Nations react to tariffs as Donald Trump begins to rattle world markets

Donald Trump’s hard line “America First” rhetoric stirred millions of voters to choose red, and now the world is beginning to witness how that will look.

The world economy is heating up as overseas markets begin to feel the weight of US President Donald Trump’s sweeping changes as commander-in-chief.

Stock markets across Asia and Europe experienced a stiff downturn on Monday, with the dollar surging following Trump’s decision to impose heavy tariffs on China, Canada, and Mexico.

Trump also issued a warning that the European Union would soon face similar measures.

In his first two weeks back in office, the 78-year-old has implemented some of the aggressive trade policies he promised during his campaign.

It has now revived fears of global trade wars among analysts who believe the boat can only be rocked so far.

The new tariffs include 25 per cent levies on imports from Canada and Mexico and 10 per cent duties on Chinese goods.

Analysts at Oxford Economics warned that Mexico’s inflation could jump to six per cent annually, up from 4.2 per cent in December, as the peso plunged by seven per cent.

Chief Economist Gregory Daco has meanwhile forecast that Canada’s economy could shrink by 2.7 per cent this year and 4.3 per cent next year due to the tariffs.

White House Press Secretary Karoline Leavitt defended the tariffs, stating they were “promises made and promises kept by the president”.

Trump’s hard line “America First” rhetoric stirred millions of voters to choose red in the election and now the nation is beginning to witness how that might look, at least for the next four years.

Hurt nations rally against Trump tariffs

Counterpunches are beginning to be thrown by nations opposing the Trump wave.

Canada has announced plans to challenge the tariffs at the World Trade Organisation, while Mexico’s President Claudia Sheinbaum unveiled retaliatory tariffs would be imposed on US products.

Justin Trudeau has urged his citizens to purchase locally-produced goods wherever possible to keep the economy stimulated through the uncertain period.

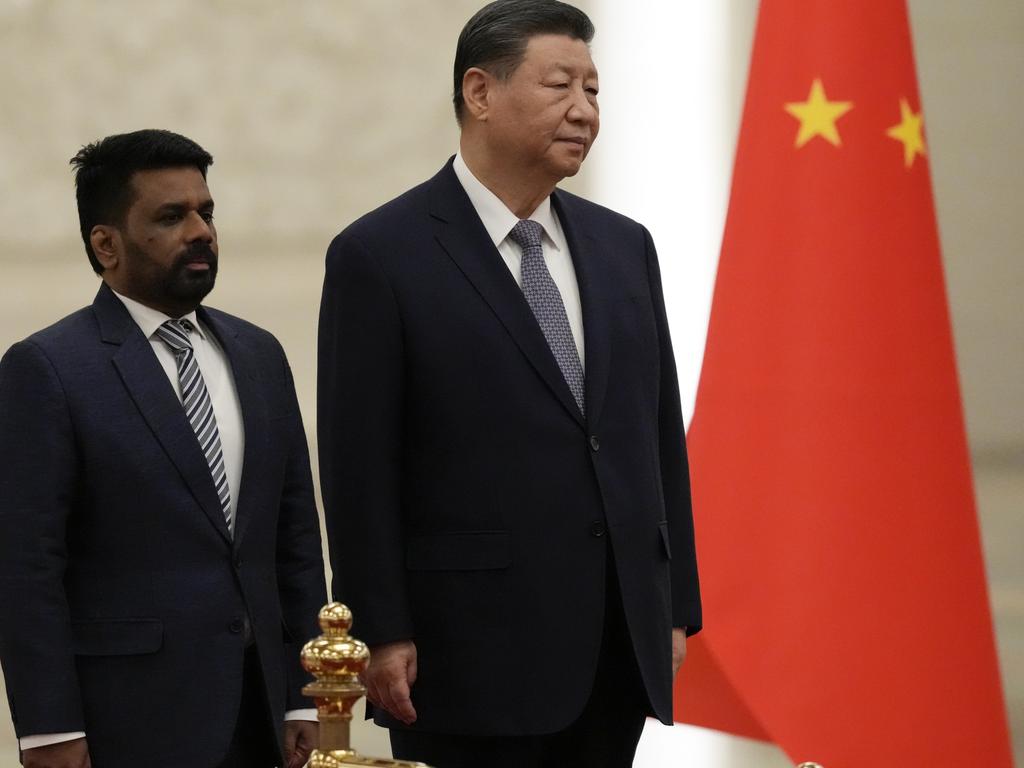

China’s trade ministry also vowed to take “corresponding countermeasures” through the WTO.

In the US, all three main indexes finished Friday in the red, and Asian markets saw steep losses to start the week.

Tokyo, Seoul, and Jakarta each dropped more than two per cent, while Sydney, Bangkok, and Wellington also experienced steep losses.

Hong Kong’s market gave up early deep losses to close marginally down, and Shanghai remained closed for a holiday.

In Europe, London opened more than one per cent lower, and both Paris and Frankfurt saw declines of more than two per cent.

On the currency front, the US dollar gained 2.3 per cent against the Mexican peso and rose more than one per cent against the Canadian dollar and the Euro.

It also strengthened against the South Korean won, Australian dollar, and South African rand.

Crypto takes a slide, gold surges

Cryptocurrency prices took a dive on Monday, with Bitcoin hitting a three-week low and Ether dropping to its lowest point since early September.

The global trade war looming in the background spooked investors, pushing them out of risky assets and sending the crypto market into a downturn.

Bitcoin fell to $US94,476.18 ($A154,073.77) on Monday morning in Asia, dipping as low as $91,441.89 ($A149,837.58).

Meanwhile, Ether dropped by 24 per cent, returning to levels not seen since early September.

It last traded at $2,494.33 ($A4,091.23).

While it hasn’t been branded as the crypto doomsday worth panicking over – some investors are actually excited at an opportunity to cash in on cheap assets – the downturn this week has come as a reality check.

As markets got put through the tumble dryer, gold surged past its all time high at US$2,835 (AU$4,612).

Key figures:

Tokyo - Nikkei 225: DOWN 2.7 per cent at 38,520.09 (close)

Hong Kong - Hang Seng index: FLAT at 20,217.26 (close)

London - FTSE 100: DOWN 1.1 per cent at 8,577.26

Euro/dollar: DOWN at $1.0221 from $1.0363 on Friday

Pound/dollar: DOWN at $1.2275 from $1.2392

Dollar/yen: UP at 155.67 yen from 155.18 yen

Euro/pound: DOWN at 83.25 pence from 83.59 pence

West Texas Intermediate: UP 1.9 per cent at $73.92 per barrel

Brent North Sea Crude: UP 1.0 per cent at $76.43 per barrel

New York - Dow: DOWN 0.8 per cent at 44,544.66 (close)