Sydney home prices tipped to rise off back of tax cuts, migration

A signature Albanese government policy, combined with other housing issues, has been forecast to drive up Sydney home prices by another startling margin over the next year.

Sydney home prices have been forecast to balloon even further over the coming year, despite already being “impossibly unaffordable”, with migration and Labor’s tax reforms pointed to as the key drivers.

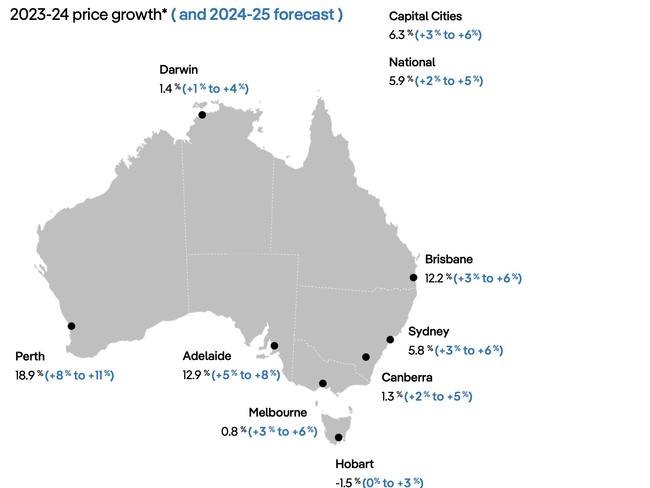

PropTrack’s latest Property Market Outlook report released Thursday tipped prices to rise 3-6 per cent over the next financial year – a rate of increase expected to be higher than inflation.

Such a rise would push up the cost of some houses by more than a hundred thousand dollars in just the space of a year given many suburbs already have median prices well over $3m, PropTrack noted.

The coming growth in prices would also be similar to the 5.8 per cent average rise in Sydney property values over the past year – considered strong growth in the weakening economic climate.

PropTrack director of economic research Cameron Kusher said it was likely a “confusing” market for many due to price rises coinciding with higher interest rates.

MORE: Slick homes of State of Origin’s biggest stars

Labor’s overhaul of stage 3 tax cuts, set to take effect from July 1, would add further fuel to the fire by increasing the amount that home seekers could spend on property, according to PropTrack.

Mr Kusher said the tax cuts would boost borrowing power at a margin equivalent to “two interest rate cuts”.

“These tax cuts have the potential to further inflate housing prices,” he said.

Coming growth in prices over the next year would be “modest” compared to previous market rises, but would still result in buyers needing to pay substantially more, Mr Kusher said.

“Even a small (percentage) rise in Sydney makes a massive difference because of how expensive prices already are,” he said.

MORE: Troubled OnlyFans star’s $12m family mansion for sale

It comes as a global study released earlier this month showed Sydney was the world’s second least affordable city measured by the gap between incomes and prices.

The Demographia report deemed Sydney prices “impossibly unaffordable” for locals.

It was the 15th time in 17 years Sydney was ranked within the top three least affordable markets, with only land starved Hong Kong deemed less affordable in the most recent annual study.

A report by KPMG also predicted further rises in Sydney prices over the next year, with the international group forecasting an average increase of 4.9 per cent by the end of 2024 and another 5.3 per cent rise by the end of 2025.

KPMG chief economist Brendan Rynne said building challenges were a factor in the expected price increases.

“Although material costs and financing costs have started to stabilise after sustained increases, labour costs continue to increase in response to high demand for qualified tradespeople,” Mr Rynne said.

“Many barriers remain to developers building new homes, while continuing high rental costs are pushing renters to look to buy instead, which is pushing up demand.”

Interest rate cuts remain the biggest unknown for the housing market. The latest Consumer Price Index released Wednesday showed inflation over May was 4 per cent, up from 3.4 per cent in February.

Canstar group executive of financial services Steve Mickenbecker said this level of inflation was higher than expected and raised the prospect of another rate hike.

“The increase in the CPI Indicator will have the Reserve Bank moving towards the starting blocks and readying to fire the interest rate increase gun, just as the men line up for the 100m final in Paris, presuming that June quarter inflation reflects the same trend,” he said.

Mr Kusher said it was likely prices would still continuE rising even if there was another interest rate rise as the longer-term expectation was for a cut in 2025.

He added that there was little to suggest a coming “crash” in the housing market.

“A crash is very unlikely,” he said. “I’d suggest anyone who thinks that should go to an insurance website, put in their address and see what the replacement cost would be to rebuild their home. In many cases, the prices of houses are actually below the replacement cost.”

Originally published as Sydney home prices tipped to rise off back of tax cuts, migration