Why refinancing doesn’t always mean the best deal

When it comes to refinancing, homeowners are not necessarily getting a much lower rate in the current market, new research has found. Check out some of the top deals.

When it comes to refinancing, homeowners are not necessarily getting a much better rate, new research has found.

Australians are shopping around for better deals more than ever off the back of 12 interest rate rises along with cost of living pressures.

However a new report by Finder.com has revealed many are not getting significantly lower deals.

Finder’s latest Housing Market Report surveyed refinancers on their savings in the last 12 months finding an average variable rate of 5.01 per cent prior to refinancing and new variable rate of 4.78 per cent (or 23 basis points).

This equates to a $71 saving per month based on the average refinanced home loan balance of $507,000 and transferring from one 30-year loan to another.

MORE: Inside Popstar Amy Shark’s epic new beachside home

‘Metro-fication’ hits home prices hard

Fashion guru buys own home at auction

The report states while it was a decent saving, it was low considering the Reserve Bank increased the case rate by 25 points four times in 2022.

“Borrowers are being pushed to refinance because of rising rates and cost of living pressures but they are not always getting the best deal,” the report stated.

“This suggests that the lack of knowledge about refinancing holds borrowers back from making the best decisions possible.”

The report found the past 12 rate rises have added $14,688 per year to the cost of servicing a mortgage in Australia.

Finder’s head of consumer research Graham Cooke said rising borrowing costs were of great concern.

“Many have reached the end of their tether – spending a disproportionate part of their income on monthly repayments,” he said.

“Refinancing your mortgage is a great way to improve your financial situation.

“A reduction of even half a per cent can be the difference of thousands of dollars a year which is better off in your pocket than as more profit for the banks.”

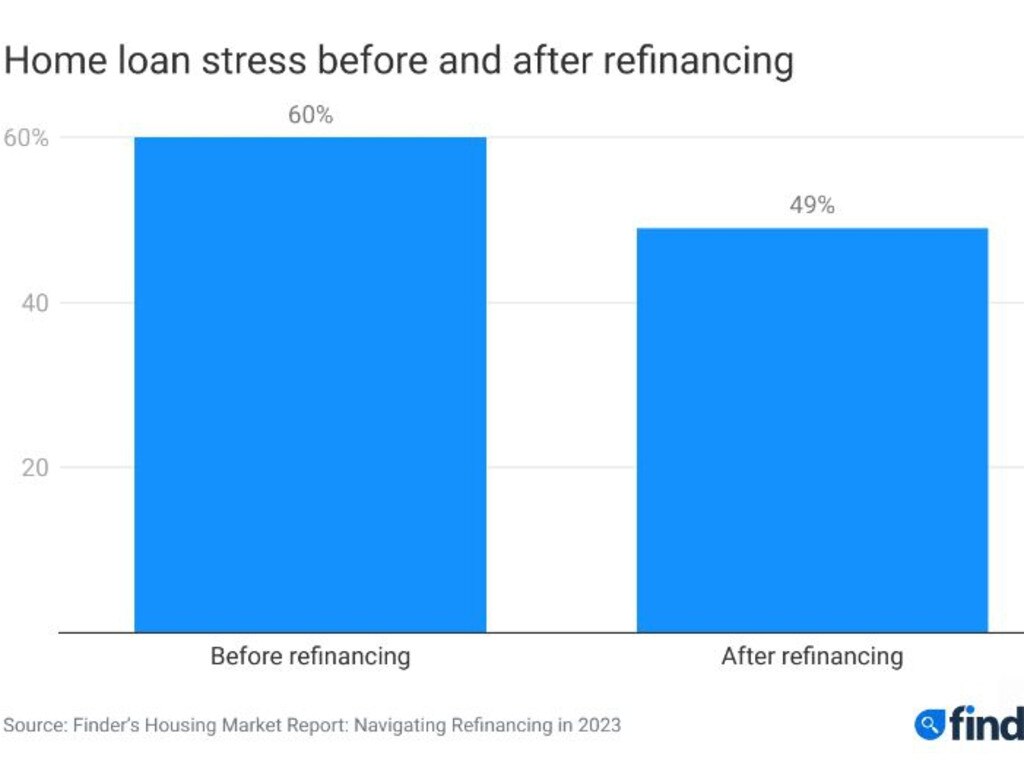

Signs of stress are also evident, with the report finding almost two-thirds of people planning to refinance stressed about their mortgage, while 49 per cent of homeowners said they were stressed about their mortgage even after refinancing.

“Millennials struggling the most out of all the generations is a concern because they are the generation which has bought most recently,” Mr Cooke said.

“This could be a sign that they jumped in when rates were at record lows and were unprepared for an environment where rates and repayments increased.”

He said a lack of knowledge was holding people back, with research revealing men considered themselves more confident when it came to refinancing compared to women which could be put down to “arrogance” among other factors.

“Lack of knowledge is key in this journey and there’s not enough out there,” he said.

“The best thing you can do is take the time to review and compare your home loan options to ensure you’re getting the most competitive rate. It’s never too late to find a better home loan deal.”

MORE: Aussie suburbs set to boom in 2024

Elon Musk’s $60m ‘special place’ he can’t get rid of

End of an era for Gallipoli vet’s home

MORE

‘Metro-fication’ hits Sydney home prices hard

Most popular suburb for Sydney’s first-home buyers

University of NSW School of Economics associate professor Geni Dechter said while many people were switching to smaller lenders with better deals, bigger banks needed to provide more information and be upfront.

“The biggest hurdle is information gathering and understanding the process,” she said.

“If it’s all simply laid out, customers will more likely go with that provider.’

She said she hoped to see more competitive refinancing rates among banks next year.

Tic:Toc Home Loans digital performance specialist Cate Mayer said people were more aware than ever on how much they needed to save.

She said while some people were not seeing benefits of refinancing, another worrying trend was extending loans term during the refinancing process.

“It’s not ideal but completely understandable,” she said.

Ms Mayer said while the last few years had been “unprecedented” the housing market had shown resilience not recording as many foreclosures as predicted.

“People are still looking for the best deals and shopping around,” she said.

FINDER.COM’S TOP REFINANCING DEALS

5.72 per cent - Bendigo Bank Live in Express Variable Home Loan - (Owner Occupier, P&I)

One of the market’s more competitive rates, it also has minimal fees.

5.74 per cent - Unloan Variable Home Loan - (Owner Occupier)

Currently only offered to refinancers, Unloan has a no-fee loan with a low rate.

5.78 per cent - Qantas Money Variable Home Loan - Sub 80 (Owner Occupier, P&I)

This is a low-rate loan and you can also earn Qantas Points as a bonus.

5.79 per cent - Greater Bank Great Rate Discount Variable Home Loan - Up to 110% LVR

This loan has a low rate and while it is available for first home buyers with small deposits, refinancers can get the same deal.

5.79 per cent - BCU OMG! Home Loan - LVR >60% and

5.79 per cent - loans.com.au Variable Home Loan - LVR 90% (Owner Occupier, P&I)

5.84 per cent - Newcastle Permanent Building Society Real Deal Home Loan - Special Offer 1 (Owner Occupier, P&I)

5.9 per cent - Up Home Loan Variable Rate. Up offers a competitive rate with low fees, plus you can easily manage your savings via multiple offset accounts.

MORE: Shock as first ever The Block winner finally resells

Hot spots for Sydney first home buyers

Sydney’s ‘suburban’ unicorn up for grabs

Originally published as Why refinancing doesn’t always mean the best deal