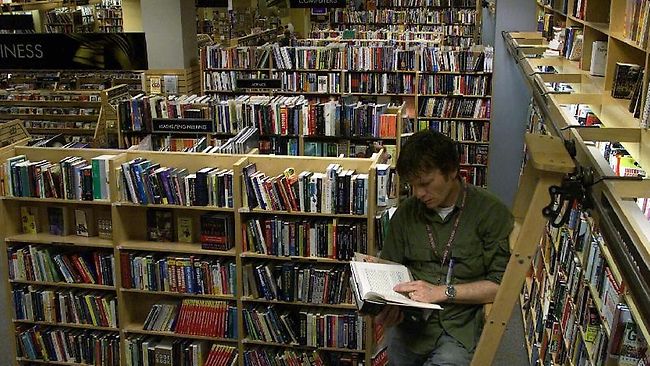

Borders collapsed owing millions to staff

FAILED book chain reveals it collapsed with only $1 million cash in the bank while it owed its employees almost $8 million.

THE failed Borders book chain revealed this morning it had only $1 million cash in the bank but owed staff almost $8 million.

Administrator Steve Sherman of Ferrier Hodgson told creditors the company behind Borders, REDgroup, had a total debt of more than $118 million when it went into administration last month, The Sydney Morning Herald reports.

Mr Sherman said REDgroup had $6.4 million in cash and stock on hand worth $119.9 million.

Mr Sherman said company management had been considering closing a number of stores prior to the group being placed in administration on February 17, reported The Australian.

"When we do make that decision it's not because we want to make it, it's because we have to make it," he said.

The revelations about the chain come as January retail trade figures come in better than expected, helped by a rise in food sales and a recovery in department store sales, economists say.

Retail spending increased 0.4 per cent in January, official figures show.

Retail trade rose in the month to a seasonally adjusted $20.441 billion, compared to an upwardly revised $20.365 billion in December, the Australian Bureau of Statistics (ABS) said on Tuesday.

Economists' forecasts had centred on a 0.3 per cent rise the month.

Retail sales stronger

Commonwealth Bank economist James McIntyre said the ABS retail sales figures outcome was stronger that expected.

"We did see some strong outcomes in the sectors that have been particularly weak over the last few months," he said.

"Food rose 2.5 per cent in the month of January. That followed two surprise falls.

"In particular, the RBA (Reserve Bank of Australia) has been surprised for a number of months in inflation outcomes coming out of the food sector.

"There has been this intense competition between the major supermarkets, which has been muting some of the price pressures that have been coming through at a wholesale level."

He said the other strong outcome was department stores, which had been weak recently.

"They rose 2.3 per cent in the month, following a 1.1 per cent fall in December," Mr McIntyre said.

"Department store sales compared to a year ago are still quite weak, that January outcome is one that is at least positive."

At the same time, the ABS reported Australia's trade position widened in the December quarter to $7.299 billion from a downwardly revised deficit of $6.490 billion in the September quarter.

The median market forecast was for a deficit of $7 billion in the December quarter.

Commonwealth Bank senior economist John Peters said the deterioration in the current account deficit was not that worrying.

"Importantly there is only a minor deterioration in chain volume measure of the trade deficit," Mr Peters said.

"The bottom line you can take from the numbers is there will be flat contribution to GDP in the December quarter.

"I guess that's a real improvement in previous quarters, where we've been getting a negative net exports, continued to take a chunk out of overall growth by making a negative contribution.

"We're really seeing a big improvement in the terms of trade. Commodity prices are starting to flow into the bottom line," he said.