‘Exploitation, fee gouging and ruined lives’: The horrific reality of operating a franchise

It’s billed as the fast track to wealth and escaping the office grind — but it’s actually ruining lives and devastating families across Australia.

When you buy a pizza or a loaf of bread, do you ever think about who owns the business? Not the big multinational brand, but the people who bought the local franchise?

Next time you’re there take a look out the back. Can you see someone who is not wearing a uniform and who looks incredibly stressed? That person is probably the franchisee: The person who paid a large sum — perhaps several hundred thousand dollars — to secure the franchise.

They may well be regretting it.

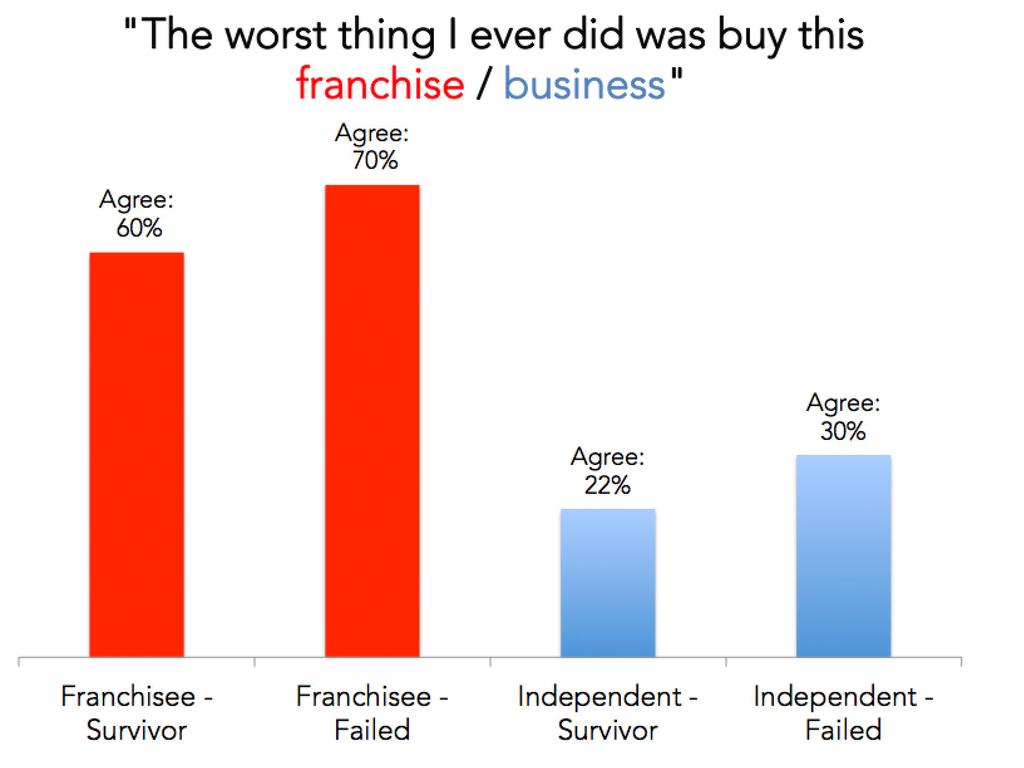

The next graph shows franchisees and independent business owners and how much they regret buying their business. It breaks the data down by whether their business survived or went broke.

The results are shocking. Franchisees feel incredible regret — even if their business survives. And they feel more regret than an independent business owner whose business went broke.

What this graph tells us is buying a franchise is, for most franchisees, the worst decision they made in their life. There is obviously something about being a franchisee that can become extremely unpleasant.

Not all franchise systems are bad though. It’s important to remember this. You almost never hear someone who bought a McDonald’s complain. There are also probably good franchise systems that are cake shops, gyms, garden businesses and beauty businesses. The problem is it is hard to tell if you’re buying into a lifetime of wealth or a world of pain.

GETTING TREATED LIKE DIRT

An explosive new report into franchising came out last week, and it tells us what the problem with franchising is — franchise systems have all the power while the franchisees too often get systemically exploited.

For example, franchisees in some franchise systems are often compelled to buy supplies for their business from certain suppliers, in certain amounts. In theory, by buying something like bottled water in bulk the franchise system can arrange a discount for all the franchisees. But sometimes the bottled water costs more through these arrangements than it would at the supermarket.

Franchise companies let the supplier put the price up and in return get the supplier to pay them a “rebate” — basically a kickback for sending so many customers their way.

The poor franchisee has no option but to continue to overpay for the item — if they buy the cheaper option at the shop down the road they are in breach of their agreement. And bottled water is not even the worst example — some overpriced compulsory purchases are for big orders of baked goods that will not even sell and will have to be thrown out a few days later.

The explosive report into franchising comes from a senate committee that has been investigating the sector for months. They found thousands of ways in which franchising goes wrong, and it’s too often the little guy who ends up suffering while the franchising system makes easy money.

They made lots of recommendations that might — if the government pays attention — become law and make it harder for franchise systems to exploit franchisees.

CHURN AND BURN

One way for a franchise system to make money is to collect royalties and annual revenues. The other way is to sell franchises. This creates a temptation to “churn and burn”. Allowing old franchises to collapse while selling new ones keeps money coming in the door of the franchising company, even if it screws over franchisees.

Over one seven-year period, one large franchising company called Retail Food Group (RFG) opened 1000 new franchises and closed 1100. RFG owns Brumby’s Bakery, Gloria Jeans, Donut King, Crust Gourmet Pizza Bar and Michel’s Patisserie. The senate committee report has suggested ASIC should investigate “churning and burning”.

The committee was particularly harsh on RFG. In the final report it gave the company this damning indictment: “The committee considers that RFG’s business model remains a high risk because it appears to rely on acquiring previously successful brands, opening new outlets, stripping out costs, exploitative fee gouging and increased costs to franchisees and cutting services to franchisees.”

A statement released after the franchising inquiry findings said RFG fully supported any changes the senate committee might recommend and was working towards improving the experiences of its franchisees.

“The current management team and board completely understand that RFG’s future success is directly linked to the profitability of its franchisees,” RFG executive chairman Peter George said. “We have instituted a comprehensive program of investment and improvement to materially help existing and new franchisees grow and prosper.”

TIME FOR CHANGE

The behaviour of too many franchising companies is unacceptable. Big change could be coming to the franchise sector if the recommendations of the senate committee are put in place. But the change is not certain. The franchise sector is full of powerful businesses who will be able to lobby the government to request it not change a thing.

When it considers whether to listen to lobbyists, it’s important the government knows we are paying attention. Us. The people who get pizza from franchise pizza places and buy coffee from franchise coffee shops. We care. We don’t want the guy out the back to think he’s ruined his whole life, and we don’t want him to be bullied by a big business. We want the franchisees to be treated right.

Jason Murphy is an economist. He runs the blog Thomas the Think Engine.