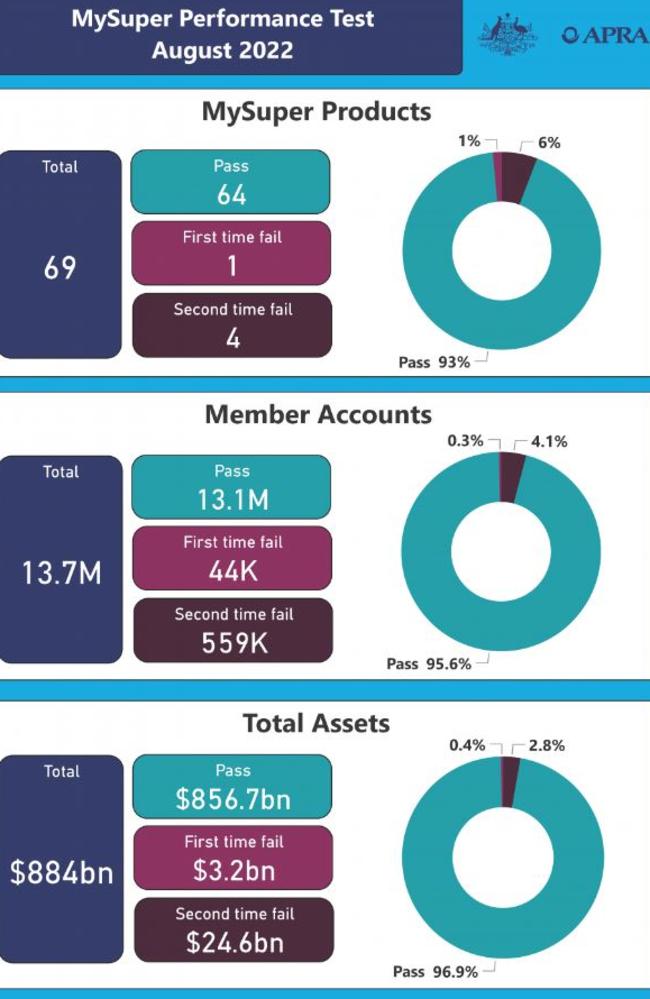

The Australian Prudential Regulation Authority (APRA) late on Wednesday released its results of 69 super funds across Australia using the MySuper test.

Although 13.1 million Australians have put their super in funds that meets basic standards, several funds alarmingly failed regulations.

Four super funds, in fact, failed the benchmark test twice and are not able to take on any new members as punishment.

APRA named and shamed Westpac-owned BT, a Westpac staff fund, and also the Australian Catholic Superannuation Retirement Fund, the Energy Industries Superannuation Scheme and AMG Super.

“The four products that failed the test for a second time are now closed to new members,” APRA stated in its release.

“Of those four products, three were offered by trustees with plans to exit the industry.”

Westpac also received a warning for another one of its super funds, the Westpac Group Plan MySuper, which failed the test once.

A whopping 559,000 Australians are members of funds that failed the test twice, while a further 44,000 were in the Westpac account that failed for the first time.

Stream more finance news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

In a statement to news.com.au, a BT spokesperson said they were “disappointed” with the regulator’s findings and that they have plans to merge with another large super fund, Mercer Super

“Mercer Super passed this year’s APA,” the spokesperson said.

“We have worked hard to improve member outcomes, including reducing fees, and the outcome was mainly due to some periods of underperformance, particularly in the 2014-15 financial year and in last year’s turbulent global markets.”

If the merger goes ahead, they said they will be able to reduce fees by 25 per cent.

Customers of the failed funds must be notified by later this month, on September 28.

The 500,000 members from the three funds shutting down are currently in the process of transferring to alternative funds.

APRA Member Margaret Cole said: “APRA will be engaging with these trustees to ensure that members achieve better outcomes as quickly and safely as possible.”

The MySuper performance benchmark was only introduced last year to safeguard members and ensure funds were doing the right thing.

There are two components to the performance rating: investment performance, and the fees and costs associated with a superannuation fund.

In 2021, 13 MySuper products failed the test of which four have since exited.

Although the performance measure is only in its second year, there have been signs of positive results already.

Five super funds that failed the 2021 performance test passed this time around.

”The performance test has contributed to over 5.1 million MySuper members (just over 38 per cent) now paying lower fees than they were last year,” Ms Cole added.

In total, all 69 super funds account for 13.7 million people in the population.